MFF Capital Investments (ASX:MFF): Valuation Check as Gerald Stack Steps Up to CEO in 2026

MFF Capital Investments (ASX:MFF) has just reshuffled its leadership, promoting Gerald Stack to Chief Executive Officer and Managing Director from January 2026. This move could subtly reshape strategy and refresh sentiment around the stock.

See our latest analysis for MFF Capital Investments.

The leadership change comes amid steadily improving sentiment, with a roughly mid single digit recent share price return and a powerful multiyear total shareholder return at the current A$4.99 share price. This suggests momentum is building rather than fading.

If this kind of turnaround story interests you, it could be worth broadening your search and discovering fast growing stocks with high insider ownership next.

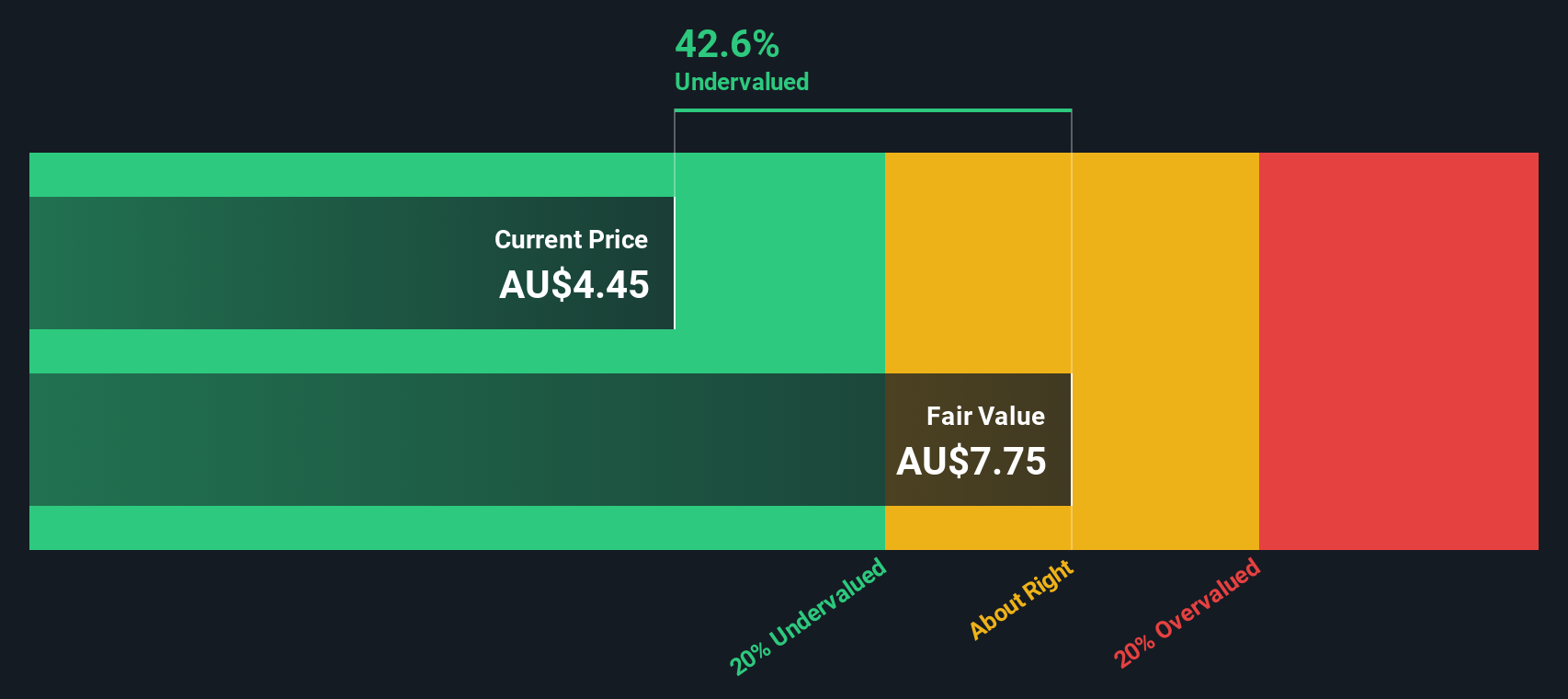

With the shares still trading at a steep discount to estimated intrinsic value despite double digit long term returns, is the market overlooking MFF’s next chapter, or already baking in its future growth potential?

Price-to-Earnings of 6.8x: Is it justified?

MFF Capital Investments appears materially undervalued on earnings, with a price to earnings ratio of 6.8x at a last close of A$4.99 compared to peers.

The price to earnings multiple compares the company’s market price with its earnings per share, helping investors gauge how much they are paying for each unit of profit in the capital markets space.

For MFF, a 6.8x price to earnings ratio, combined with a history of significantly growing earnings over the past five years, indicates that the market may not be fully reflecting its profit compounding track record in the share price.

Relative to both its specific peer group average of 24.3x and the broader Australian Capital Markets industry average of 20.7x, MFF’s current 6.8x price to earnings ratio implies a wide valuation gap that could indicate potential upside if sentiment or fundamentals strengthen.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.8x (UNDERVALUED)

Alongside the earnings multiple, our DCF model estimates a fair value of A$14.75 per share for MFF Capital Investments, versus the current A$4.99 price, indicating the stock is trading about 66 percent below this estimate of intrinsic value based on discounted cash flows.

By projecting the company’s future cash flows and discounting them back to today, the SWS DCF model builds a valuation anchored in long term fundamentals rather than short term market swings.

Given MFF’s role as an investment firm focused on acquiring quality businesses at attractive prices, this kind of cash flow based approach aligns closely with how value oriented investors often assess opportunity over a medium to longer term horizon.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of $14.75 (UNDERVALUED)

However, investors should still weigh risks, including execution missteps under new leadership and weaker market returns that could pressure portfolio performance and valuation.

Find out about the key risks to this MFF Capital Investments narrative.

Another View: What If The Cash Flows Are Right?

While the low 6.8x earnings multiple already hints at value, our DCF model paints an even starker picture, pointing to fair value of about A$14.75 per share. If both earnings and cash flow lenses are this optimistic, is the market underestimating how long MFF’s edge can last?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MFF Capital Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MFF Capital Investments Narrative

If you see things differently or prefer to test the numbers yourself, you can build a personalized MFF view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MFF Capital Investments.

Looking for more investment ideas?

If you stop at MFF, you risk missing some of the most compelling opportunities on the platform. Put the Simply Wall St Screener to work now:

- Capture potential mispricings by targeting companies trading below intrinsic value with these 911 undervalued stocks based on cash flows, where cash flows and fundamentals do the heavy lifting.

- Explore structural shifts in intelligent automation by zeroing in on breakthrough innovators through these 25 AI penny stocks, before the crowd fully catches on.

- Turn volatility into an ally by focusing on high potential small caps via these 3625 penny stocks with strong financials, built to surface ideas you might otherwise overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報