UK Penny Stocks To Watch In December 2025

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors might consider exploring opportunities beyond well-known names; penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies with potential for significant returns. This article will explore three such penny stocks that combine financial resilience with the potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.255 | £326.76M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.79 | £11.93M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6425 | $373.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.458 | £176.58M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.475 | £71.23M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.465 | £40.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £178.63M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 304 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across various international markets, with a market cap of £118.21 million.

Operations: The company generates its revenue from Foundry Operations amounting to £195.57 million and Machining Operations totaling £31.21 million.

Market Cap: £118.21M

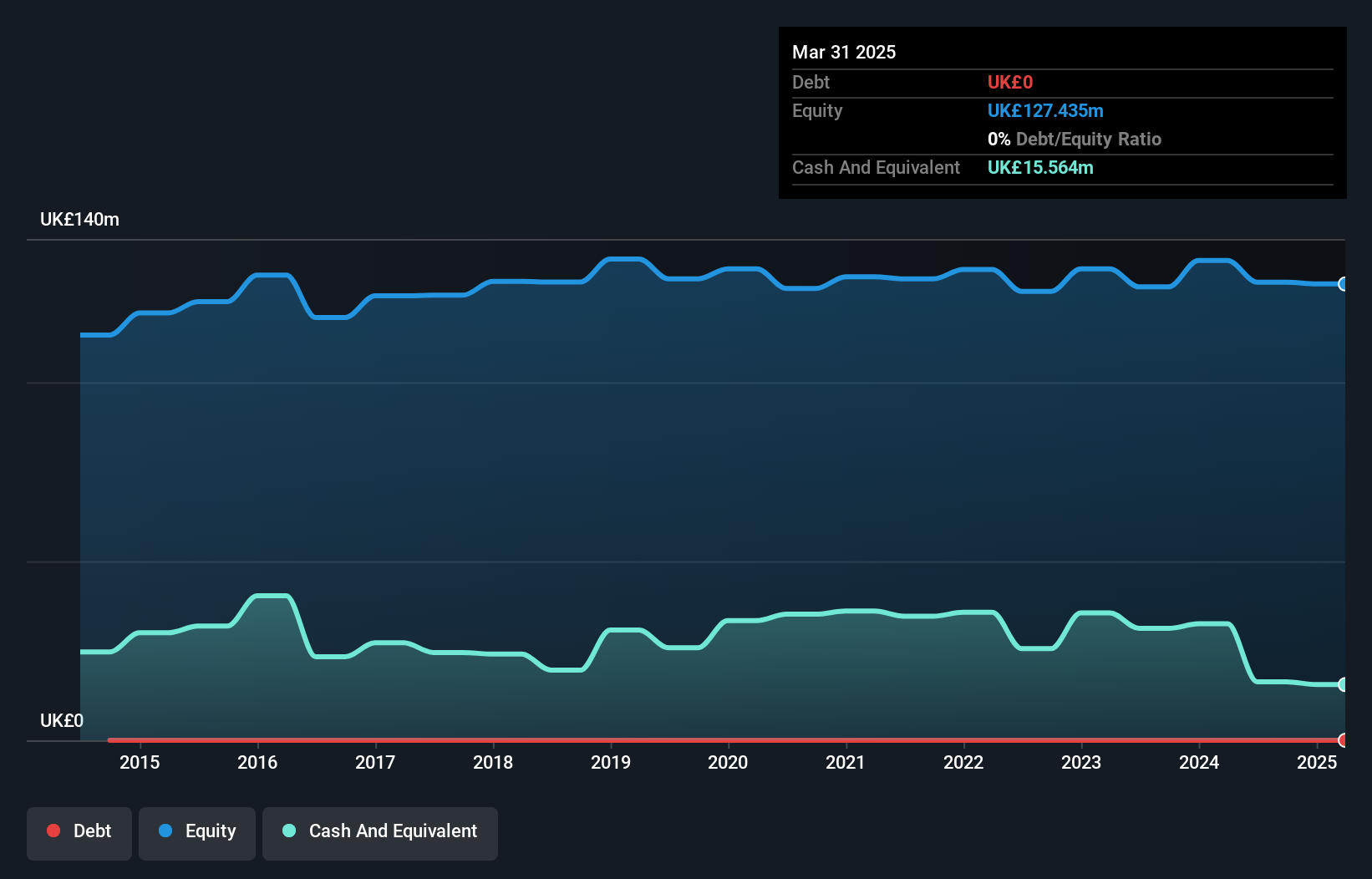

Castings P.L.C., with a market cap of £118.21 million, reported half-year sales of £87.56 million and net income of £3.73 million, reflecting an increase from the previous year despite lower profit margins (2.8% vs 6%). The company is debt-free and has stable short-term assets (£86M) covering both short-term (£31M) and long-term liabilities (£9.8M). Although trading at 47.8% below estimated fair value, the dividend yield of 6.76% is not well-covered by earnings or free cash flows, raising sustainability concerns amidst forecasted earnings growth of 25.28% annually.

- Unlock comprehensive insights into our analysis of Castings stock in this financial health report.

- Assess Castings' future earnings estimates with our detailed growth reports.

MJ Gleeson (LSE:GLE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £231.79 million.

Operations: The company generates revenue through two primary segments: Gleeson Homes, which accounts for £348.25 million, and Gleeson Land, contributing £17.57 million.

Market Cap: £231.79M

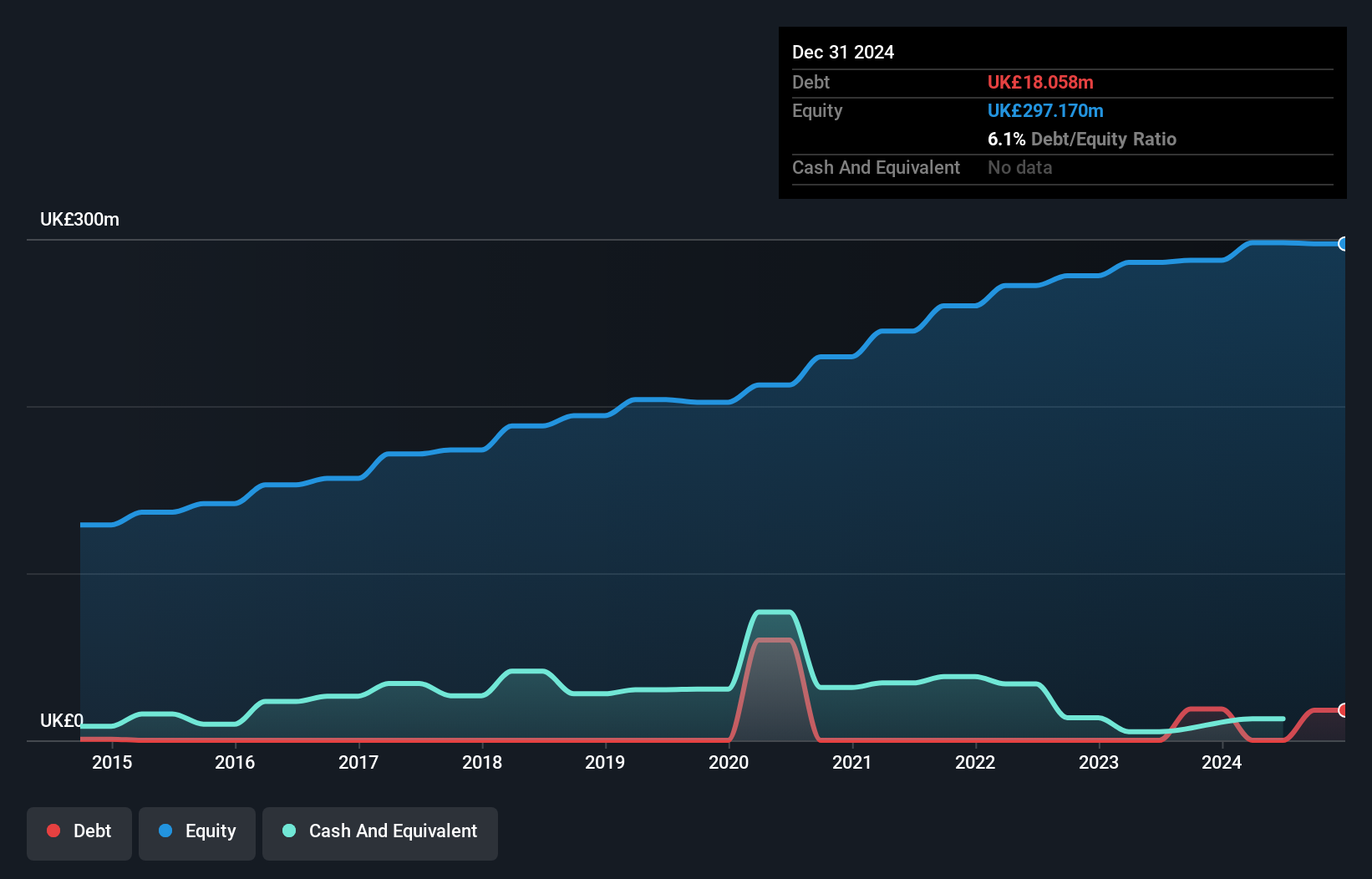

MJ Gleeson, with a market cap of £231.79 million, operates in the house building and land promotion sectors. Despite recent negative earnings growth and declining profit margins, it maintains a satisfactory net debt to equity ratio of 0.3% and covers its interest payments well with EBIT. The company’s short-term assets (£407.6M) exceed both short-term (£92.6M) and long-term liabilities (£19.1M), indicating strong liquidity management. Recent board changes include the appointment of Graham Prothero as Director and Keith Adey as Independent Non-Executive Director, enhancing governance structure ahead of expected Q1 2026 results announcement on November 26, 2025.

- Click to explore a detailed breakdown of our findings in MJ Gleeson's financial health report.

- Gain insights into MJ Gleeson's outlook and expected performance with our report on the company's earnings estimates.

Life Settlement Assets (LSE:LSAA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Life Settlement Assets PLC is a closed-ended investment trust company that invests in and manages portfolios of life settlement policies primarily from U.S. life insurance companies, with a market cap of $68.42 million.

Operations: The company generates revenue from its life settlement portfolios, amounting to $6.85 million.

Market Cap: $68.42M

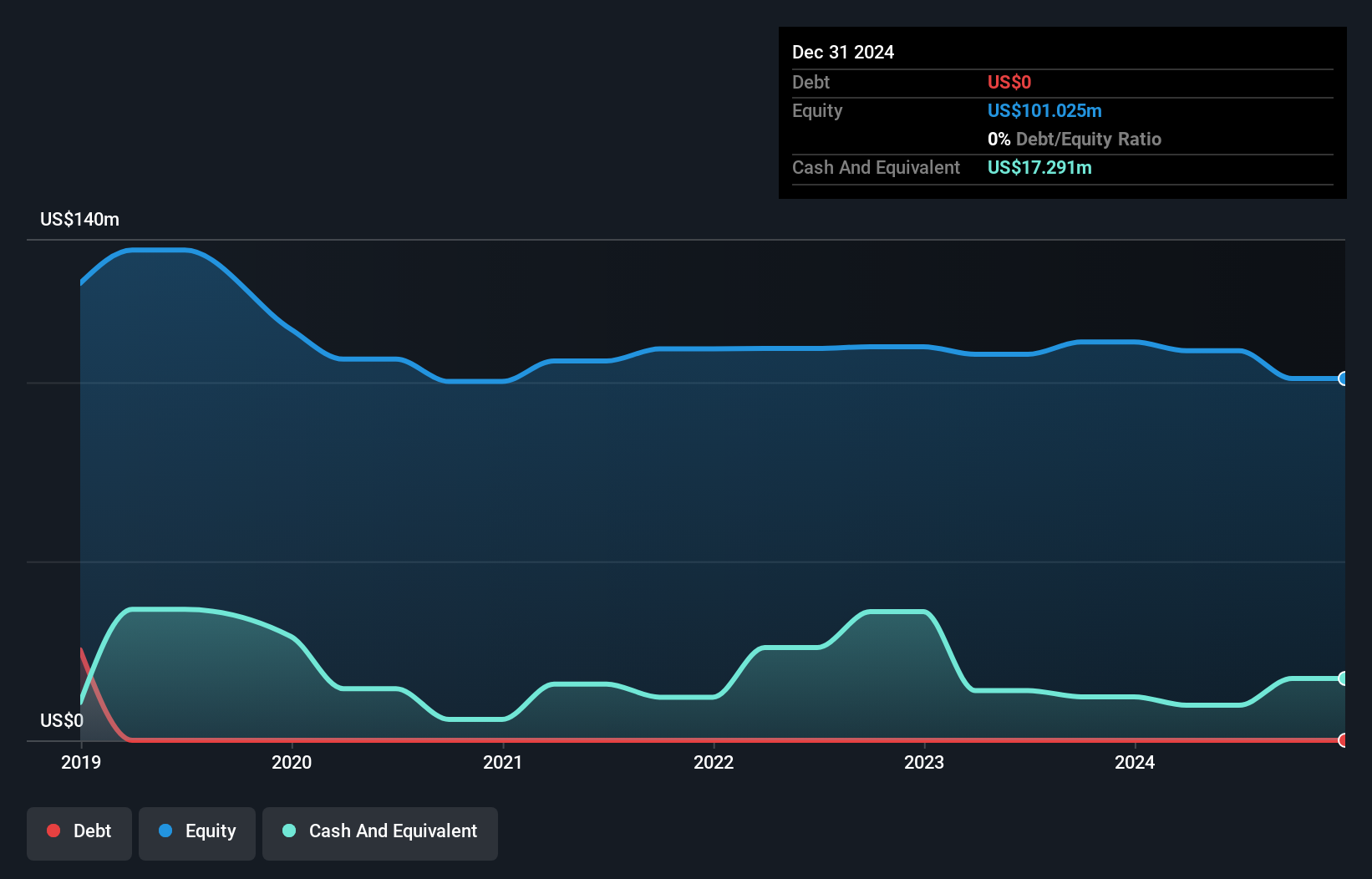

Life Settlement Assets PLC, with a market cap of $68.42 million, has demonstrated financial prudence by repurchasing 11.84% of its shares for $10.19 million and declaring a special dividend of 4.5307 cents per share totaling $2 million. Despite being unprofitable, the company has reduced losses over five years and maintains strong liquidity with short-term assets ($28.3M) exceeding liabilities ($1.6M). The firm remains debt-free, eliminating concerns about interest coverage or debt levels, while its board is experienced with an average tenure of 6.2 years, supporting stable governance amidst earnings challenges.

- Dive into the specifics of Life Settlement Assets here with our thorough balance sheet health report.

- Learn about Life Settlement Assets' historical performance here.

Where To Now?

- Investigate our full lineup of 304 UK Penny Stocks right here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報