The three-year shareholder returns and company earnings persist lower as Relaxo Footwears (NSE:RELAXO) stock falls a further 4.7% in past week

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Relaxo Footwears Limited (NSE:RELAXO) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 57% drop in the share price over that period. And over the last year the share price fell 37%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days.

With the stock having lost 4.7% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

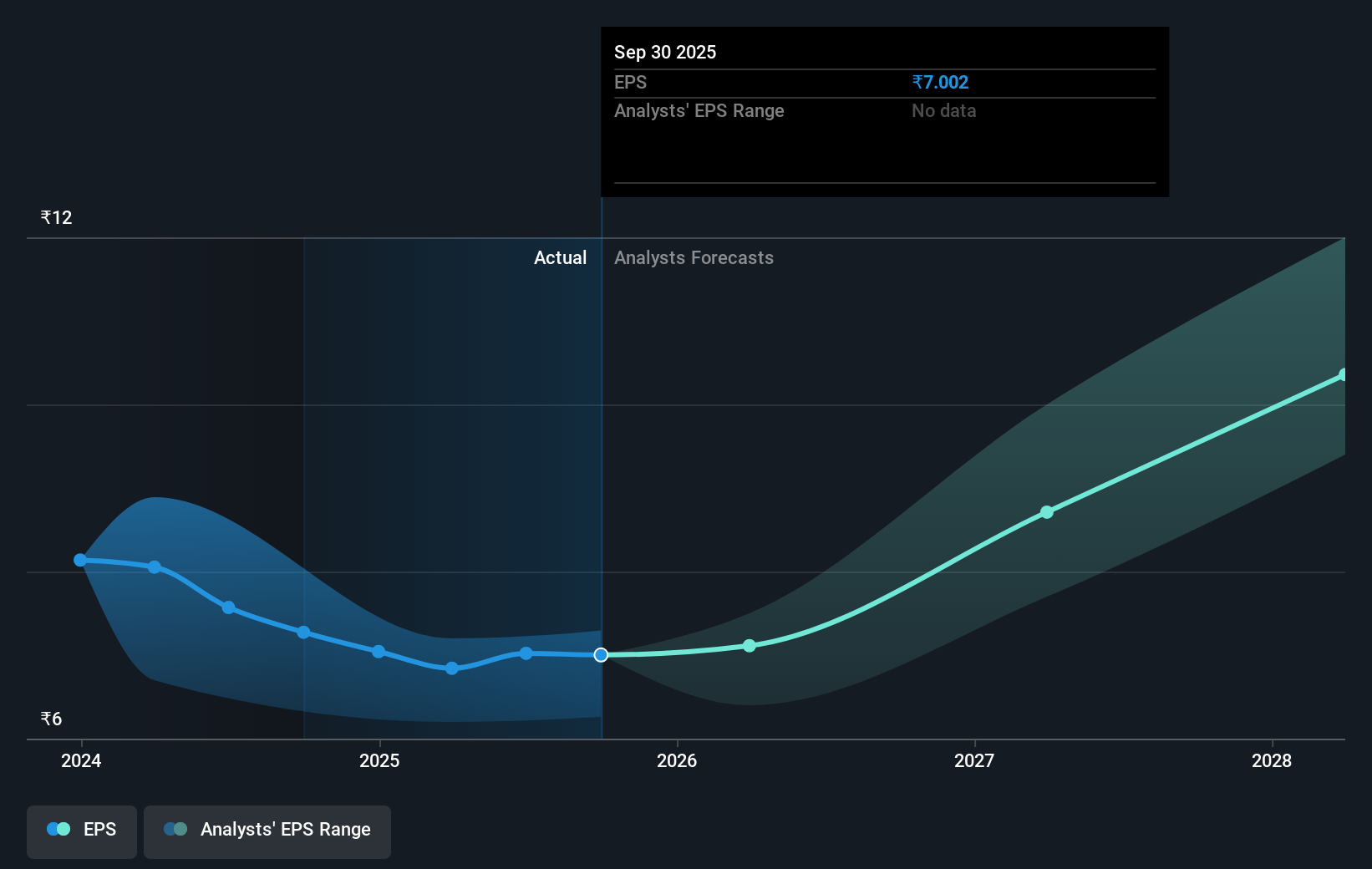

During the three years that the share price fell, Relaxo Footwears' earnings per share (EPS) dropped by 3.5% each year. This reduction in EPS is slower than the 24% annual reduction in the share price. So it seems the market was too confident about the business, in the past. Of course, with a P/E ratio of 57.27, the market remains optimistic.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Relaxo Footwears shareholders are down 37% for the year (even including dividends), but the market itself is up 0.06%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before deciding if you like the current share price, check how Relaxo Footwears scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報