Assessing Sarepta Therapeutics (SRPT) Valuation After a Recent Share Price Rebound

Why Sarepta Therapeutics Stock Is Back on Investors Radar

Sarepta Therapeutics (SRPT) has quietly bounced over the past month, even after a tough year where the stock is still down sharply. That disconnect is exactly what makes it interesting now.

See our latest analysis for Sarepta Therapeutics.

The recent 30 day share price return of 18.61 percent, capped by a 3.53 percent gain in the last session to 22.31 dollars, looks more like early momentum than a full reversal when you set it against the painful 1 year total shareholder return of minus 82.26 percent.

If this turnaround story has you curious about where else capital might work harder, it could be worth scanning other specialised drug makers through healthcare stocks.

With the share price still crushed versus history but showing signs of life, and intrinsic value screens flagging a steep discount even as analysts stay cautious, is Sarepta a contrarian opportunity or a stock already reflecting modest future growth?

Most Popular Narrative Narrative: 9.2% Overvalued

With Sarepta shares last closing at 22.31 dollars against a narrative fair value near 20.43 dollars, the story hinges on how future earnings evolve.

The analysts have a consensus price target of $23.96 for Sarepta Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $5.0.

Want to see what kind of shrinking revenues can still justify rising profits and a richer earnings multiple than the broader biotech space? The narrative spells it out.

Result: Fair Value of $20.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, safety setbacks around Elevidys and persistent reimbursement or administrative hurdles could quickly undermine bullish assumptions and delay Sarepta’s path to profitable growth.

Find out about the key risks to this Sarepta Therapeutics narrative.

Another Angle on Valuation

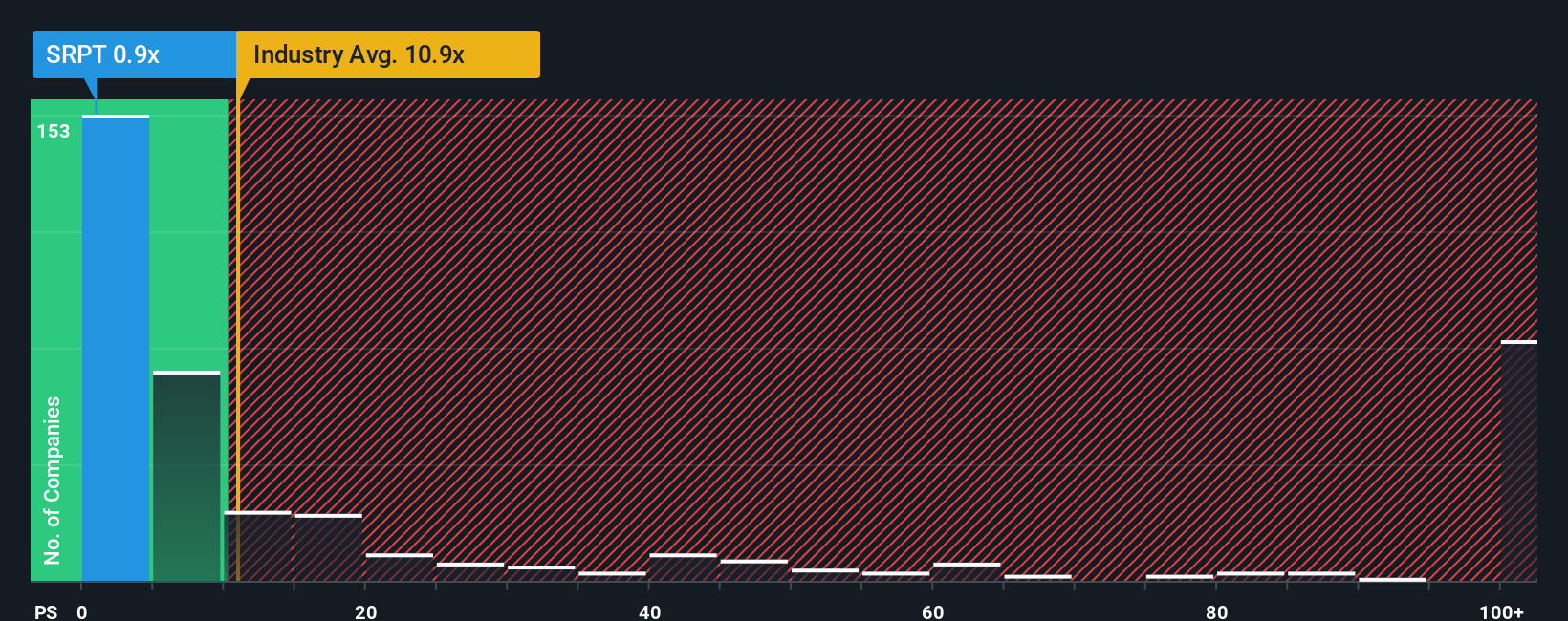

While the narrative model suggests Sarepta is about 9 percent overvalued, its 1x price to sales ratio looks cheap versus biotech peers at 12.3x and an estimated fair ratio of 1.2x. If sentiment normalizes, does today’s discount signal upside or a value trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sarepta Therapeutics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If you stop at Sarepta, you could miss powerful opportunities. Let Simply Wall Street’s screener surface fresh, data backed ideas before the crowd spots them.

- Capture asymmetric upside by scanning these 3626 penny stocks with strong financials that already show solid balance sheets and improving fundamentals before they hit most investors radars.

- Position your portfolio for the next wave of innovation by targeting these 25 AI penny stocks that are turning breakthrough algorithms into real revenue growth.

- Lock in quality at a discount by zeroing in on these 915 undervalued stocks based on cash flows where market pessimism has pushed prices well below long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報