Kinsale Capital Group (KNSL): Valuation Check After New Share Repurchase Authorization and Relaxed Debt Covenants

Kinsale Capital Group (KNSL) just paired a fresh $250 million buyback authorization with amended debt covenants that loosen limits on shareholder payouts, signaling management’s confidence in both the balance sheet and the stock’s current valuation.

See our latest analysis for Kinsale Capital Group.

The fresh buyback firepower lands after a rough patch, with the share price down around 15% year to date and the 1 year total shareholder return off more than 20%. Yet longer term holders still sit on solid multi year gains, suggesting momentum has cooled but the underlying growth story is intact.

If this kind of capital allocation story has your attention, it might be worth widening your lens and exploring fast growing stocks with high insider ownership as potential next ideas.

But with the stock already commanding a premium to book and trading below analyst targets, should investors treat this pullback as a rare entry point into a high growth specialty insurer, or assume the market is correctly discounting future gains?

Most Popular Narrative Narrative: 17.2% Undervalued

With Kinsale Capital Group last closing at $385.16 against a most popular narrative fair value of roughly $465, the story hinges on sustained earnings power and disciplined growth rather than a quick sentiment swing.

The analysts have a consensus price target of $499.111 for Kinsale Capital Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $560.0, and the most bearish reporting a price target of just $448.0.

Want to see what justifies a richer earnings multiple than the sector, even as growth cools from prior highs? The core narrative leans on compounding revenues, still elevated margins, and a future valuation framework that treats this niche insurer more like a structural growth platform rather than a cyclical carrier. Curious which specific long term assumptions unlock that upside gap between today’s price and fair value? Dive in and test those numbers for yourself.

Result: Fair Value of $465 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could crack if competition keeps pressuring commercial property pricing or if inflation driven claims severity erodes Kinsale’s underwriting edge.

Find out about the key risks to this Kinsale Capital Group narrative.

Another Angle On Valuation

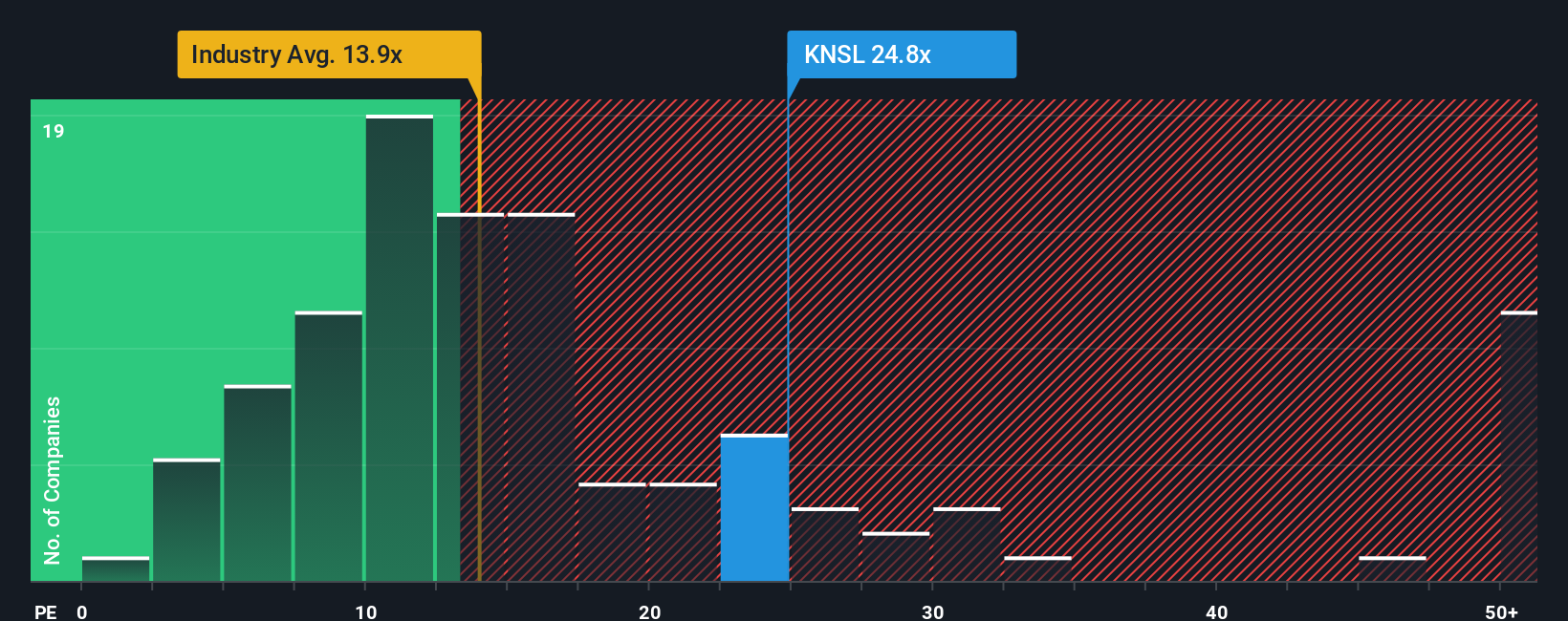

On earnings based metrics, Kinsale looks anything but cheap. The stock trades at about 18.9 times earnings versus 18.4 times for peers and a fair ratio of just 13.1 times, implying investors are paying a sizable premium that could amplify downside if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinsale Capital Group Narrative

If you see things differently or want to dig through the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kinsale Capital Group.

Looking for more investment ideas?

Do not stop with one compelling story. Widen your opportunity set with tailored stock ideas that match your strategy, risk appetite and long term goals.

- Capture early stage potential by scanning these 3633 penny stocks with strong financials that pair smaller market caps with stronger than expected balance sheets and improving fundamentals.

- Position ahead of the next technology wave by targeting these 25 AI penny stocks that harness artificial intelligence to reshape industries and accelerate earnings growth.

- Explore value focused opportunities with these 13 dividend stocks with yields > 3% that may increase portfolio income while still leaving room for potential capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報