Organización Soriana, S. A. B. de C. V.'s (BMV:SORIANAB) Shares Climb 31% But Its Business Is Yet to Catch Up

Despite an already strong run, Organización Soriana, S. A. B. de C. V. (BMV:SORIANAB) shares have been powering on, with a gain of 31% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

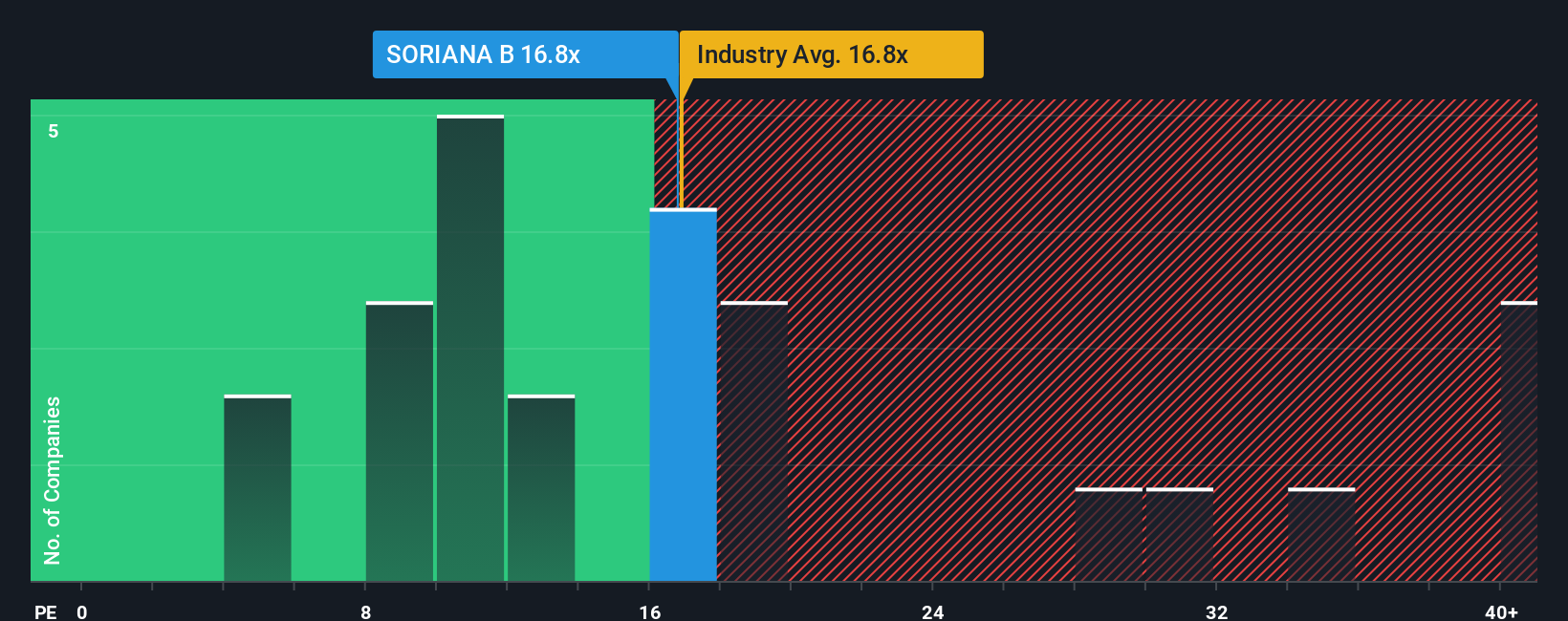

Following the firm bounce in price, Organización Soriana S. A. B. de C. V may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.8x, since almost half of all companies in Mexico have P/E ratios under 13x and even P/E's lower than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Organización Soriana S. A. B. de C. V as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Organización Soriana S. A. B. de C. V

Does Growth Match The High P/E?

Organización Soriana S. A. B. de C. V's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 89%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 19% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 9.2% per year during the coming three years according to the six analysts following the company. With the market predicted to deliver 12% growth each year, that's a disappointing outcome.

In light of this, it's alarming that Organización Soriana S. A. B. de C. V's P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Organización Soriana S. A. B. de C. V's P/E?

Organización Soriana S. A. B. de C. V's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Organización Soriana S. A. B. de C. V currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Organización Soriana S. A. B. de C. V has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Organización Soriana S. A. B. de C. V, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報