Amer Sports (NYSE:AS) Valuation Check as Salomon Revamps Creative Leadership and Expands Global Brand Presence

Amer Sports (NYSE:AS) just put its Salomon brand in the spotlight, with global chief brand officer Scott Mellin set to depart in April 2026 and Finnish designer Heikki Salonen reportedly in the mix to reshape creative direction.

See our latest analysis for Amer Sports.

The leadership reshuffle at Salomon comes as Amer Sports trades around $38.9 a share, with a powerful 30 day share price return of 28.09 percent and year to date momentum supporting a 1 year total shareholder return of 35.35 percent.

If Salomon’s refresh has you watching the broader sports and outdoor space, it could be a good moment to widen your search with fast growing stocks with high insider ownership

With shares already up strongly this year and analysts still seeing upside to their price targets, the key question now is clear: is Amer Sports still undervalued or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 16.1% Undervalued

With Amer Sports last closing at $38.9 against a narrative fair value of about $46.38, the valuation story hinges on aggressive earnings expansion and richer margins.

The rapid global expansion of Salomon and Arc'teryx, especially their footwear and women's categories, driven by increased participation in outdoor and active lifestyles (particularly among younger and female consumers in APAC and EMEA) is creating significant white-space growth opportunities and unlocking higher revenue and gross margin potential.

Curious how fast growing premium brands, rising margins and a lofty future earnings multiple all add up to that fair value? The full narrative unpacks the bold revenue ramp, the step change in profitability and the valuation runway it believes still lies ahead.

Result: Fair Value of $46.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on China and aggressive DTC expansion could strain margins and expose Amer Sports to regional shocks if demand underperforms expectations.

Find out about the key risks to this Amer Sports narrative.

Another Angle On Valuation

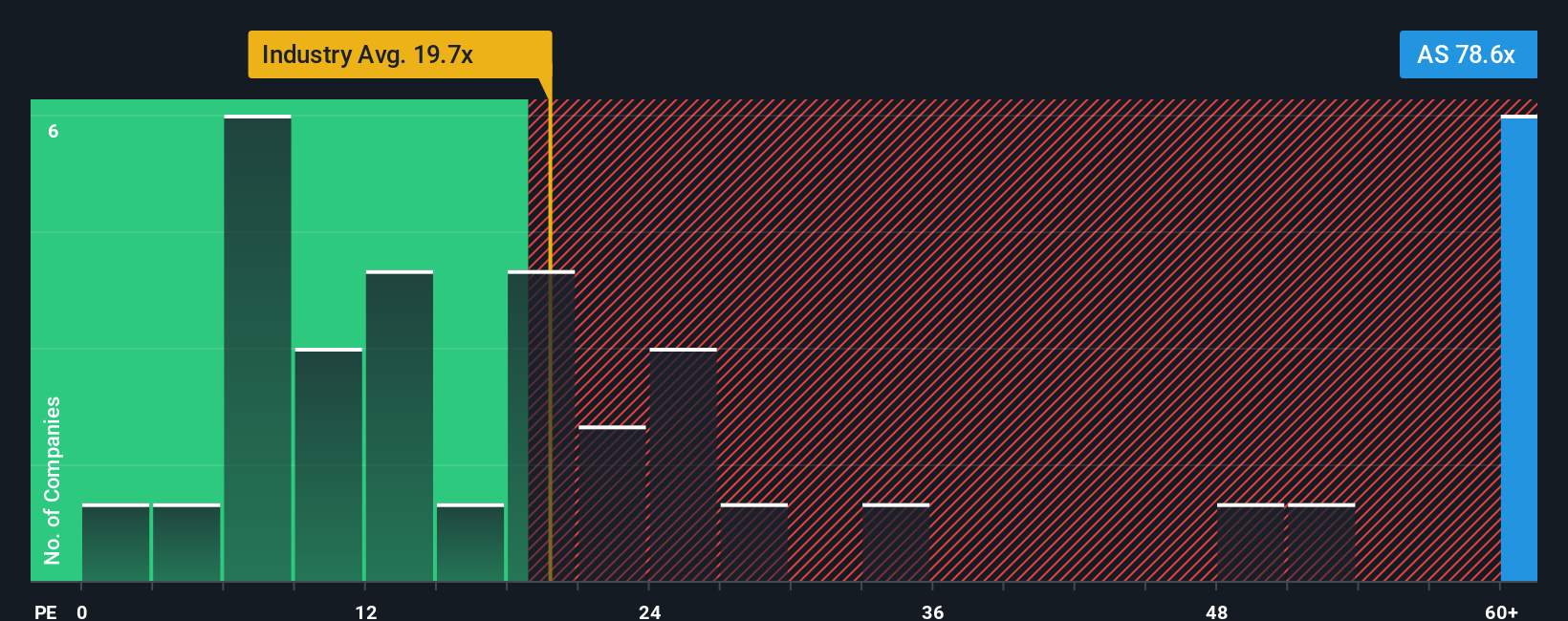

While the narrative fair value suggests upside, the earnings multiple tells a tougher story. Amer Sports trades at about 69 times earnings versus 22.6 times for the US Luxury industry and a fair ratio of 28.6 times, which implies the market may be overpaying for growth. What happens if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amer Sports Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom take in minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Amer Sports.

Ready for your next investing move?

Set yourself up for the next opportunity now, because potential gains often go to investors who actively scan fresh ideas instead of waiting for headlines.

- Explore potential income streams by focusing on reliable payers using these 13 dividend stocks with yields > 3% that can help support your portfolio’s cash flow.

- Seek the next wave of innovation by targeting companies involved in advanced automation and data science with these 25 AI penny stocks before they become widely followed.

- Identify opportunities that may interest value-focused investors by examining companies trading below their projected cash flows through these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報