AAR (AIR) Valuation Check After Strong Multi‑Year Share Price Gains

AAR (AIR) has quietly rewarded patient investors, with the stock up about 32% this year and nearly 80% over the past 3 years, as earnings and revenue growth continue to outpace many industrial peers.

See our latest analysis for AAR.

With the share price now around $81.49 and a solid 90 day share price return of 9 percent, momentum still looks constructive, echoing the company’s strong multi year total shareholder returns.

If AAR’s run has you thinking about where else to allocate capital in aerospace and defense, this could be a good moment to explore aerospace and defense stocks.

Yet with the shares trading near all time highs, still sitting at a double digit discount to analyst targets and a steep implied intrinsic discount, it raises the question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 11.7% Undervalued

With AAR last closing at $81.49 against a narrative fair value of $92.25, the story leans toward upside, built on compounding earnings power and disciplined assumptions.

Analysts expect earnings to reach $293.3 million (and earnings per share of $8.08) by about September 2028, up from $12.5 million today. The analysts are largely in agreement about this estimate.

Want to see how moderate revenue growth, expanding margins, and a surprisingly conservative future earnings multiple combine to support that upside case? The narrative spells out a step by step path that turns today’s slim profitability into far larger earnings power. Curious which assumptions do the heavy lifting in that fair value math and how sensitive the story is to even small changes in those inputs? Dive in to unpack the full blueprint.

Result: Fair Value of $92.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising OEM aftermarket competition and execution risk around Trax’s digital rollout could compress margins and undermine the earnings ramp embedded in this upside narrative.

Find out about the key risks to this AAR narrative.

Another View: Rich On Earnings

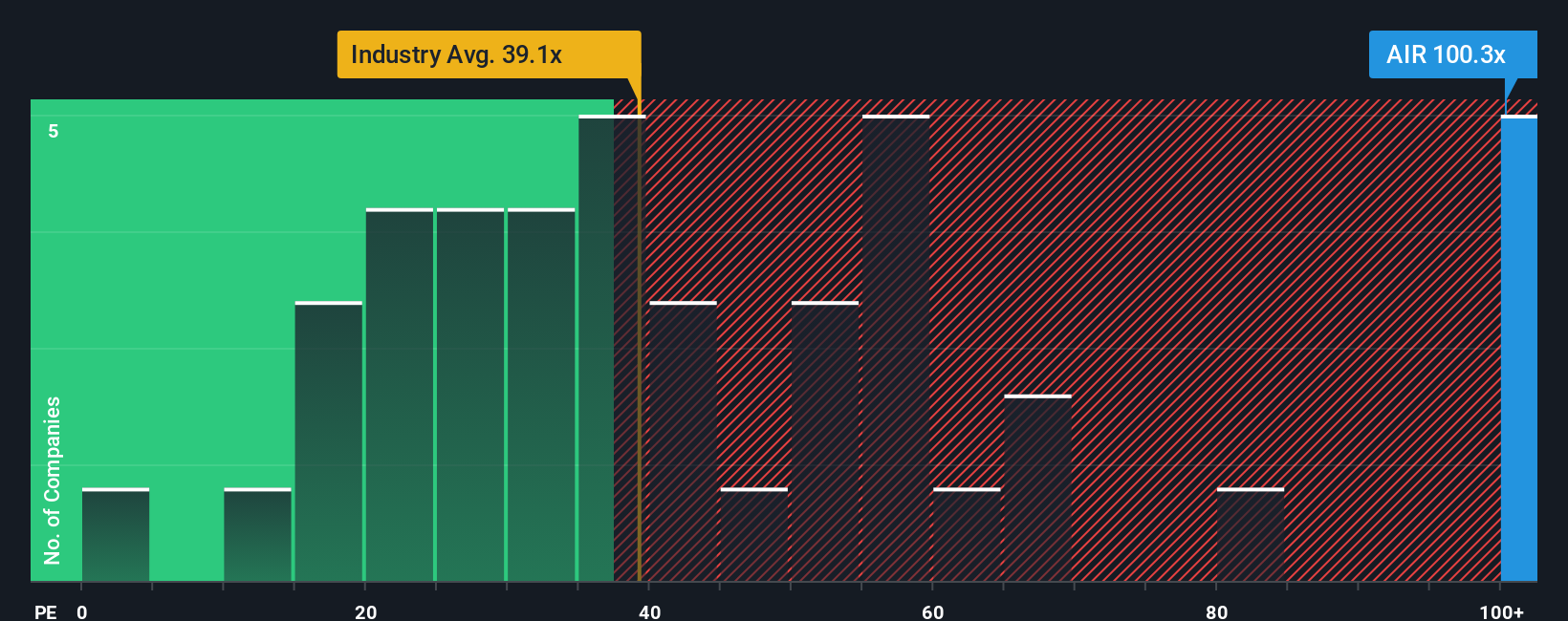

Look past the upbeat narrative and AIR looks expensive on earnings. Its price to earnings ratio sits around 111.6 times, versus about 37.5 times for the US Aerospace and Defense group and a fair ratio of 53.1 times, which points to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

If the story here does not fully resonate, or you would rather dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If AAR has sparked your interest, do not stop here. Tap into fresh opportunities across sectors using our data driven screeners designed to uncover strong candidates.

- Capture breakout potential by reviewing these 3625 penny stocks with strong financials that pair lower share prices with surprisingly resilient fundamentals and improving financial trajectories.

- Position ahead of the next tech shift by targeting these 25 AI penny stocks powering advances in automation, data intelligence, and scalable software models.

- Strengthen long term income with these 13 dividend stocks with yields > 3% that combine attractive yields with solid balance sheets and room for sustainable payout growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報