Shopify (SHOP) Valuation Check After 12% Monthly Gain and 50% Year-to-Date Rally

Shopify (SHOP) has quietly kept climbing, with shares up about 12% over the past month and more than 50% year to date, as investors lean into its accelerating revenue and profit growth.

See our latest analysis for Shopify.

That latest leg higher takes Shopify’s share price to about 163 dollars, and with a roughly 12 percent 1 month share price return and 3 year total shareholder return above 350 percent, the trend still points to strong, long term momentum rather than a fading spike.

If Shopify’s run has you thinking bigger about digital commerce, this is a good moment to explore high growth tech and AI stocks for other fast moving opportunities in the same space.

Yet with revenue and profits now scaling faster than many peers, the debate intensifies: is Shopify still trading below what its long runway of growth deserves, or are markets already baking in every ounce of future upside?

Most Popular Narrative Narrative: 7% Undervalued

With Shopify last closing at 163.14 dollars versus a fair value near 175 dollars, the prevailing narrative sees more upside anchored in profitable growth and AI driven leverage.

The company is aggressively integrating AI driven capabilities (e.g., Sidekick, AI store builder, conversational commerce integrations with large language models), enabling merchants to launch, manage, and scale stores with less friction and more efficiency. This is likely to accelerate merchant acquisition, improve retention, and drive higher margins through automation and new high value features.

Want to see why sustained double digit growth, shrinking but still rich margins, and a lofty future earnings multiple all line up behind this valuation story?

Result: Fair Value of $175.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained outperformance still hinges on Shopify weathering intense ecommerce competition and navigating higher regulatory and compliance costs across faster growing international markets.

Find out about the key risks to this Shopify narrative.

Another Way to Look at Valuation

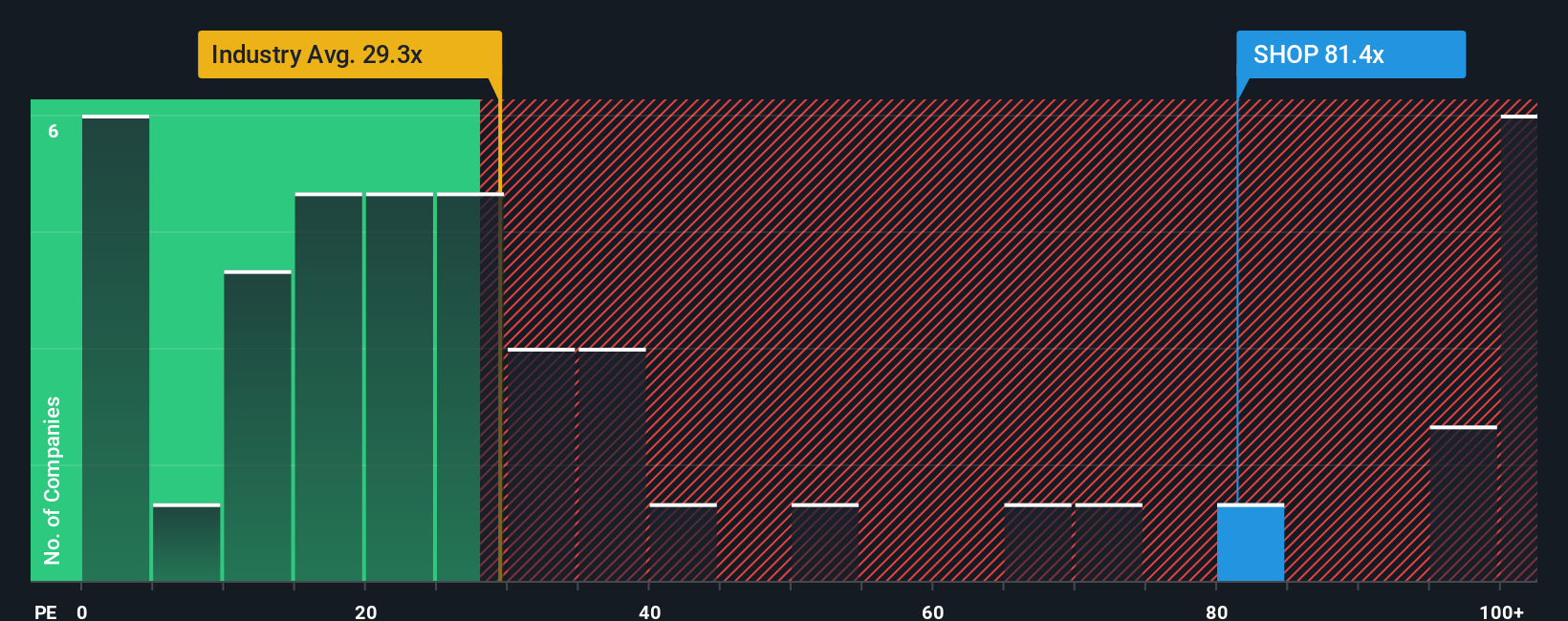

On a price to earnings basis, Shopify looks stretched, trading around 119 times earnings versus about 29 times for the wider US IT sector and roughly 39 times for peers, while our fair ratio sits closer to 49 times. That gap implies real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If this framing does not quite match your view, or you prefer digging into the numbers yourself, you can build a custom narrative in minutes: Do it your way

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single winner; use Simply Wall Street’s screener to uncover the next wave of opportunities before the crowd catches on.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that could strengthen your portfolio when markets turn volatile.

- Capitalize on long term innovation by tracking these 28 quantum computing stocks shaping the next era of computing and competitive advantage.

- Seize potential mispricings early by scanning these 914 undervalued stocks based on cash flows where market expectations may not yet match underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報