ASX Growth Companies With High Insider Ownership To Watch

The Australian stock market has seen a mixed performance recently, with sectors like Real Estate and Materials experiencing gains while others such as Staples, Health Care, and Energy faced declines. In this fluctuating environment, growth companies with high insider ownership can be of particular interest to investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.4% |

| Titomic (ASX:TTT) | 13.2% | 74.9% |

| Sea Forest (ASX:SEA) | 14.6% | 92.5% |

| Pure One (ASX:P1E) | 10.4% | 114.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.3% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's dive into some prime choices out of the screener.

Pinnacle Investment Management Group (ASX:PNI)

Simply Wall St Growth Rating: ★★★★☆☆

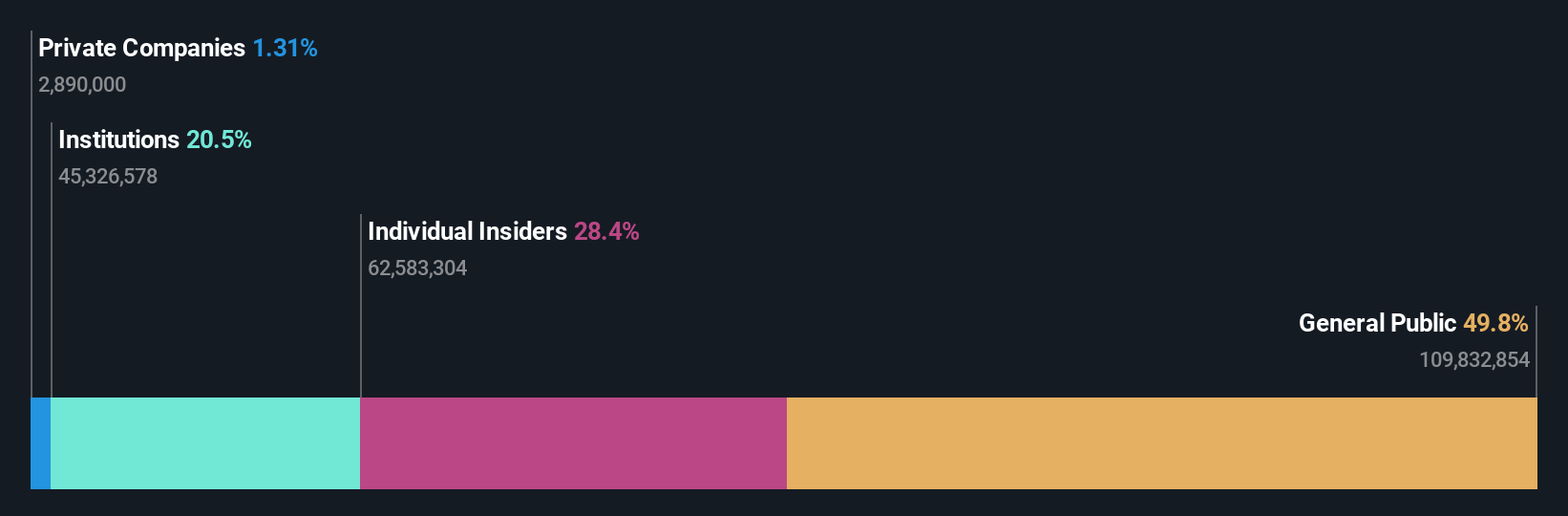

Overview: Pinnacle Investment Management Group Limited is an Australian investment management company with a market cap of A$3.66 billion.

Operations: The company generates revenue primarily from its Funds Management Operations, amounting to A$65.47 million.

Insider Ownership: 26.5%

Revenue Growth Forecast: 10.8% p.a.

Pinnacle Investment Management Group shows potential as a growth company with high insider ownership, evidenced by earnings growth of 48.8% over the past year and forecasted annual profit growth of 14.1%, outpacing the Australian market. Although revenue growth is expected to be moderate at 10.8% annually, it remains above market average. Insider activity indicates more buying than selling recently, suggesting confidence in future prospects despite a dividend not well-covered by earnings or cash flows.

- Get an in-depth perspective on Pinnacle Investment Management Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Pinnacle Investment Management Group's share price might be too pessimistic.

Santana Minerals (ASX:SMI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Santana Minerals Limited is involved in the exploration and evaluation of gold properties across New Zealand, Cambodia, and Mexico, with a market cap of A$685.86 million.

Operations: Santana Minerals Limited does not report any specific revenue segments, focusing primarily on the exploration and evaluation of gold properties in New Zealand, Cambodia, and Mexico.

Insider Ownership: 13.8%

Revenue Growth Forecast: 50.2% p.a.

Santana Minerals is forecast to achieve profitability within three years, outpacing typical market growth. Despite currently generating less than US$1 million in revenue, the company trades significantly below its estimated fair value. Recent exploration results at the Rise & Shine deposit highlight potential for extended mine life and high-grade mineralization. With regulatory progress on the Bendigo-Ophir Gold Project and a high projected return on equity, Santana's growth trajectory remains promising amid insider confidence.

- Delve into the full analysis future growth report here for a deeper understanding of Santana Minerals.

- Insights from our recent valuation report point to the potential overvaluation of Santana Minerals shares in the market.

WA1 Resources (ASX:WA1)

Simply Wall St Growth Rating: ★★★★☆☆

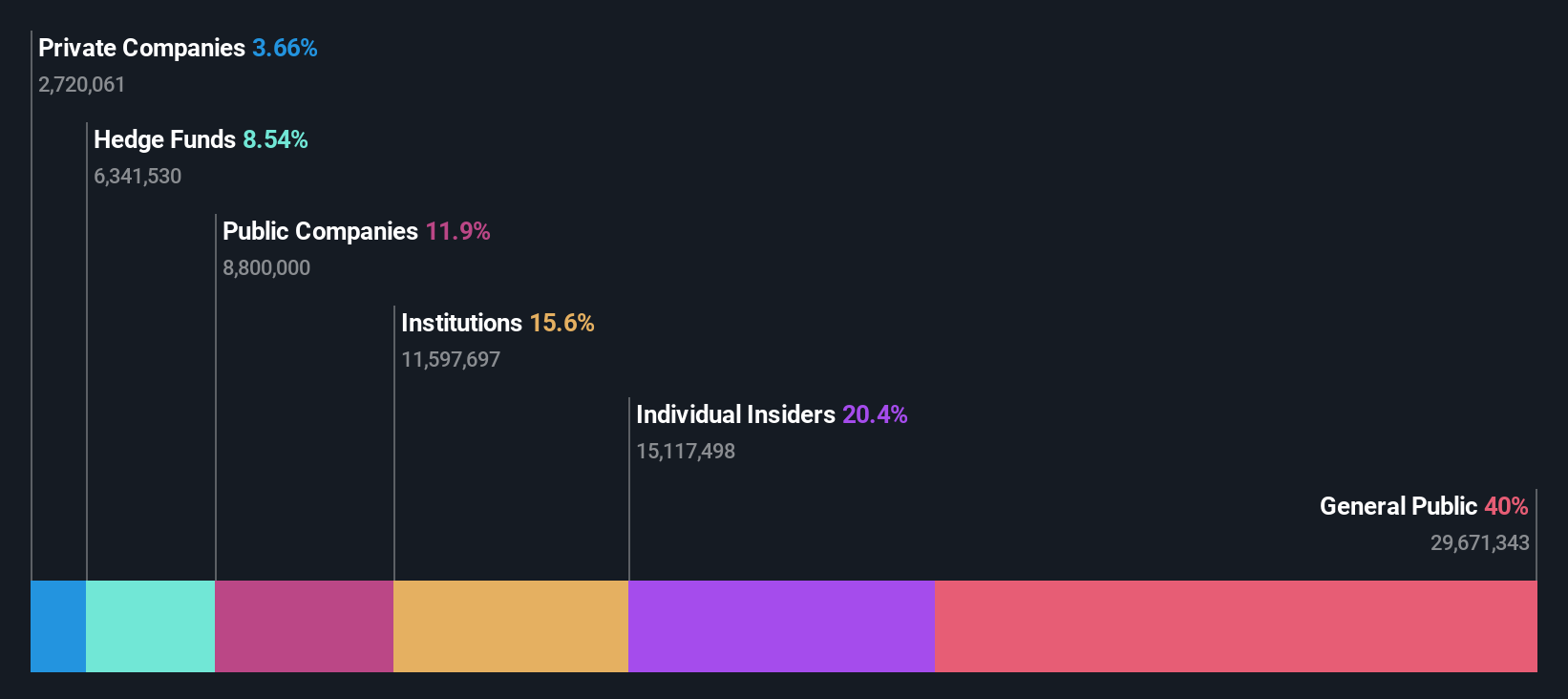

Overview: WA1 Resources Ltd is involved in the exploration and development of mineral resources in Western Australia and the Northern Territory, with a market cap of A$1.33 billion.

Operations: WA1 Resources Ltd does not currently report any revenue segments, as it is focused on the exploration and development of mineral resources in Western Australia and the Northern Territory.

Insider Ownership: 20.4%

Revenue Growth Forecast: 120% p.a.

WA1 Resources is expected to become profitable within the next three years, surpassing average market growth. Despite reporting a net loss of A$4.8 million for the year ending June 2025 and generating minimal revenue, analysts anticipate a significant stock price increase of 44.9%. The recent renewal of Proportional Takeover Provisions at their AGM underscores strategic governance decisions amid high insider ownership, suggesting confidence in its future growth prospects.

- Take a closer look at WA1 Resources' potential here in our earnings growth report.

- Our valuation report here indicates WA1 Resources may be overvalued.

Taking Advantage

- Navigate through the entire inventory of 112 Fast Growing ASX Companies With High Insider Ownership here.

- Seeking Other Investments? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報