Middle Eastern Penny Stocks: Takaful Emarat - Insurance (PSC) And 2 Promising Contenders

The Middle Eastern stock markets have recently faced downward pressure, with Gulf equities slipping due to declining oil prices and global market uncertainties. Despite these challenges, the search for value remains a key focus for investors, particularly in sectors that offer potential growth opportunities. Penny stocks, though an older term, still represent a viable investment area by highlighting smaller or less-established companies that can provide significant value when backed by solid financials and growth potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.23 | SAR1.28B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.384 | ₪170.92M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.87 | SAR974M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED371.91M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.75 | AED15.9B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED506.68M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.578 | ₪202.37M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Takaful Emarat - Insurance (PSC) (DFM:TAKAFUL-EM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Takaful Emarat - Insurance (PSC) operates in the takaful insurance sector in the United Arab Emirates and has a market capitalization of AED356.69 million.

Operations: The company's revenue is divided into AED658.46 million attributable to participants and AED5.46 million attributable to shareholders.

Market Cap: AED356.69M

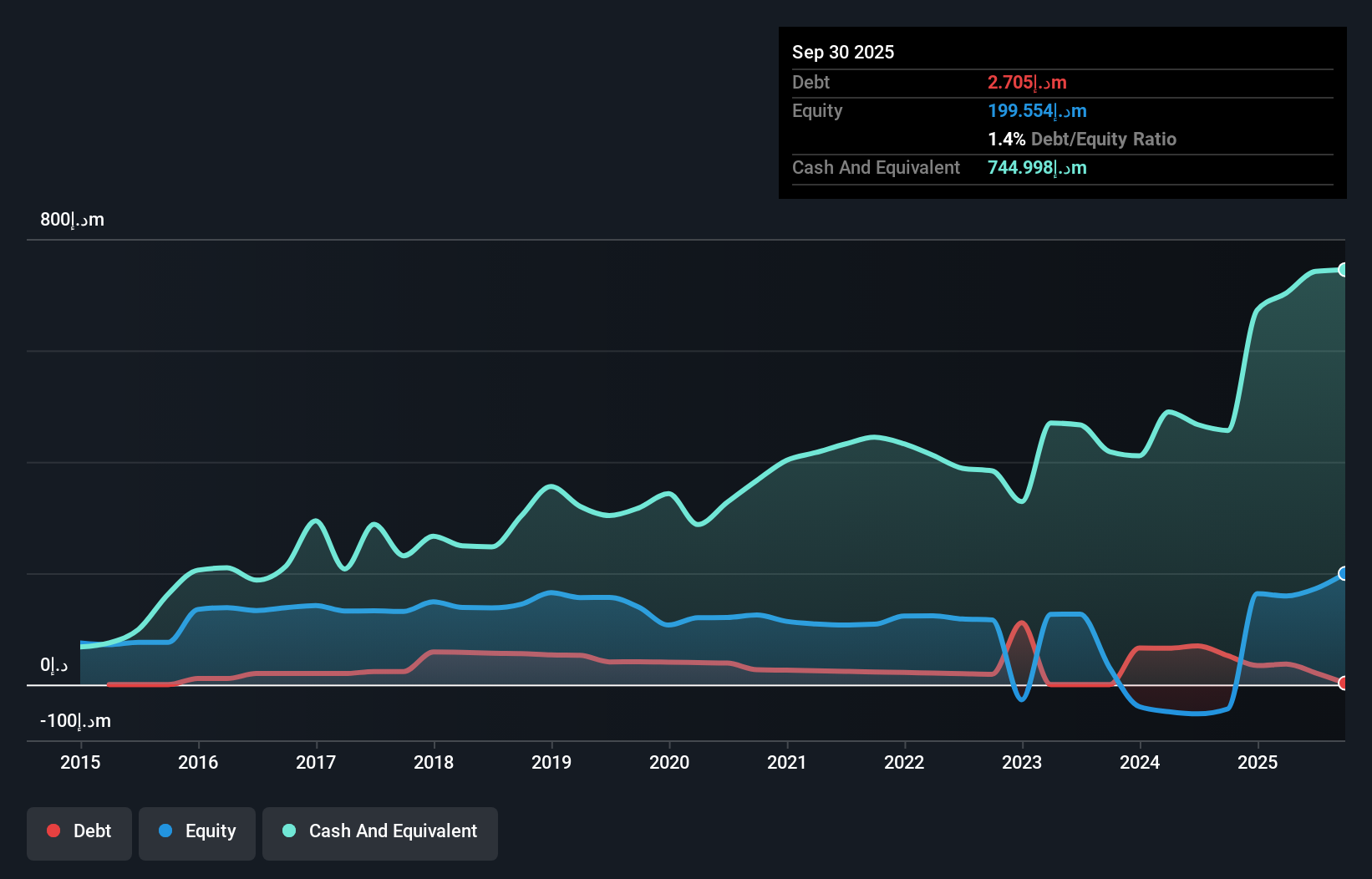

Takaful Emarat - Insurance (PSC) has shown significant financial improvement, becoming profitable in the last year with a net income of AED 23.18 million for the first nine months of 2025. The company's operating cash flow covers its debt very well, and it holds more cash than total debt, indicating strong liquidity. Short-term assets exceed both short- and long-term liabilities, highlighting sound financial health. Despite a low return on equity at 19.3%, the price-to-earnings ratio is favorable compared to the market average. However, the board's inexperience could present governance challenges moving forward.

- Dive into the specifics of Takaful Emarat - Insurance (PSC) here with our thorough balance sheet health report.

- Assess Takaful Emarat - Insurance (PSC)'s previous results with our detailed historical performance reports.

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret (IBSE:QUAGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret A.S. operates in the manufacturing and sale of granite products, with a market cap of TRY7.66 billion.

Operations: The company generates revenue primarily from its construction materials segment, amounting to TRY7.80 billion.

Market Cap: TRY7.66B

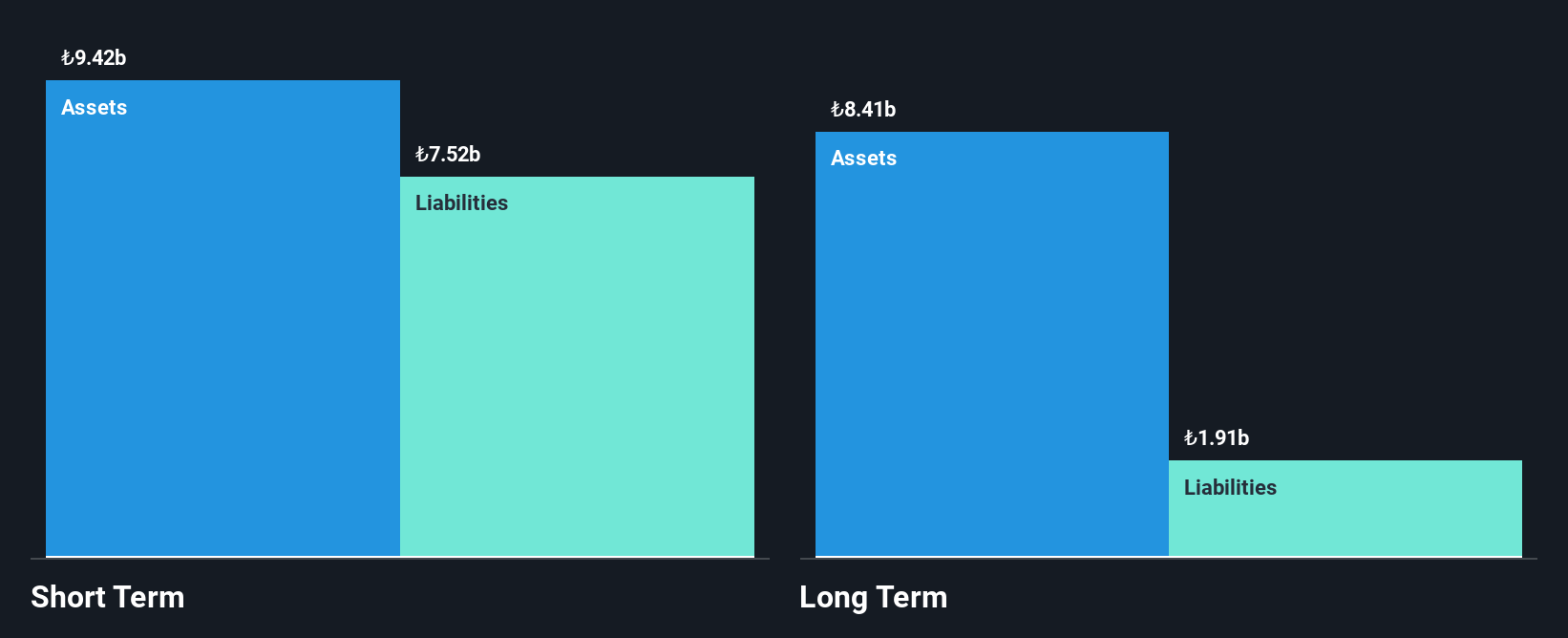

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret A.S. has seen a reduction in its net loss, reporting TRY 91.1 million for the third quarter compared to TRY 1,144.35 million a year ago, despite being unprofitable with declining earnings over five years. The company's sales for the nine months were TRY 7.58 billion, slightly down from the previous year. While short-term assets comfortably cover liabilities and debt levels have improved, interest payments remain poorly covered by EBIT at 0.5x coverage. The board's inexperience and high volatility may pose risks for investors considering this stock as an opportunity in penny stocks.

- Navigate through the intricacies of QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret with our comprehensive balance sheet health report here.

- Explore historical data to track QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret's performance over time in our past results report.

Batic Investments and Logistics (SASE:4110)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Batic Investments and Logistics Company operates in the real estate, transportation, and security sectors in Saudi Arabia with a market cap of SAR1.20 billion.

Operations: The company's revenue is primarily derived from its Transportation Sector (SAR153.71 million), Investment Property (SAR89.05 million), Security Guard Sector (SAR88.60 million), ATM Feeding Sector (SAR66.74 million), Maintenance and Operations (SAR58.76 million), Secured Money Transfer and Correspondence (SAR46.88 million), and Smart Parking Solutions (SAR39.70 million).

Market Cap: SAR1.2B

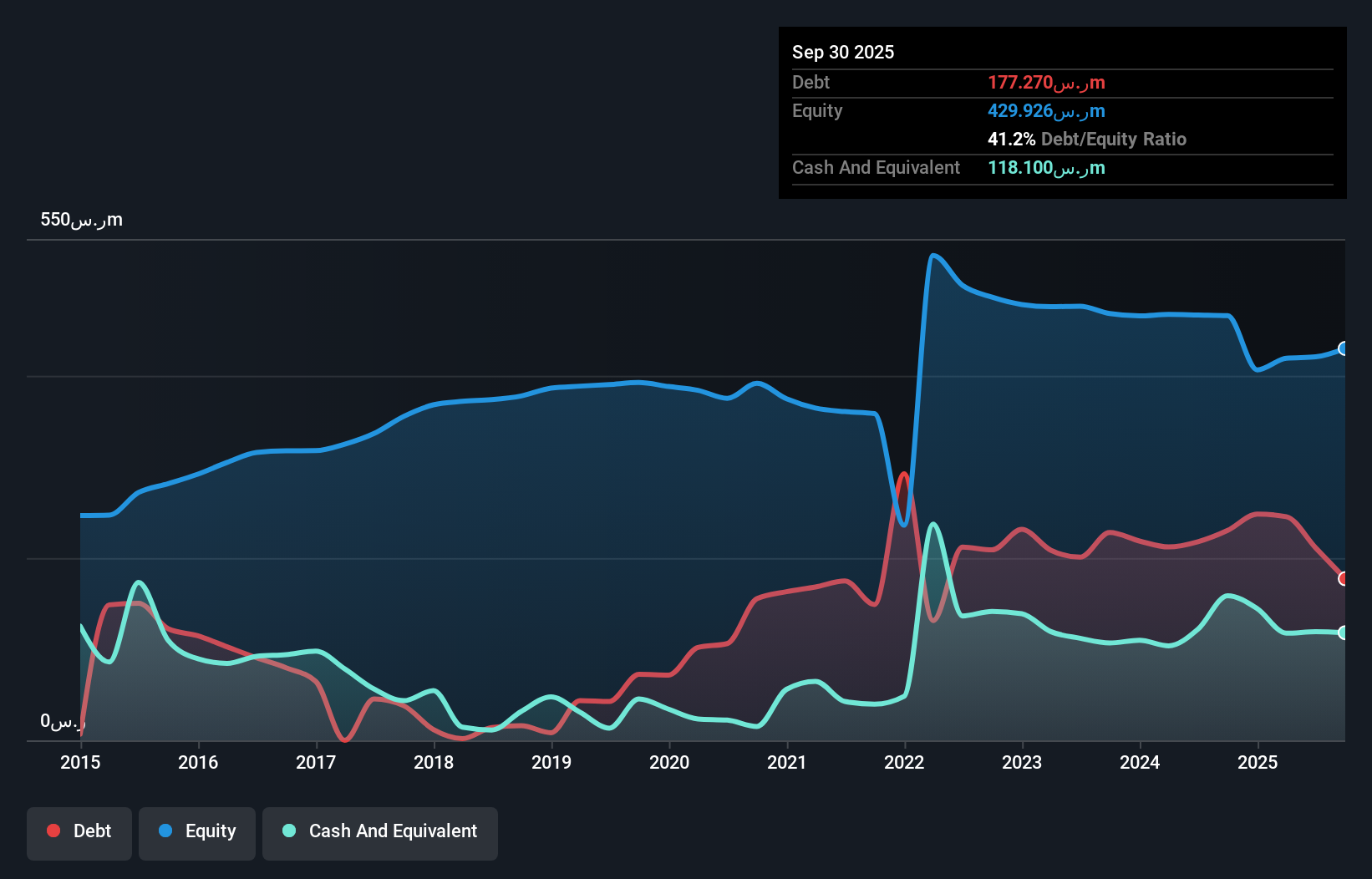

Batic Investments and Logistics Company reported a significant improvement in its financial performance for Q3 2025, with sales increasing to SAR142.17 million from SAR119.78 million the previous year, and net income of SAR9.36 million compared to a net loss previously. Despite this progress, the company remains unprofitable with negative return on equity at -8.01%. The debt is well managed with satisfactory net debt to equity ratio of 13.8% and interest payments covered by EBIT at 3.2x coverage, but the board's lack of experience could be a concern for investors in penny stocks seeking stability amidst volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Batic Investments and Logistics.

- Gain insights into Batic Investments and Logistics' historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 81 Middle Eastern Penny Stocks by clicking on this link.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報