How Is Match Group's Stock Performance Compared to Other Communication Stocks?

Dallas, Texas-based Match Group, Inc. (MTCH) is an online dating and social discovery company with a market cap of $7.7 billion. It owns and operates a diversified portfolio of well-known dating platforms, including Tinder, Hinge, Match.com, OkCupid, Plenty of Fish, and Meetic.

Companies valued at $2 billion or more are typically classified as “mid-cap stocks,” and MTCH fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the internet content & information industry. The company generates revenue primarily through subscription fees and in-app purchases, and it focuses on leveraging technology, data analytics, and product innovation to enhance user engagement and monetize its global user base.

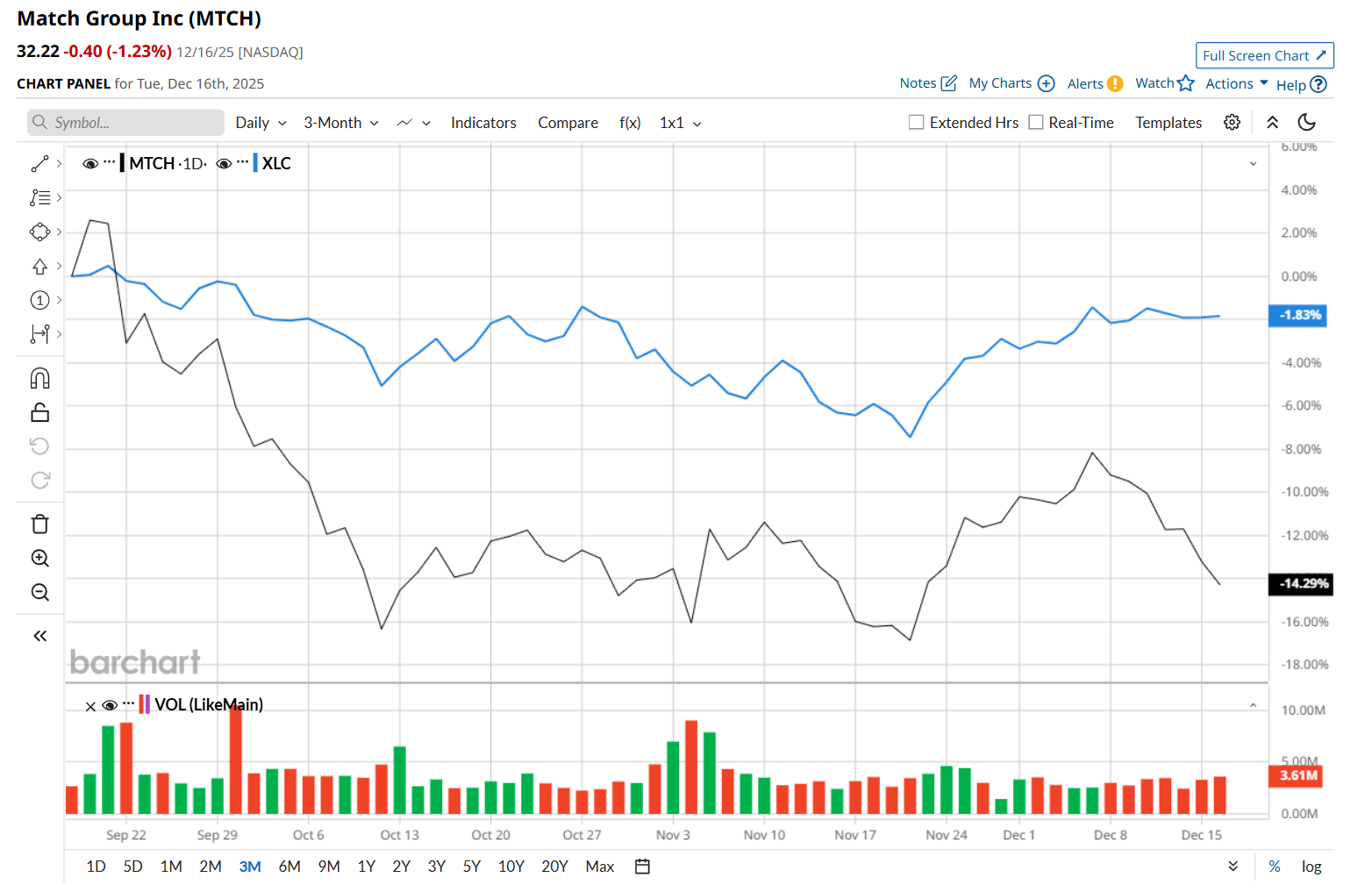

This online dating company has dipped 17.8% from its 52-week high of $39.20, reached on Aug. 15. Shares of MTCH have declined 13.9% over the past three months, underperforming the State Street Communication Services Select Sector SPDR ETF’s (XLC) 1.6% drop during the same time frame.

In the longer term, MTCH has declined marginally over the past 52 weeks, lagging behind XLC's 15.1% uptick over the same time frame. Moreover, on a YTD basis, shares of MTCH are down 1.5%, compared to XLC’s 20.5% return.

To confirm its bearish trend, MTCH has been trading below its 200-day moving average since early October, with minor fluctuations, and has remained below its 50-day moving average since late September, with slight fluctuations.

On Nov. 4, MTCH delivered weaker-than-expected Q3 results, yet its shares surged 5.2% in the following trading session. The company’s total revenue increased 2.1% year-over-year to $914.3 million, but missed consensus estimates by a slight margin. Moreover, its adjusted EBITDA fell 12% from the year-ago quarter to $301.4 million, with adjusted EBITDA margin falling by 500 basis points.

MTCH has considerably outpaced its rival, Bumble Inc. (BMBL), which declined 58.1% over the past 52 weeks and 56.6% on a YTD basis.

Despite MTCH’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 22 analysts covering it, and the mean price target of $38.37, suggests a 19.1% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 華爾街日報

華爾街日報