Mattel (MAT): Assessing Valuation After Recent Share Price Momentum

Mattel (MAT) has quietly put together a solid run, with the stock up about 6% over the past month and nearly 19% in the past 3 months, outpacing many consumer names.

See our latest analysis for Mattel.

Zooming out, that 19.03% 3 month share price return is helping claw back a patchier year, with the 9.97% 1 year total shareholder return still trailing the recent momentum in the stock.

If Mattel's renewed momentum has your attention, it could be a good moment to compare it with other consumer names and explore fast growing stocks with high insider ownership.

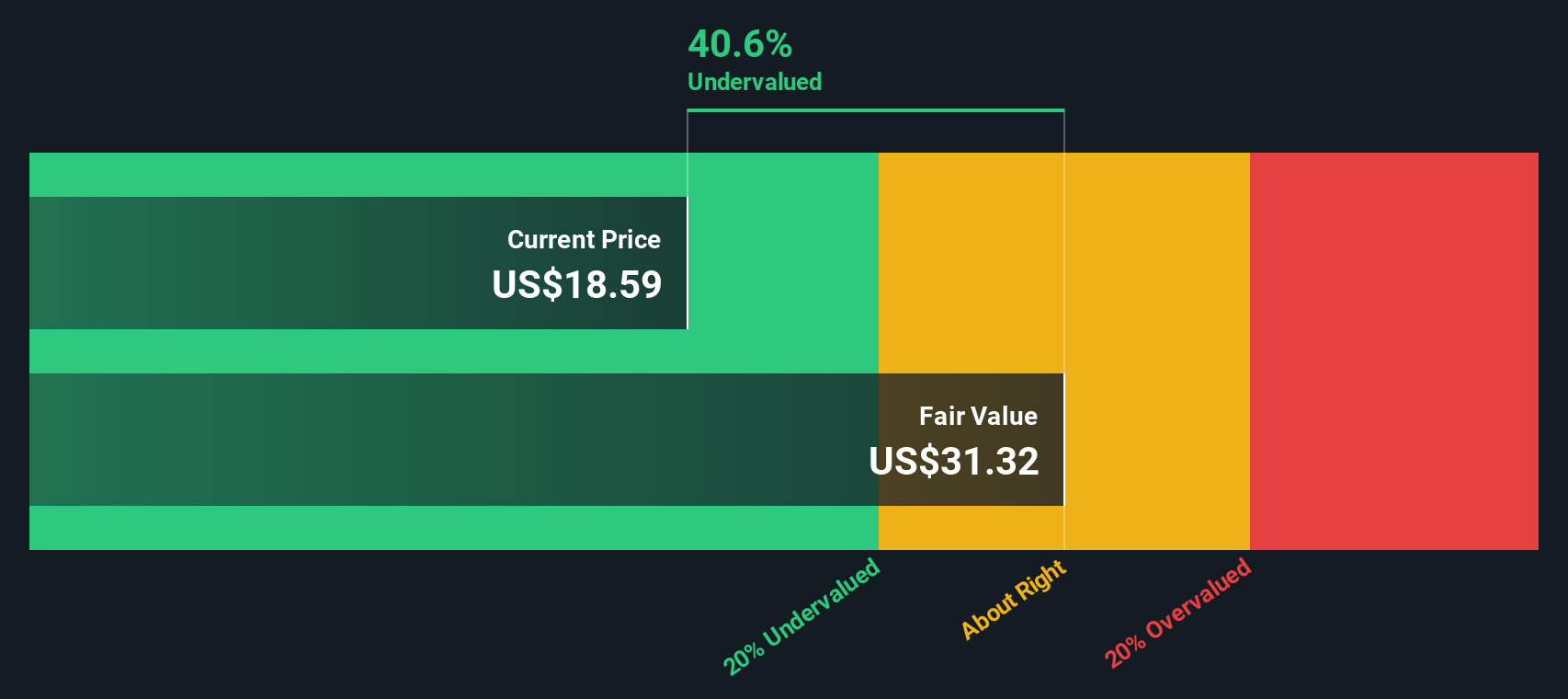

With shares still trading at a double digit discount to Wall Street targets and a hefty implied gap to some intrinsic value estimates, is Mattel quietly undervalued, or are markets already pricing in its next phase of growth?

Price-to-Earnings of 14.8x: Is it justified?

On a price-to-earnings multiple of 14.8 times, Mattel looks inexpensive versus peers at the current share price of $20.52, hinting at undervaluation.

The price-to-earnings ratio compares what investors pay today with the earnings the business generates, a key yardstick for mature, profitable consumer names like Mattel.

At 14.8 times earnings, the stock trades at a marked discount to both the global leisure industry average of 21.2 times and a peer average of 30.9 times, suggesting the market is pricing in more modest earnings power than many competitors. Relative to an estimated fair price-to-earnings ratio of 16.8 times, there is also room for the multiple to expand toward a level the market could ultimately converge on if sentiment improves.

Compared with those benchmarks, Mattel's current 14.8 times earnings multiple screens as distinctly lower, underscoring a valuation gap that stands out in the leisure space.

Explore the SWS fair ratio for Mattel

Result: Price-to-Earnings of 14.8x (UNDERVALUED)

However, slowing revenue growth and ongoing reliance on licensed entertainment brands could limit upside if consumer spending weakens or if partnership economics shift.

Find out about the key risks to this Mattel narrative.

Another View on Value

Our DCF model paints a far stronger upside story, with Mattel trading roughly 54.7% below its estimated fair value of $45.35. That gap hints at a much deeper disconnect than the price to earnings alone, but is the market missing something or simply questioning the cash flow assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mattel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mattel Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Mattel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Mattel might just be the beginning of your next moves. Use the Simply Wall Street Screener now so you do not miss stronger, better aligned opportunities.

- Capture potential multibagger opportunities early by checking out these 3632 penny stocks with strong financials that already show robust underlying financial strength.

- Tap into powerful market themes by scanning these 30 healthcare AI stocks that blend innovation in medicine with scalable artificial intelligence models.

- Lock in quality income prospects by reviewing these 13 dividend stocks with yields > 3% that offer attractive yields backed by solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報