Sun Communities (SUI): Reassessing Valuation After CFO Change and Upgraded 2025 Core FFO Outlook

Sun Communities (SUI) just paired a CFO shake up with an upgrade to its 2025 core FFO outlook, a combination that gives investors fresh reasons to revisit the stock’s long term setup.

See our latest analysis for Sun Communities.

The stock has been treading water despite these updates, with the 1 year total shareholder return of 6.98 percent and a modest year to date share price gain suggesting momentum is steady rather than explosive.

If this kind of steady, income oriented REIT story appeals to you, it could be worth broadening your search and discovering solid balance sheet and fundamentals stocks screener (None results).

Yet with the shares still lagging their long term return targets and trading below both analyst and intrinsic estimates, investors have to ask: Is Sun Communities quietly undervalued, or already priced for its next leg of growth?

Most Popular Narrative: 11.8% Undervalued

Compared to Sun Communities' last close of $123.23, the most widely followed narrative points to a higher fair value anchored in long term cash generation.

Streamlined operations, organizational restructuring, and expanded cost saving initiatives (e.g., procurement standardization, payroll efficiency) have already delivered more than $17 million in annualized expense reductions, which are set to further enhance net margins and boost recurring earnings.

Want to see how shrinking revenues can still support a higher valuation? The narrative focuses on margin rebuild, profit inflection, and a premium multiple. Curious which assumptions really carry the fair value?

Result: Fair Value of $139.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, halted developments and ongoing weakness in the RV segment could derail the margin rebuild story and limit the upside implied by that 11.8 percent discount.

Find out about the key risks to this Sun Communities narrative.

Another Take on Valuation

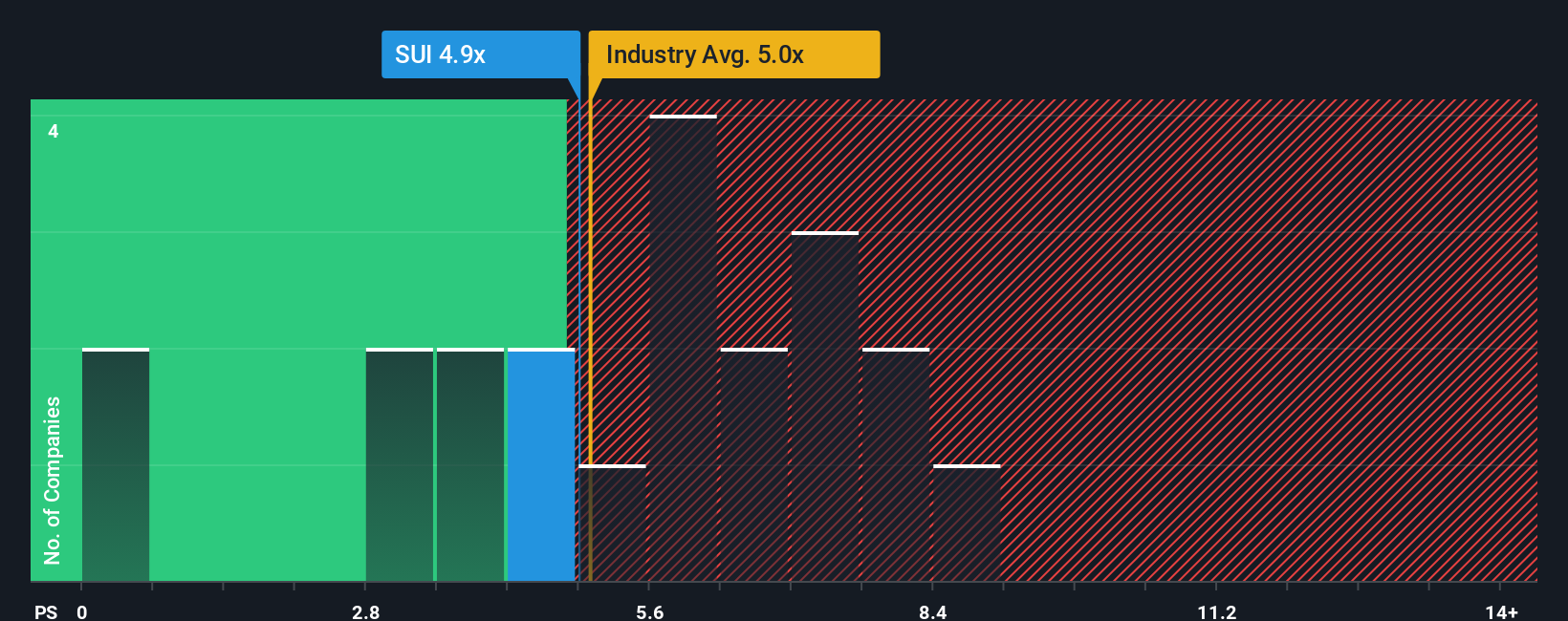

While the narrative pegs fair value around $140, a deeper look at pricing suggests a more nuanced picture. Sun trades on a 4.7x price to sales ratio, cheaper than peers at 6.4x, yet slightly above its 4.2x fair ratio. This hints at limited multiple expansion from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Communities Narrative

If you see the story differently or want to stress test every assumption yourself, you can build a complete view in minutes, starting with Do it your way.

A great starting point for your Sun Communities research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Sun Communities, you could miss out on compelling opportunities. Use the Simply Wall Street Screener to spot your next edge before others do.

- Capitalize on rapid innovation by reviewing these 25 AI penny stocks that are turning artificial intelligence breakthroughs into real revenue growth.

- Lock in stronger income potential by scanning these 13 dividend stocks with yields > 3% that offer attractive yields with the backing of solid fundamentals.

- Position yourself early in emerging trends by assessing these 80 cryptocurrency and blockchain stocks shaping the future of decentralized finance and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報