Mitsubishi UFJ Financial Group (TSE:8306): Assessing Valuation After Recent Pullback and Multi‑Year Share Price Surge

Mitsubishi UFJ Financial Group (TSE:8306) has quietly outpaced Japan’s broader banking sector over the past year, and that steady climb has investors asking whether the recent pullback is an opportunity.

See our latest analysis for Mitsubishi UFJ Financial Group.

Despite the latest 1 day share price dip and mild weekly softness, Mitsubishi UFJ’s 90 day share price return of 8.66 percent and standout 3 year total shareholder return of 233.77 percent suggest momentum is still firmly in its favor.

If this steady climb has you thinking about where else capital is quietly compounding, it could be worth exploring fast growing stocks with high insider ownership for your next idea.

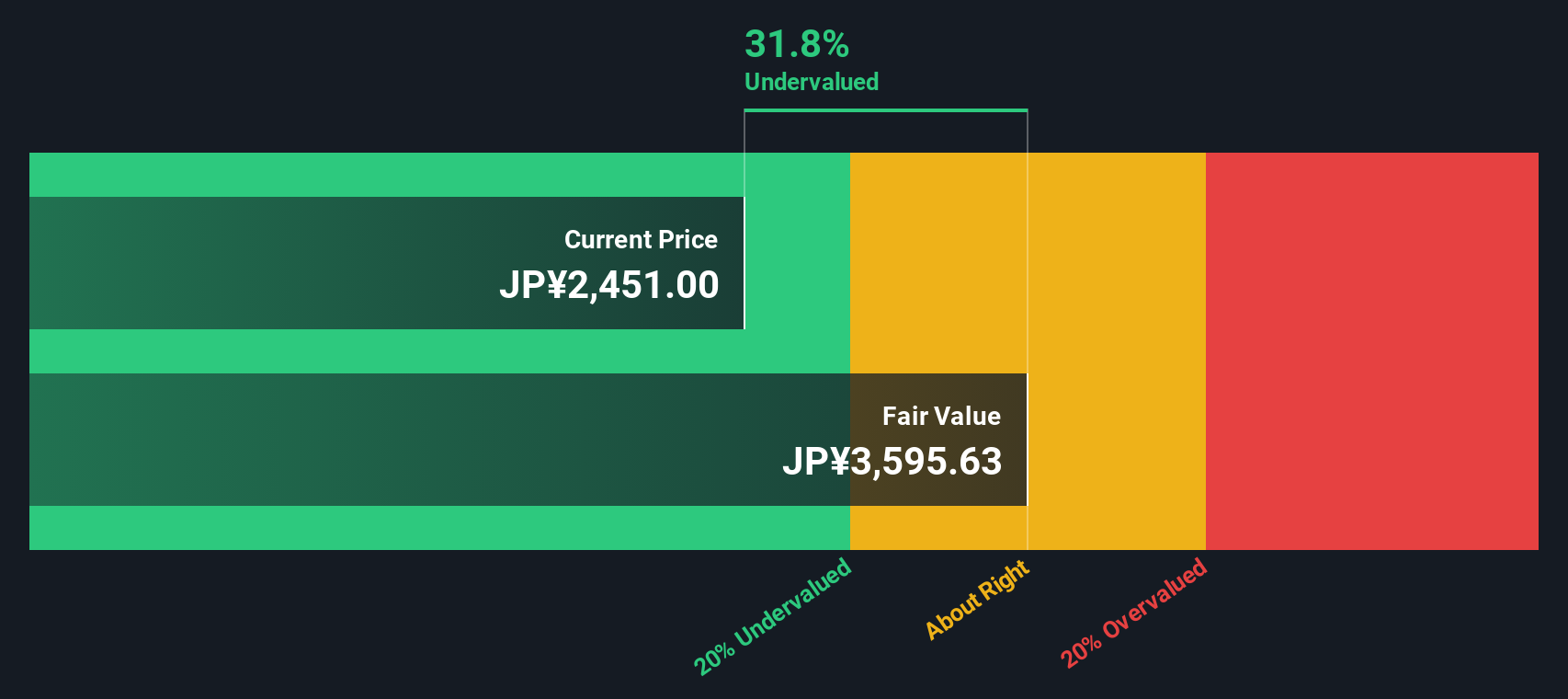

With earnings still growing solidly and the share price sitting just below analyst targets while trading at a hefty intrinsic discount, is Mitsubishi UFJ a mispriced compounding story, or has the market already banked its next leg of growth?

Most Popular Narrative Narrative: 0.3% Overvalued

With the narrative fair value sitting almost exactly at Mitsubishi UFJ’s last close of ¥2,477, the story hinges less on price gaps and more on future execution.

The analysts have a consensus price target of ¥2317.273 for Mitsubishi UFJ Financial Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2700.0 and the most bearish reporting a price target of just ¥1830.0.

Want to see what powers this near perfect alignment between price and fair value? Look at how revenue, margins and future earnings are being re engineered in this narrative.

Result: Fair Value of ¥2,470 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in bond portfolio income, or a sharp pullback in equity market gains, could quickly challenge this carefully balanced buyback and dividend story.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

Another View: Market Ratios Flash a Different Signal

Our SWS DCF model suggests Mitsubishi UFJ is about 30 percent undervalued at ¥3,563.83 per share, a far more optimistic picture than the near at par narrative fair value of ¥2,470. If cash flows point higher while sentiment sits on the fence, which signal should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi UFJ Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to pinpoint fresh ideas that match your strategy before the market fully wakes up.

- Capture potential mispricings by scanning these 909 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Target income plus resilience by reviewing these 13 dividend stocks with yields > 3% that pair yield with solid fundamentals.

- Position ahead of structural change by assessing these 80 cryptocurrency and blockchain stocks transforming finance with real world blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報