Is SoftBank (TSE:9984) Still Undervalued After Its Volatile Share Price Surge This Year?

SoftBank Group (TSE:9984) has been on a volatile run this year, and the latest swing in its share price is prompting investors to revisit what they are really paying for in this sprawling tech conglomerate.

See our latest analysis for SoftBank Group.

Recent swings, including a sharp pullback over the past month alongside the latest uptick to ¥16,755, suggest sentiment is recalibrating after an 81.45% year to date share price return and powerful multi year total shareholder returns.

If SoftBank’s turbulence has you rethinking tech exposure, it might be a good moment to explore other high growth tech and AI stocks that are helping shape the sector’s next phase of growth.

With earnings still uneven but the share price trading more than 30% below analyst targets, investors now face a pivotal question: Is SoftBank still undervalued, or is the market already pricing in its next wave of growth?

Most Popular Narrative Narrative: 26.5% Undervalued

With SoftBank closing at ¥16,755 against a narrative fair value of ¥22,780.8, the latest valuation framework sees substantial upside still on the table.

The analysts have a consensus price target of ¥14420.176 for SoftBank Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥20000.0, and the most bearish reporting a price target of just ¥9400.0.

Want to see what kind of profit reset still supports a higher long term value? The narrative leans on shrinking margins and a richer future earnings multiple. Curious which forecasts make that math work?

Result: Fair Value of ¥22,780.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer AI asset valuations or tighter regulation on cross border tech investments could quickly undercut the bullish case embedded in today’s targets.

Find out about the key risks to this SoftBank Group narrative.

Another Way of Looking at Value

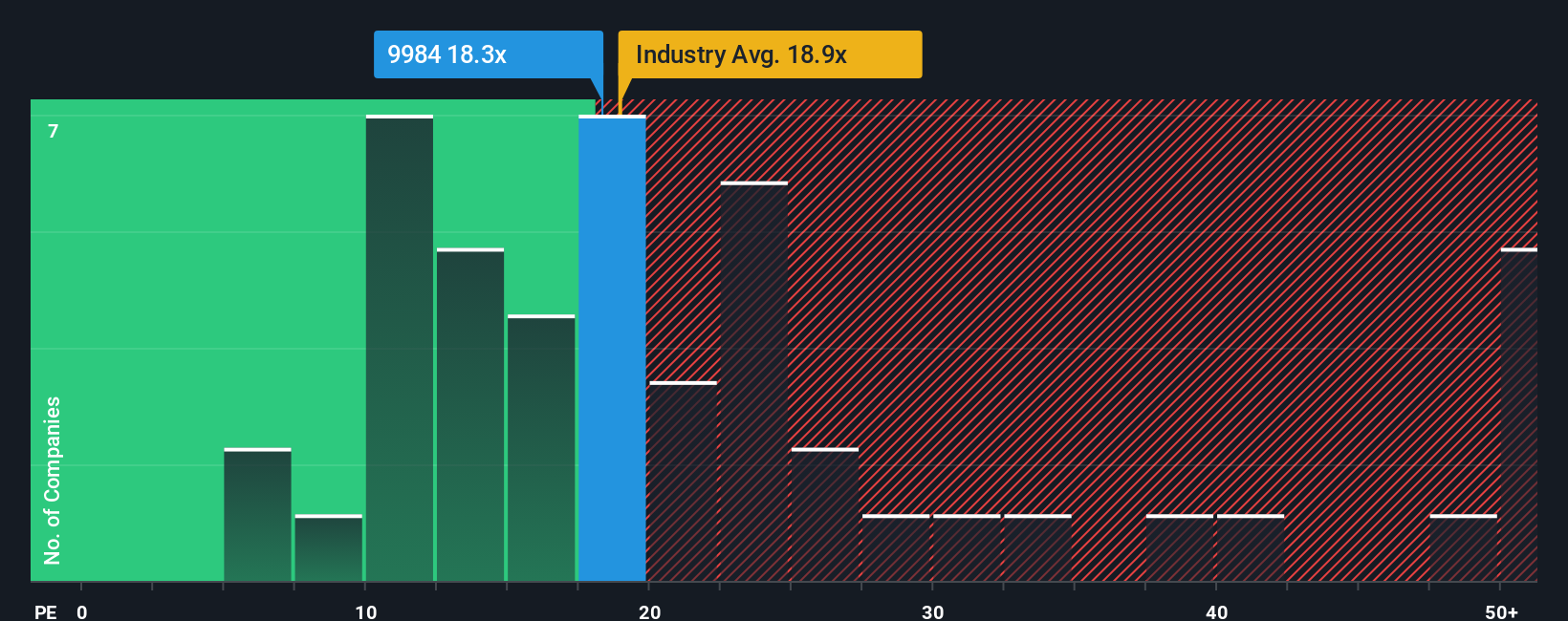

While the narrative framework points to SoftBank being 26.5% undervalued, a simple price to earnings lens sends a different signal. At 7.8x earnings, versus 19.9x for the Asian wireless telecom space and a fair ratio of 10.6x, the stock screens cheap. Is the market offering a margin of safety or flashing a value trap?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SoftBank Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SoftBank Group Narrative

If this outlook does not quite match your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your SoftBank Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to hunt for fresh opportunities with the Simply Wall St Screener so your next big winner does not pass you by.

- Capture early stage growth potential by targeting these 3633 penny stocks with strong financials that already back their stories with solid financial foundations.

- Ride powerful technological shifts by focusing on these 26 AI penny stocks positioned at the forefront of automation, data intelligence, and machine learning adoption.

- Strengthen your long term returns by filtering for these 100+ dividend stocks with yields > 3% that combine dependable income with room for future payout growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報