PBF Energy (PBF): Revisiting Valuation After a Sharp Sell-Off and Strong Long-Term Returns

PBF Energy (PBF) shares have been under pressure recently, sliding over the past month and past 3 months, and that drawdown is making value focused investors recheck the long term story.

See our latest analysis for PBF Energy.

Zooming out, PBF Energy’s recent sell off, including a sharp 1 day share price return of minus 10.99 percent and a 30 day share price return of minus 31.67 percent, contrasts with a 5 year total shareholder return of 343.82 percent. This suggests long term investors have been well rewarded even as near term momentum fades.

If this volatility has you rethinking your exposure to refiners, it could be a time to scan other energy names and compare fundamentals across aerospace and defense stocks.

With shares down sharply despite solid long term returns and a modest discount to analyst targets, investors now face a key question: is PBF Energy genuinely undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 12.9% Undervalued

Compared to PBF Energy’s last close, the most followed narrative assigns a higher fair value, framing the recent sell off as a potential mispricing.

Net global demand for refined products is expected to exceed net refining capacity additions in the coming years, driven by ongoing population growth and underinvestment in new refining capacity outside North America, this tightening supply backdrop should support strong utilization, pricing power, and higher revenues for efficient U.S. refiners like PBF.

Curious how modest growth forecasts, shifting margins, and a surprisingly low future earnings multiple can still justify a higher fair value? Unpack the full narrative.

Result: Fair Value of $30.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational challenges at Martinez and long term pressure from decarbonization and EV adoption could cap margins and undermine the undervaluation case.

Find out about the key risks to this PBF Energy narrative.

Another View: What Our DCF Says

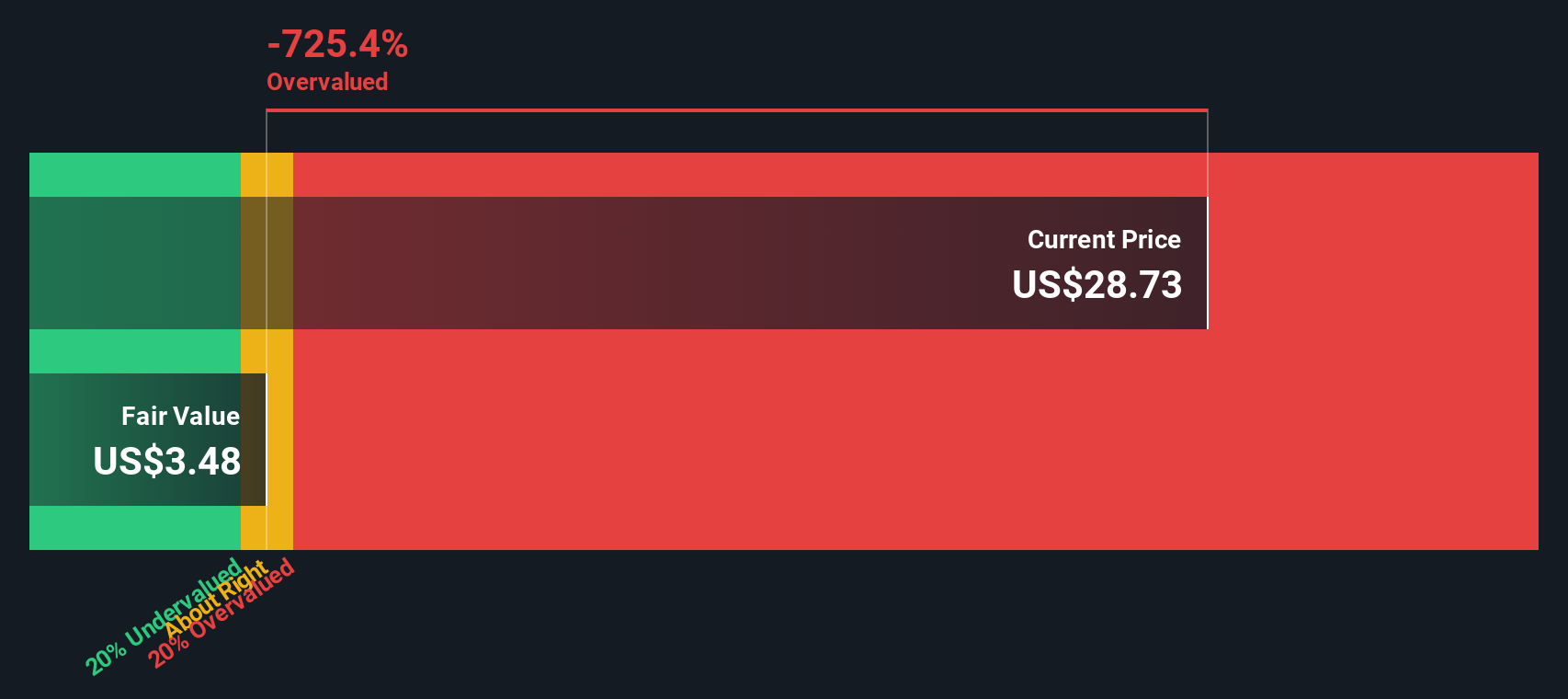

While the narrative based on future earnings multiples points to upside, our DCF model paints a very different picture. On those cash flow assumptions, PBF screens as overvalued at around $26.64 versus an estimated fair value nearer $3.78, which raises the question of which story investors should trust.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PBF Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PBF Energy Narrative

If you see the numbers differently or want to test your own assumptions against the data, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall St Screener to surface fresh, data driven opportunities that most investors are still overlooking.

- Capitalize on market mispricing by targeting companies trading below their cash flow potential through these 915 undervalued stocks based on cash flows that might not stay cheap for long.

- Ride powerful structural trends by zeroing in on innovators at the intersection of medicine and algorithms with these 30 healthcare AI stocks, where growth and real world impact meet.

- Unlock income focused strategies by scanning for resilient payers using these 13 dividend stocks with yields > 3%, so your portfolio works harder for you without relying on speculation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報