Does First Citizens BancShares' (FCNC.A) Revenue Beat Hint At A More Durable Core Franchise?

- In the past few days, First Citizens BancShares reported revenue that was flat year over year but still came in about 1.7% ahead of analyst expectations, alongside a narrow beat on net interest income estimates.

- This outcome suggests the bank’s core lending and deposit franchise may be holding up better than anticipated, even without headline revenue growth.

- Next, we’ll examine how beating revenue and net interest income expectations could influence First Citizens BancShares’ broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

First Citizens BancShares Investment Narrative Recap

To own First Citizens BancShares, you need to believe it can keep translating its enlarged franchise into resilient net interest income while managing credit and rate risks. The latest flat but better than expected revenue and net interest income do not materially change the key short term storyline, which still revolves around how the bank copes with potential rate cuts and credit quality in acquired portfolios.

Among recent developments, the ongoing share repurchase program, with US$4,000 million authorized through 2026 and over 12.7% of shares already bought back by late 2025, is particularly relevant. It reinforces how management is allocating excess capital at a time when earnings are sensitive to interest rate moves and evolving credit costs, which remain central to the near term catalysts for the stock.

Yet, while recent results beat expectations, investors should still be aware of how quickly net interest income could come under pressure if...

Read the full narrative on First Citizens BancShares (it's free!)

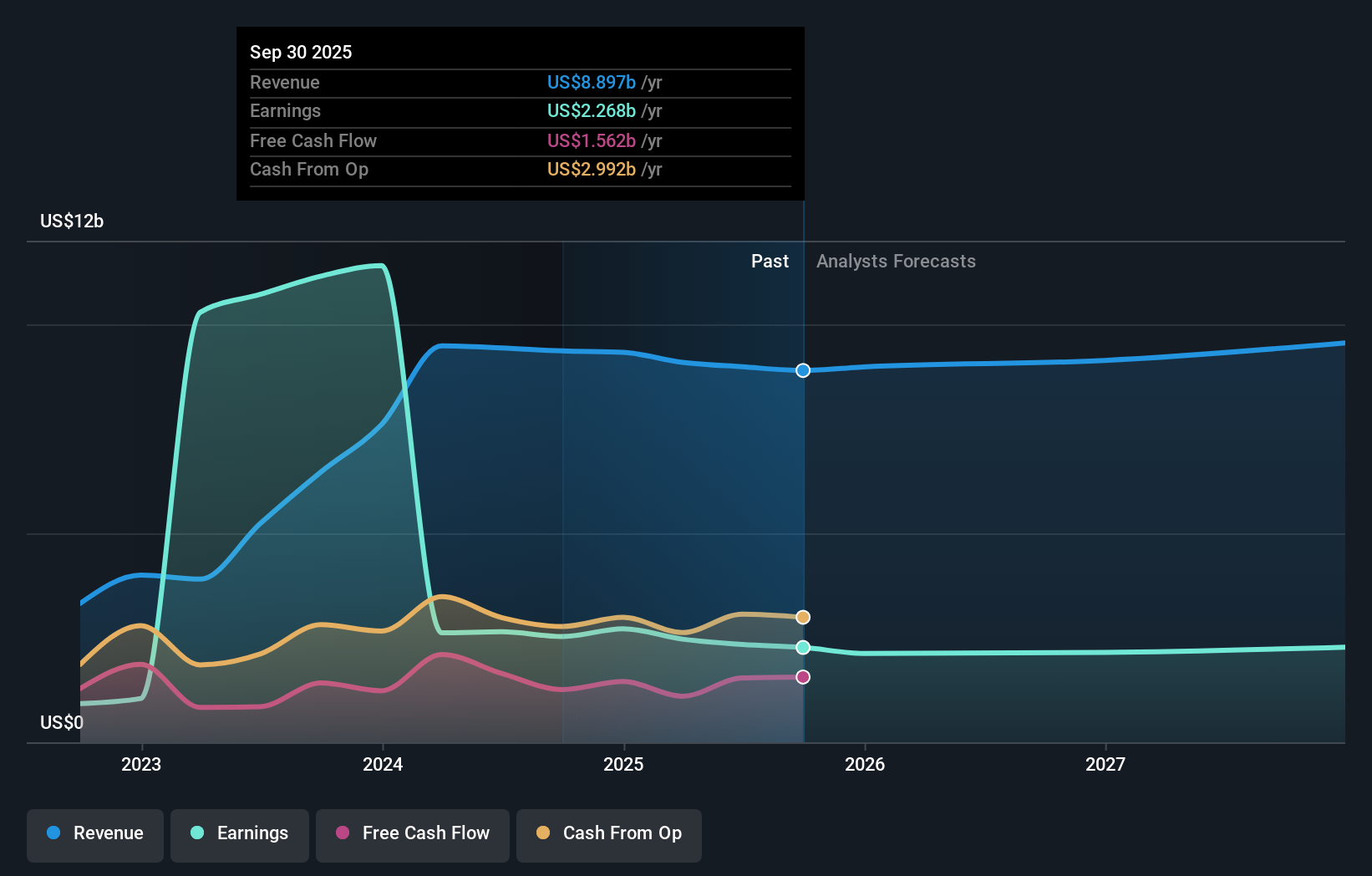

First Citizens BancShares' narrative projects $9.7 billion revenue and $2.2 billion earnings by 2028. This implies 2.6% yearly revenue growth and an earnings decrease of about $0.1 billion from $2.3 billion today.

Uncover how First Citizens BancShares' forecasts yield a $2182 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$1,568 to US$2,632 per share, underscoring how far apart individual views can be. Set this against the current concern that lower interest rates could pressure First Citizens BancShares’ core net interest income, and you can see why it pays to weigh several perspectives before forming your own view.

Explore 3 other fair value estimates on First Citizens BancShares - why the stock might be worth as much as 26% more than the current price!

Build Your Own First Citizens BancShares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Citizens BancShares research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free First Citizens BancShares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Citizens BancShares' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報