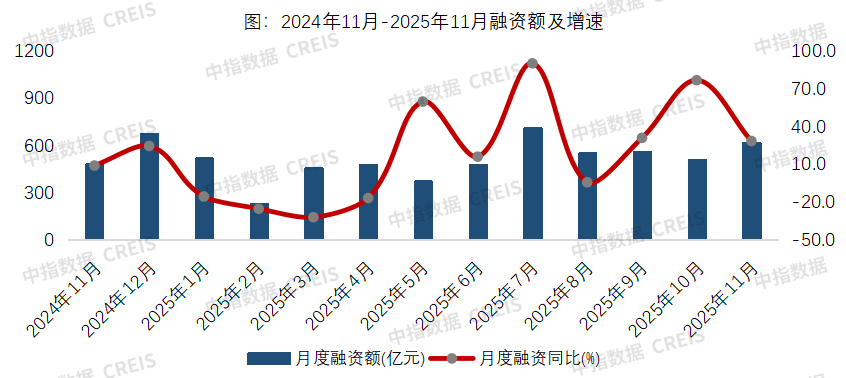

China Index Research Institute: The total amount of bond financing in the real estate industry in November was 62.04 billion yuan, up 28.5% year-on-year

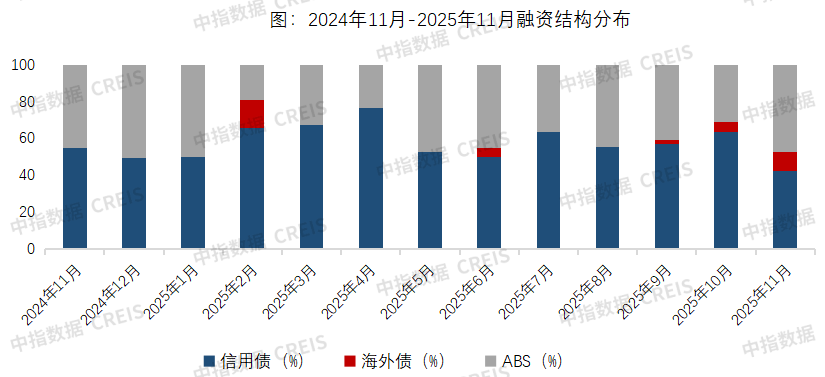

The Zhitong Finance App learned that according to monitoring by the China Index Research Institute, the total amount of bond financing in the real estate industry in November 2025 was 62.04 billion yuan, an increase of 28.5% over the previous year. Looking at the financing structure, credit bond financing in the real estate industry was 26.22 billion yuan, down 1.6% year on year, accounting for 42.3%; overseas bond financing was 6.42 billion yuan, accounting for 10.3%; and ABS financing was 29.40 billion yuan, up 36% year on year, accounting for 47.4%. The average interest rate for bond financing was 2.66%, down 0.07 percentage points from the previous year and up 0.1 percentage points from the previous month.

Data source: Middle Index Data CREIS

From January to November 2025, the total amount of real estate corporate bond financing was 55.28 billion yuan, an increase of 10.5% over the previous year. Looking at the financing structure, credit bond financing in the real estate industry was 320.0 billion yuan, a slight increase of 2.9% year on year, accounting for 58.2%; overseas bond financing was 16.15 billion yuan, up 141.0% year on year, accounting for 2.9%; and ABS financing was 213.93 billion yuan, up 19.0% year on year, accounting for 38.9%.

Credit bond issuance declined slightly year-on-year in November. Housing enterprises issuing bonds were mainly central state-owned enterprises. This month, the total amount issued by China Merchants Shekou, Poly Development, etc. exceeded 3 billion yuan, and the amount of credit bonds issued by CCCC Real Estate exceeded 2 billion yuan. This month, mixed ownership companies such as Greentown successfully issued credit bonds, with a total amount of about 1.5 billion yuan, for a period of 3 years. Long-term capital inflows helped companies extend their debt maturity structures. This month's credit bonds are issued for a long time, mainly bonds with a term of 1-3 years or more, with an average issuance period of 3.56 years.

China Resources Land successfully issued overseas bonds in November, leading to an increase in the scale of overseas bond issuance. On November 13, China Resources Land Limited issued RMB 4.3 billion and US$300 million dual-currency green bonds in Hong Kong, including: 3-year US$300 million bonds with a coupon interest rate of T3+68 basis points, or 4.125%; and 5-year RMB 4.3 billion bonds with a coupon interest rate of 2.40%.

The distribution scale of ABS was 29.40 billion yuan, a significant increase over the previous year. Among them, REITs are the most widely issued asset securitization products, accounting for 51.7%; followed by CMBS/CMBN, accounting for 24.5%; supply chain ABS and guaranteed housing account for 12.7% and 11.1%, respectively. On November 28, the “Huatai-Shanghai China Construction Plaza Holding Real Estate Asset Support Program” was successfully established. The project used Shanghai China Construction Plaza, a high-quality commercial complex under the China Construction Eighth Bureau, as the underlying asset pool. Previously, in November 2024, the “CITIC Securities - Yuexiu Commercially Held Real Estate Asset Support Program” was successfully issued on the Shenzhen Stock Exchange. The underlying asset was the Guangzhou International Trade Center office building. Holding real estate ABS continues to expand, creating favorable conditions for real estate companies to develop operational business and establish a new model for real estate development.

Financing interest rate: Overall financing costs have declined slightly

Looking at the financing interest rate, the average interest rate for bond financing this month was 2.66%, down 0.07 percentage points year on year, up 0.1 percentage point from month to month. The average interest rate for bond financing fell slightly year on year and rose slightly from month to month. Among them, the average interest rate for credit bonds was 2.23%, down 0.55 percentage points from the previous year; the average interest rate for overseas bonds was 2.97%, down 0.33 percentage points from the previous month; and the average interest rate for ABS was 2.97%, up 0.31 percentage points from the previous year, up 0.15 percentage points from the previous month.

Corporate financing news: China Merchants Shekou has the highest issuance amount, and Suzhou Hi-Tech has the lowest financing cost

Judging from typical housing enterprise bond issuance, China Merchants Shekou issued the highest amount this month, reaching 5.04 billion yuan; Suzhou Hi-Tech's financing cost was the lowest, at 1.73%.

Table: Credit bond issuance statistics for typical enterprises in November 2025

Note: The unit of size is 100 million yuan, and the interest rate unit is% Data Source: China Index Data CREIS

Nasdaq

Nasdaq 華爾街日報

華爾街日報