Vertex Pharmaceuticals (VRTX): Valuation Check After Positive Pediatric CASGEVY Data and Priority FDA Review Voucher

Vertex Pharmaceuticals (VRTX) just delivered encouraging pediatric data for its gene editing therapy CASGEVY in sickle cell and beta thalassemia, and secured an FDA priority voucher that could accelerate review for children ages 5 to 11.

See our latest analysis for Vertex Pharmaceuticals.

Investors seem to be warming back up to that growth story, with Vertex’s share price at around $454.96 and a solid 90 day share price return of 17.52 percent. This is occurring even though the 1 year total shareholder return is still slightly negative, while the longer term three and five year total shareholder returns remain strong.

If this kind of catalyst driven move has your attention, it is a good moment to see what else is brewing across innovative healthcare stocks that might be setting up for their next leg higher.

With Vertex trading modestly below consensus targets while also boasting robust growth, pipeline diversification and a sizable intrinsic value gap, is this simply fair pricing for a quality biotech, or a genuine opportunity before markets fully account for potential future growth?

Most Popular Narrative: 6.3% Undervalued

With Vertex closing at $454.96 against a narrative fair value of about $485, the current setup implies investors are not fully crediting its long term earnings power yet.

Strong cash flows and a robust balance sheet, bolstered by meaningful share repurchases and prudent reinvestment in R&D and commercial infrastructure, support future earnings power and the ability to capitalize on long-term industry trends such as faster drug development via AI and high-throughput screening, replenishing the pipeline and widening growth opportunities.

Curious how steady, double digit growth, rising margins and a premium future earnings multiple can still point to upside from here? The narrative explains how those moving parts fit together in a single valuation blueprint, built on specific forecasts for revenue, profits and share count. Want to see which assumptions really drive that gap between today’s price and the implied fair value? Dive in to unpack the numbers behind this story.

Result: Fair Value of $485.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in high profile kidney or gene editing programs, or mounting pricing pressure on the cystic fibrosis franchise, could quickly challenge that upside case.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another Lens on Valuation

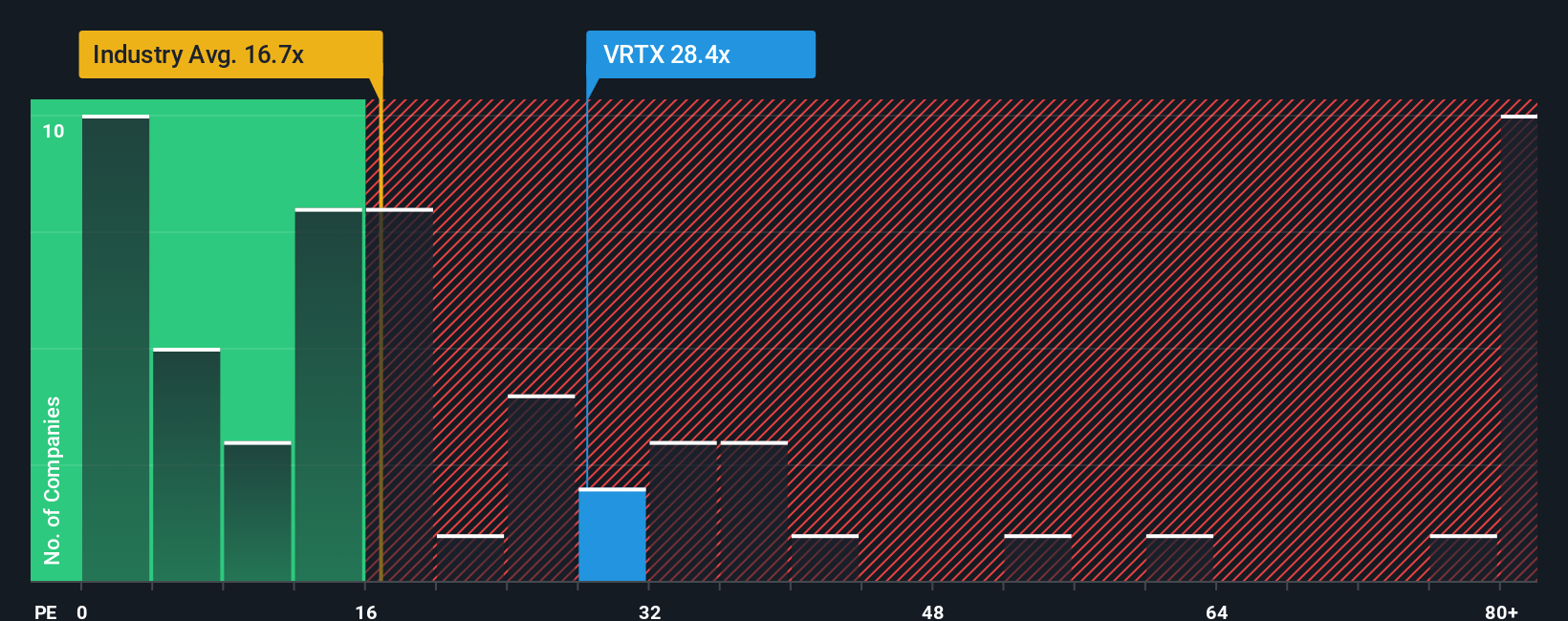

While the narrative fair value suggests modest upside, today’s 31.4x earnings multiple sits above both the US Biotech average of 18.6x and our fair ratio of 30x. That premium hints at less margin for error and raises the question: how much future success is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for more investment ideas?

Before the next catalyst hits, lock in your edge by scanning hand picked opportunities on Simply Wall St's powerful Screener, tailored to different strategies and risk levels.

- Target resilient cash generators by reviewing these 13 dividend stocks with yields > 3% that can keep income flowing even when markets turn choppy.

- Ride structural growth trends by tracking these 30 healthcare AI stocks that fuse data, algorithms, and medicine to reshape patient care.

- Position early in potential market disruptors by analysing these 80 cryptocurrency and blockchain stocks shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報