How Life Time’s New Otay Ranch Flagship Could Shape LTH’s Premium Wellness Strategy for Investors

- Life Time Group Holdings has opened its newest athletic country club, Life Time Otay Ranch, a 135,000-square-foot, ground-up facility in Chula Vista’s Cota Vera community, expanding its California footprint to nine clubs with nearly 200 new team members.

- This Southern California flagship underscores Life Time’s focus on large-format, premium wellness destinations that bundle fitness, recovery, dining, workspaces and family services into a single, high-touch membership offering.

- We’ll now explore how this large-format Otay Ranch opening, with its broad wellness and family amenities, affects Life Time’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Life Time Group Holdings Investment Narrative Recap

To own Life Time Group Holdings, you need to believe its capital intensive, premium club build outs can keep attracting high value members while supporting earnings growth despite a high debt load. The Otay Ranch opening fits this thesis but does not materially change the key near term catalyst of executing the broader new club pipeline, nor the central risk around funding large projects through sale leasebacks and other financing.

The most relevant recent announcement is Life Time’s November 2025 guidance raise, with full year 2025 revenue now expected at US$2,978 million to US$2,988 million and net income at US$304 million to US$306 million. Otay Ranch sits within the same large format, premium expansion strategy that underpins this outlook, but it also reinforces how dependent the story remains on successful, capital heavy club rollouts in targeted markets.

Yet behind the glossy new clubs, investors should be aware that Life Time’s heavy use of debt and real estate financing could...

Read the full narrative on Life Time Group Holdings (it's free!)

Life Time Group Holdings' narrative projects $3.8 billion revenue and $457.9 million earnings by 2028. This requires 10.7% yearly revenue growth and a $231.1 million earnings increase from $226.8 million today.

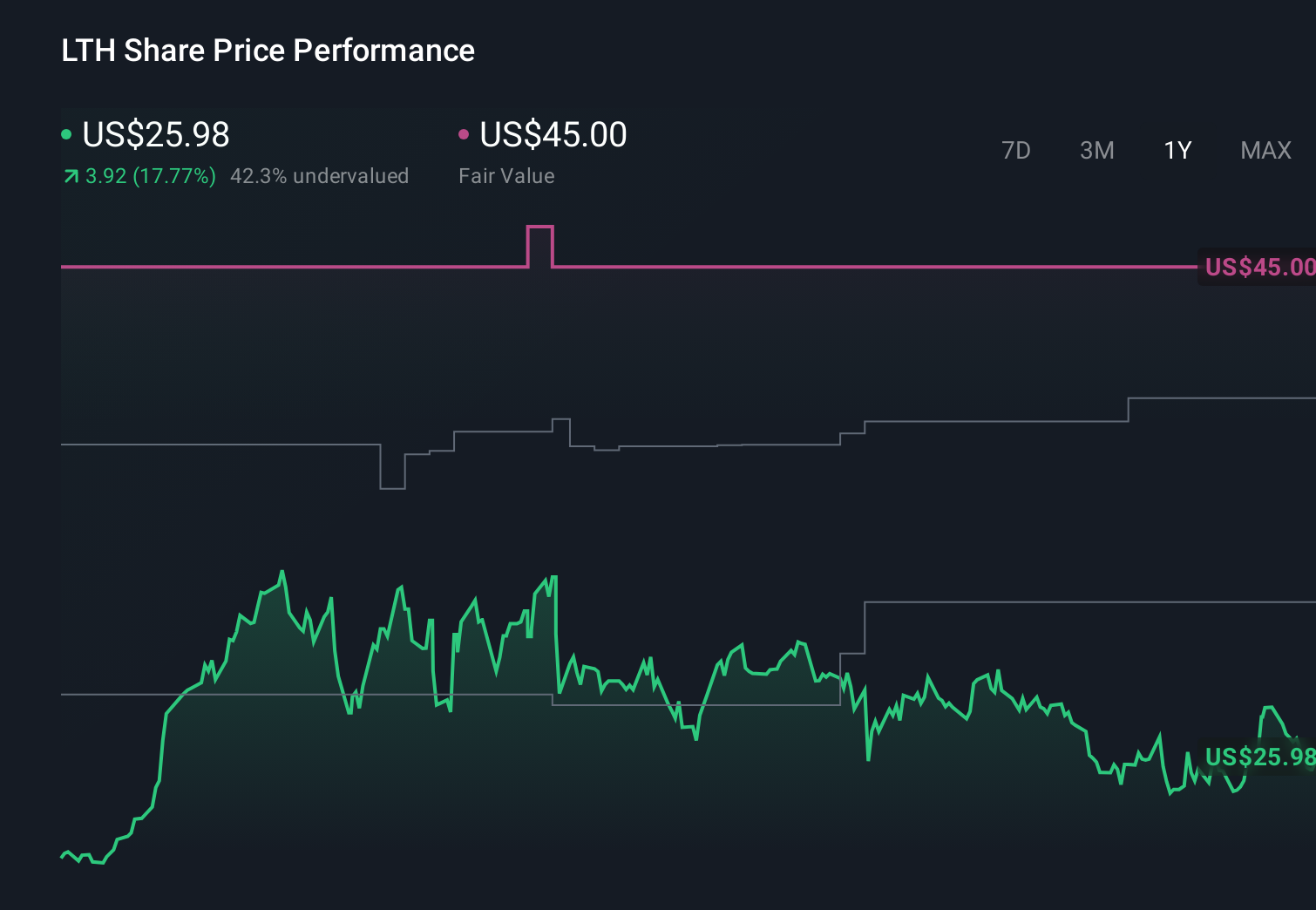

Uncover how Life Time Group Holdings' forecasts yield a $39.91 fair value, a 54% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates span roughly US$24.47 to US$45, showing how far apart individual views on Life Time can be. Against this wide range, the company’s aggressive, capital hungry expansion program keeps financing risk front and center for anyone assessing its long term performance.

Explore 3 other fair value estimates on Life Time Group Holdings - why the stock might be worth as much as 73% more than the current price!

Build Your Own Life Time Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

No Opportunity In Life Time Group Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報