GBPAUD and GBPNZD Currency Pairs Are Poised for Further Declines

GBPAUD

GBPAUD has reacted cleanly from a projected resistance area, aligning with wave (c) of an (a)(b)(c) corrective structure. This reaction increases the probability of a bearish continuation in the coming sessions. Traders should closely monitor price behavior around the rising channel support. A sustained break back below the 2.0100 level would act as bearish confirmation and could trigger further downside toward lower support zones.

www.wavetraders.com

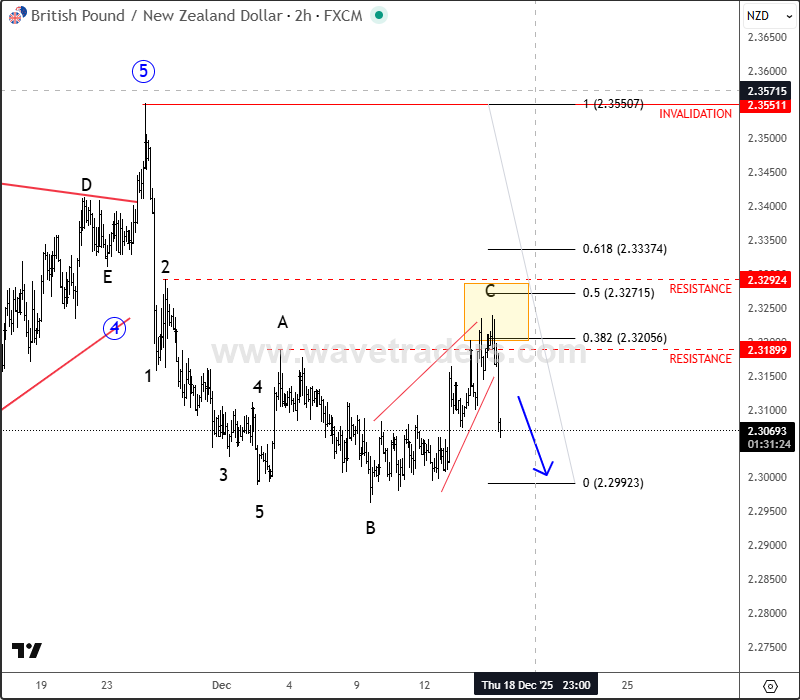

GBPNZD

GBPNZD is currently trading near a projected resistance zone formed within an intraday wedge pattern, which appears to be completing wave C of an irregular ABC flat correction. Such structures often precede trend continuation moves. A clear bearish confirmation below the 2.30 area would strengthen the bearish scenario and suggest that sellers are regaining control, potentially leading to a continuation of the broader downside trend.

www.wavetraders.com

All that being said, with both GBPAUD and GBPNZD pairs showing signs of further downside, it appears that the Australian Dollar (AUD) and New Zealand Dollar (NZD) may outperform the British Pound (GBP) in the coming weeks to months. Such relative strength in the commodity-linked currencies could help sustain a broader risk-on sentiment in the market.

For more analysis like this, you can watch below our latest recording of a live webinar streamed on December 15:

Nasdaq

Nasdaq 華爾街日報

華爾街日報