Lululemon (LULU) Valuation Check After a Sharp Rebound in the Share Price

lululemon athletica (LULU) has quietly staged a sharp rebound lately, with the stock climbing about 13% over the past week and roughly 21% this month after a deep year to date slide.

See our latest analysis for lululemon athletica.

Even after this latest pop, the 1 year total shareholder return is still deeply negative and the share price return year to date sits well below water. This suggests that the sharp rebound looks more like early momentum rebuilding than a fully healed uptrend.

If lululemon’s move has you rethinking where growth could surprise next, it is worth exploring fast growing stocks with high insider ownership as a way to spot other potential leaders before sentiment fully turns.

With shares still down sharply over the past year but trading only a touch below analyst targets, the key question now is whether lululemon remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 8.7% Overvalued

With lululemon trading around $206.74 against a narrative fair value near $190, expectations for the brand’s next phase are running ahead of fundamentals.

Ongoing investments in digital commerce, technology (including new AI initiatives), and omnichannel capabilities aim to enhance customer personalization and operational agility, which should better capture shifting consumer behaviors and support both revenue growth and margin efficiency.

Curious how modest revenue growth, thinner margins, and a lower future earnings multiple can still justify a premium story for lululemon? The full narrative unpacks the precise growth runway, profitability reset, and valuation bridge that have led followers to call this stock slightly ahead of itself. Want to see which assumptions really carry that fair value math?

Result: Fair Value of $190.19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. demand softness and mounting tariff pressures could further squeeze margins and undermine the premium story that currently justifies lululemon’s valuation.

Find out about the key risks to this lululemon athletica narrative.

Another View: Earnings Multiple Sends a Different Signal

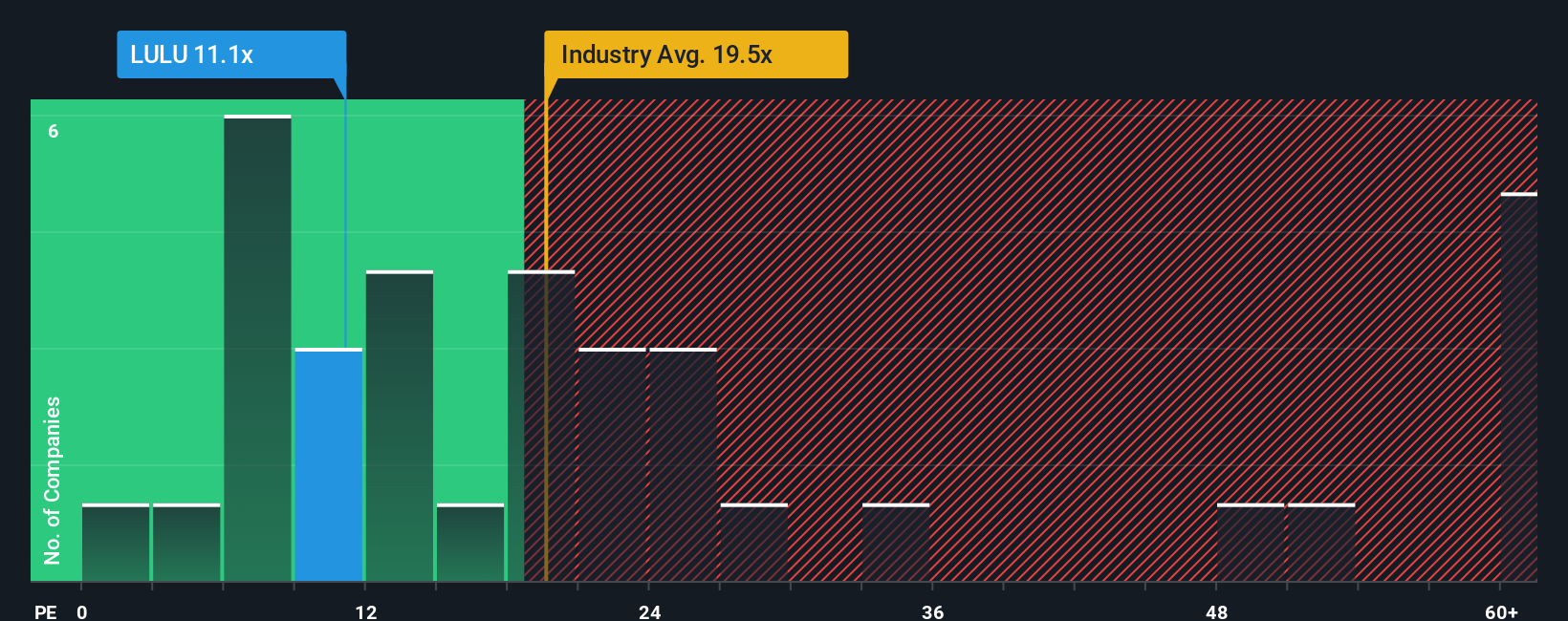

While the narrative based fair value suggests lululemon is about 8.7% overvalued, our earnings multiple view points the other way. At a 13.9x price to earnings ratio versus a 17.4x fair ratio, and far below peer and industry averages, the stock screens as undervalued. Is sentiment overshooting near term fears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own lululemon athletica Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a complete view in just minutes: Do it your way.

A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before sentiment on lululemon fully settles, broaden your edge by lining up fresh opportunities from powerful screeners that can reveal what most investors are still missing.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value using these 915 undervalued stocks based on cash flows before the market corrects.

- Ride structural growth trends in medicine and diagnostics by focusing on innovators powered by smart algorithms through these 30 healthcare AI stocks.

- Secure income focused returns by zeroing in on companies with robust cash generation and attractive yields via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報