SPIE (ENXTPA:SPIE): Assessing Valuation After New Multi‑Year Tesla Energy Storage Agreement

SPIE (ENXTPA:SPIE) just deepened its relationship with Tesla through a multi year European framework agreement for battery energy storage projects, a strategic move that plugs SPIE directly into the grid scale transition story.

See our latest analysis for SPIE.

Those moves sit against a strong backdrop, with the share price up sharply this year on the back of the Tesla framework, energy transition acquisitions and an upcoming anti dilutive buyback, signalling building momentum and improving long term expectations, as reflected in a 1 year total shareholder return of 67.2 percent and a 5 year total shareholder return of 222.7 percent.

If SPIE’s momentum has you thinking more broadly about the energy and infrastructure theme, it could be worth exploring fast growing stocks with high insider ownership as a source of other potential growth names.

Yet with SPIE trading near its price target despite double digit earnings growth and a deepening role in Europe’s energy transition, investors must ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative Narrative: 7.9% Undervalued

SPIE’s most followed narrative sets a fair value slightly above the recent €48.66 close, framing upside that depends on ambitious profitability gains.

The evolving mix toward higher value services (e.g., Transmission and Distribution, High Voltage, battery storage, and data centers), combined with rigorous contract selection and pricing discipline, is enabling SPIE to deliver consistent margin expansion and support robust earnings growth.

Want to see what powers that upside case? The narrative leans on accelerating earnings, firmer margins and a premium future multiple. Curious how those pieces fit together?

Result: Fair Value of $52.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside could unravel if European growth disappoints, or if labor shortages and project delays squeeze margins more than analysts currently expect.

Find out about the key risks to this SPIE narrative.

Another Lens on Valuation

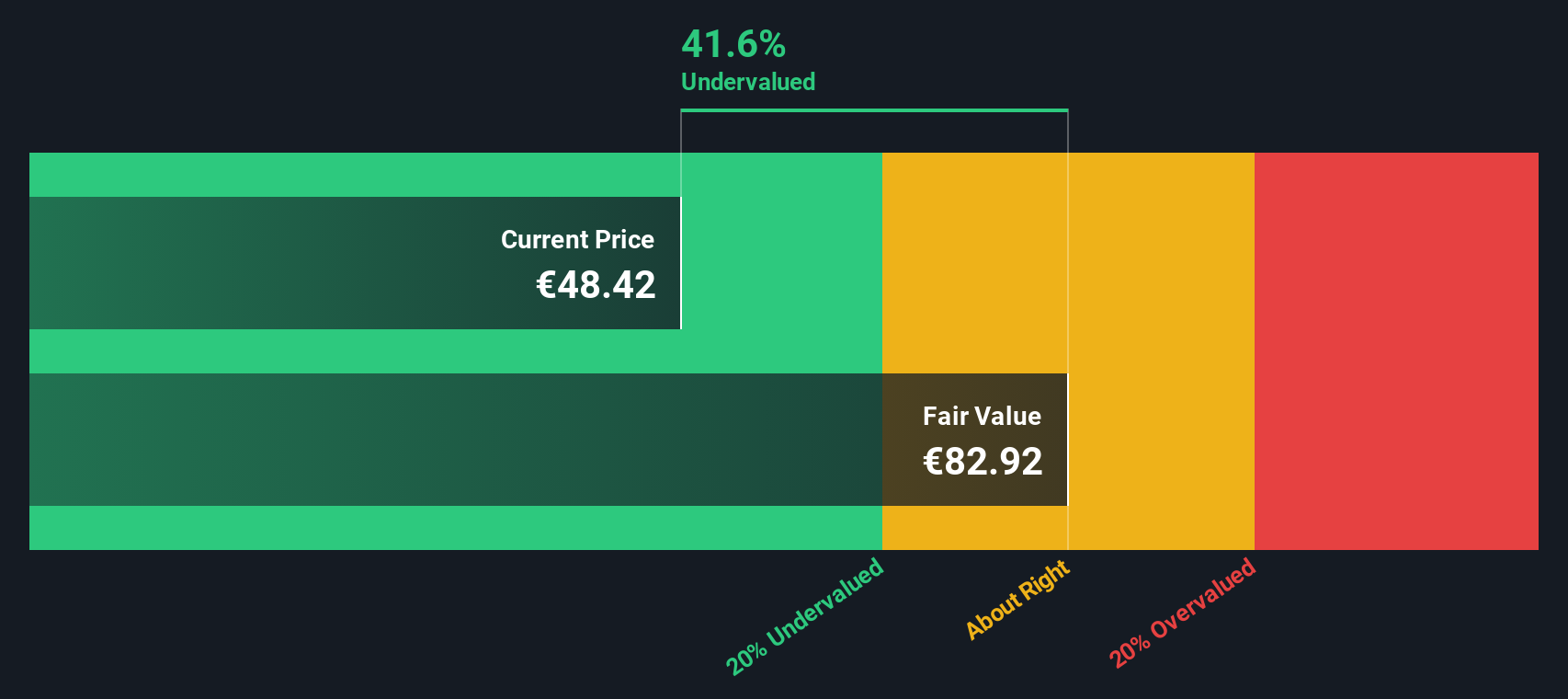

Our SWS DCF model paints a far bolder picture than the narrative based fair value, suggesting SPIE is trading roughly 41.7 percent below its estimated intrinsic value. If that cash flow view holds, are today’s earnings based multiples missing a longer term opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SPIE Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your SPIE research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few more opportunities by scanning targeted stock lists on Simply Wall Street’s Screener so promising ideas never slip past you.

- Capture potential mispricings early by reviewing these 915 undervalued stocks based on cash flows that may offer solid upside as fundamentals and sentiment catch up.

- Capitalize on cutting edge innovation with these 25 AI penny stocks that are reshaping industries through rapid advances in artificial intelligence.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help support long term, compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報