Cannabix Technologies And 2 Other TSX Penny Stocks Worth Watching

Recent developments in the Canadian market have seen equities reaching new highs, buoyed by dovish signals from the Bank of Canada and interest-rate adjustments south of the border. In this context, penny stocks—though an older term—remain a relevant investment area, representing smaller or less-established companies that might offer significant value. By focusing on those with strong financials and growth potential, investors can uncover promising opportunities among these lesser-known entities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.14 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$257.26M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.21 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.47 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.28 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$22.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.96 | CA$154.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$190.2M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Cannabix Technologies (CNSX:BLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cannabix Technologies Inc. is a technology company focused on developing marijuana and alcohol breathalyzer technologies for use by employers, law enforcement, workplaces, and laboratories in the United States, with a market cap of CA$60.54 million.

Operations: Cannabix Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$60.54M

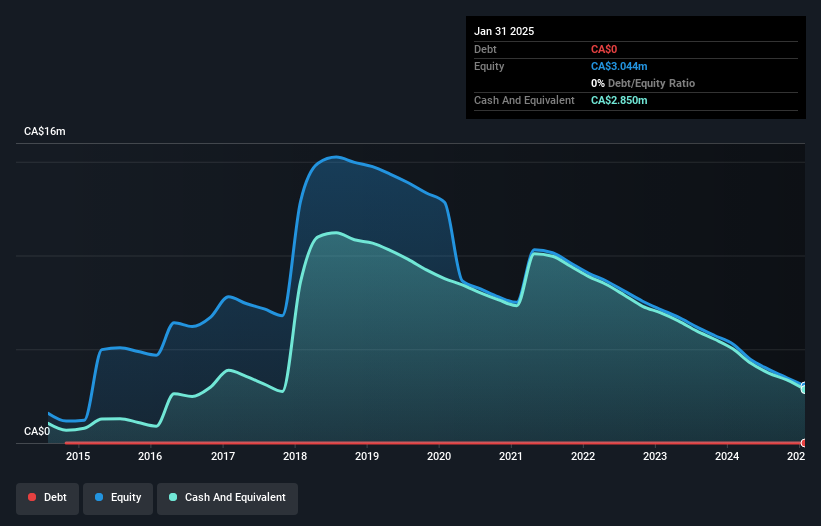

Cannabix Technologies Inc. is currently pre-revenue, focusing on developing innovative breathalyzer technologies for marijuana and alcohol testing. Recent milestones include the successful completion of electronic emissions testing for its Marijuana Breath Test system, a crucial step towards commercialization in the US and Canadian markets. The company has also secured sales agreements for its BreathLogix alcohol screening technology with European maritime clients, highlighting potential market traction. Despite being unprofitable with a net loss of CA$2.46 million last quarter, Cannabix remains debt-free and has sufficient cash runway exceeding one year based on current free cash flow trends.

- Click to explore a detailed breakdown of our findings in Cannabix Technologies' financial health report.

- Examine Cannabix Technologies' past performance report to understand how it has performed in prior years.

Bragg Gaming Group (TSX:BRAG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bragg Gaming Group Inc. is an iGaming content and technology solutions provider that serves online and land-based gaming operators with proprietary and exclusive content, with a market cap of CA$78.13 million.

Operations: The company generates its revenue primarily from B2B Online Gaming, amounting to €105.55 million.

Market Cap: CA$78.13M

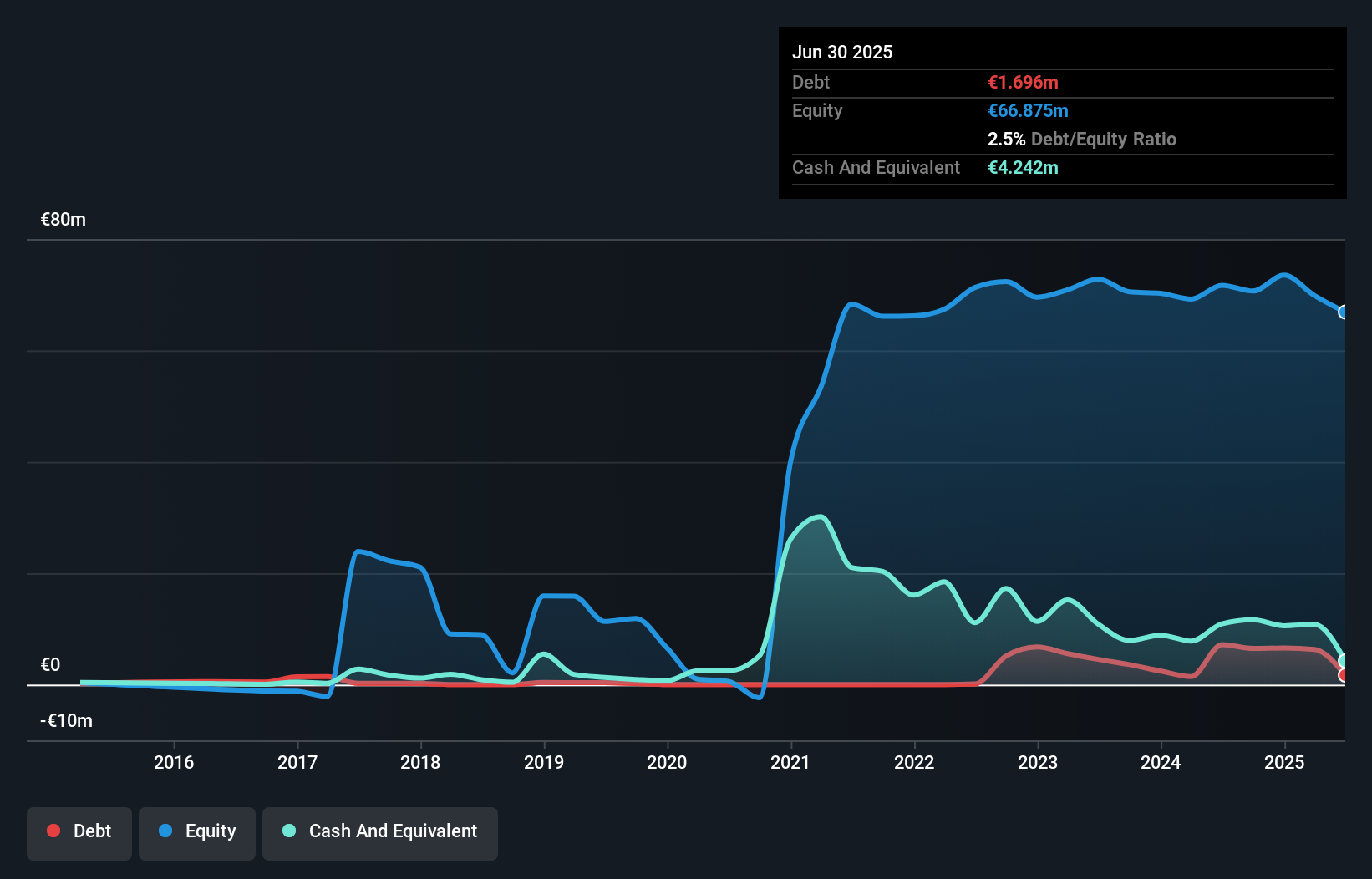

Bragg Gaming Group is navigating the penny stock landscape with a focus on expanding its proprietary and exclusive content in the iGaming sector. Despite being unprofitable, Bragg maintains a strong cash position with more assets than liabilities and a positive free cash flow, ensuring a runway exceeding three years. Recent strategic moves include launching content on Brazil's Blaze platform and extending partnerships in Belgium, which align with its growth strategy to increase high-margin revenue streams. Although facing increased net losses recently, Bragg continues to leverage its robust Player Account Management platform for international expansion opportunities.

- Get an in-depth perspective on Bragg Gaming Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Bragg Gaming Group's future.

Condor Resources (TSXV:CN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Resources Inc. is an exploration stage company focused on acquiring and exploring mineral properties in Peru, with a market cap of CA$33.78 million.

Operations: Condor Resources Inc. has not reported any revenue segments as it is an exploration stage company focused on mineral properties in Peru.

Market Cap: CA$33.78M

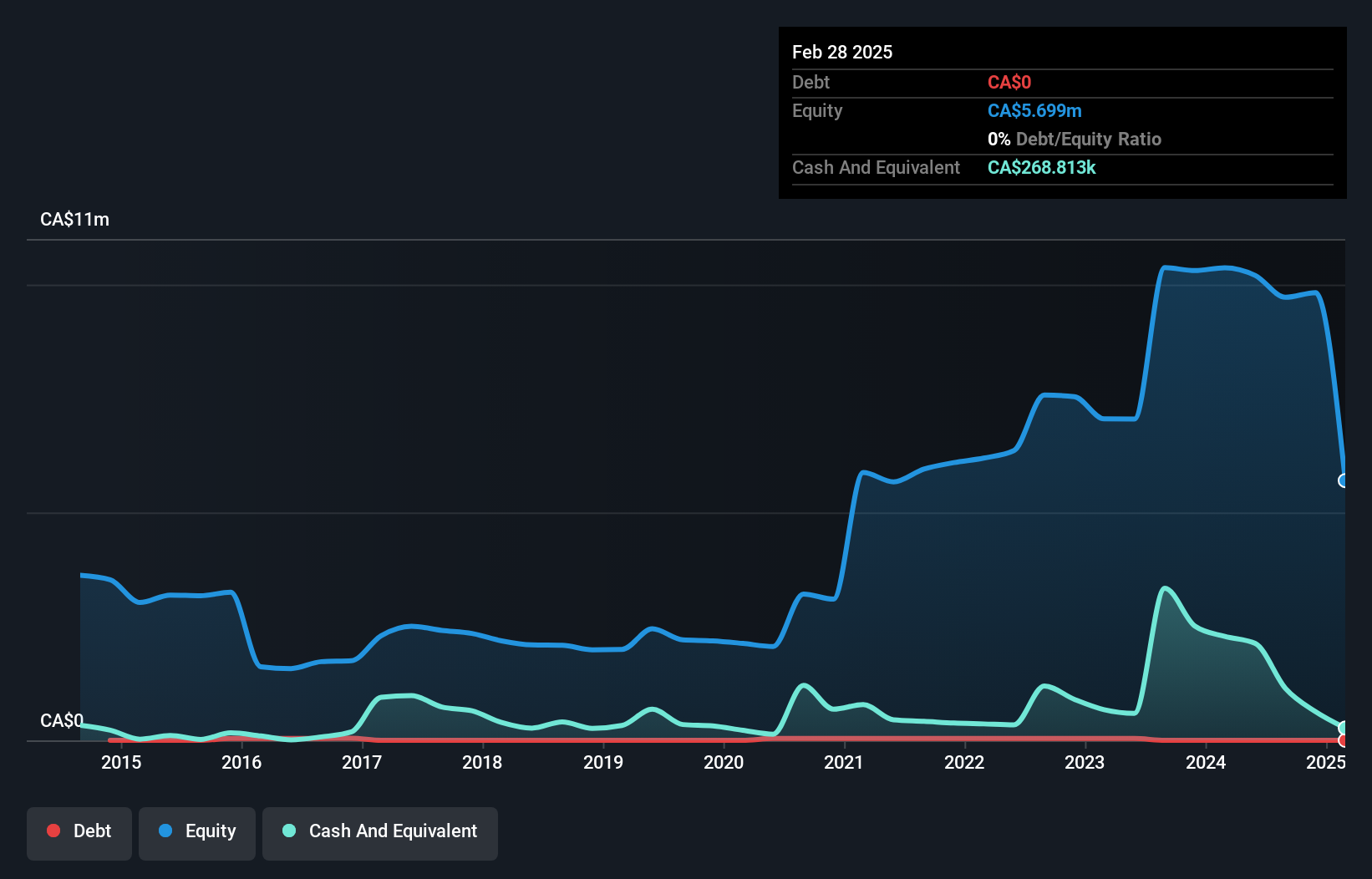

Condor Resources, with a market cap of CA$33.78 million, is pre-revenue and unprofitable, reflecting its status as an exploration stage company focused on mineral properties in Peru. The company operates without debt and has no long-term liabilities, but it faces financial constraints with less than a year of cash runway based on current free cash flow. Despite stable weekly volatility over the past year and an experienced management team averaging 14.7 years of tenure, Condor's net losses have decreased slightly from previous periods. Shareholder dilution has not been significant recently as the company continues to explore growth opportunities in mining exploration.

- Click here and access our complete financial health analysis report to understand the dynamics of Condor Resources.

- Review our historical performance report to gain insights into Condor Resources' track record.

Key Takeaways

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 387 more companies for you to explore.Click here to unveil our expertly curated list of 390 TSX Penny Stocks.

- Ready To Venture Into Other Investment Styles? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報