Exploring 3 Undervalued European Small Caps With Insider Buying

In recent weeks, the European market has experienced a mix of performances across major indices, with the pan-European STOXX Europe 600 Index ending slightly lower and varied results in national markets such as Germany's DAX and France's CAC 40. Amidst these movements, small-cap stocks have garnered interest due to their potential for growth in an environment where economic indicators and central bank policies suggest both opportunities and challenges. In this context, identifying companies with strong fundamentals and insider buying can be particularly appealing to investors looking for promising opportunities within the small-cap segment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.4x | 0.7x | 42.39% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 41.17% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.2x | 0.3x | 41.88% | ★★★★★☆ |

| A.G. BARR | 14.4x | 1.6x | 48.14% | ★★★★☆☆ |

| Eurocell | 16.7x | 0.3x | 39.06% | ★★★★☆☆ |

| Senior | 25.1x | 0.8x | 26.35% | ★★★★☆☆ |

| Tristel | 28.8x | 4.1x | 22.14% | ★★★☆☆☆ |

| Kendrion | 29.1x | 0.7x | 42.42% | ★★★☆☆☆ |

| CVS Group | 46.7x | 1.3x | 25.20% | ★★★☆☆☆ |

| Linc | NA | NA | 0.90% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

James Halstead (AIM:JHD)

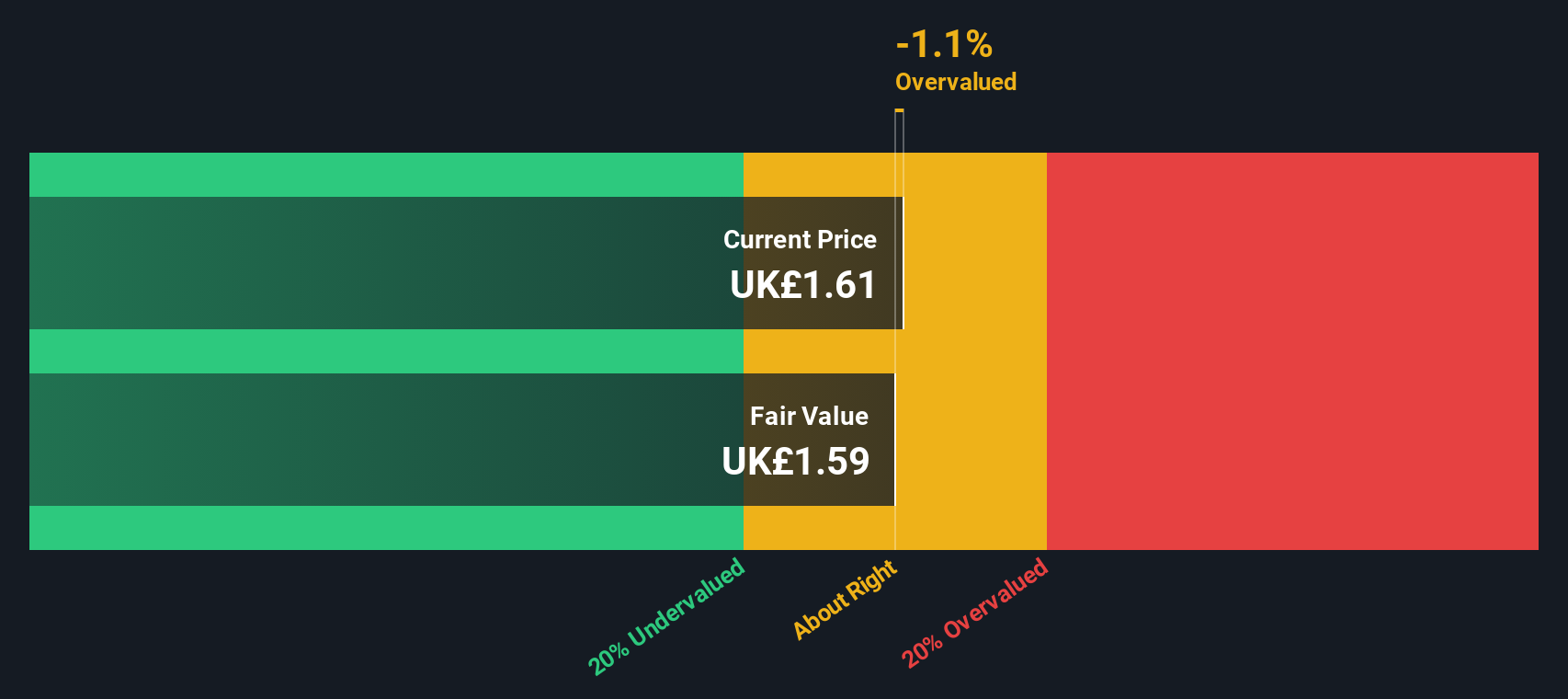

Simply Wall St Value Rating: ★★★☆☆☆

Overview: James Halstead is a company engaged in the manufacture and distribution of flooring products, with a market capitalization of approximately £1.03 billion.

Operations: The company generates revenue primarily from the manufacture and distribution of flooring products, with recent figures showing revenue at £261.97 million. The gross profit margin has shown fluctuations, reaching 44.50% in June 2025 after a previous decline to 35.22% in December 2023. Operating expenses include significant allocations towards sales and marketing, which was £48.83 million as of June 2025, impacting overall profitability alongside non-operating expenses and general administrative costs.

PE: 13.9x

James Halstead, a European flooring manufacturer, presents an intriguing opportunity in the small cap segment. Despite a slight dip in sales to £261.97 million and net income to £40.61 million for the year ending June 2025, insider confidence is evident with recent share purchases. The company maintains its reputation for reliability with a record 49th consecutive annual dividend increase, proposing a final dividend of 6.05 pence per share. While earnings are projected to grow at 4% annually, reliance on external borrowing poses some risk but underscores potential growth avenues within their market niche.

- Click here to discover the nuances of James Halstead with our detailed analytical valuation report.

Understand James Halstead's track record by examining our Past report.

NCC Group (LSE:NCC)

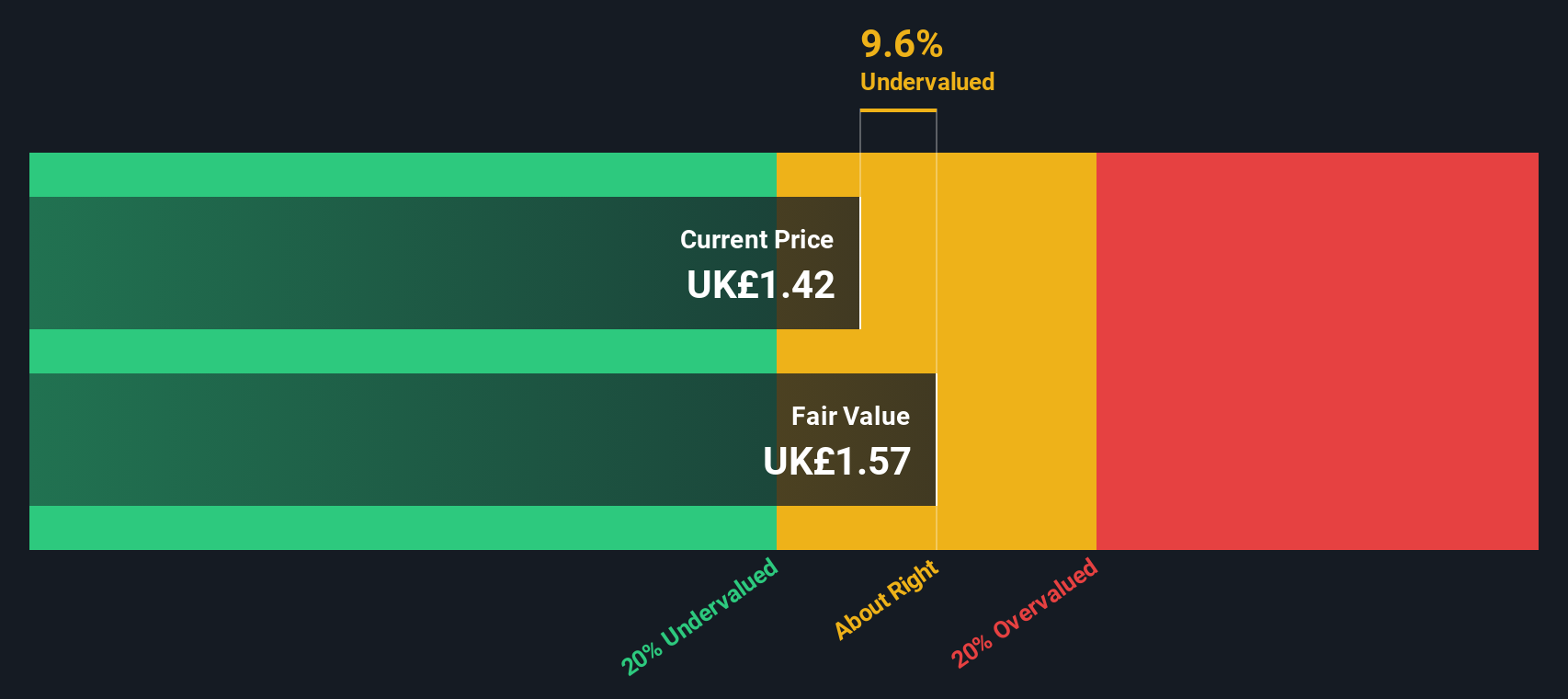

Simply Wall St Value Rating: ★★★★★☆

Overview: NCC Group is a global cyber security and risk mitigation company with operations focused on providing comprehensive services to protect businesses from cyber threats, and it has a market capitalization of approximately £0.64 billion.

Operations: The company's revenue streams are primarily driven by its operations, with a notable focus on Cyber Security. Over time, the gross profit margin has shown fluctuations, reaching 42.80% in November 2022 before declining to 37.00% by September 2025. Operating expenses have consistently been a significant component of costs, with General & Administrative Expenses being substantial throughout the periods observed.

PE: -46.8x

NCC Group, recognized for its construction expertise, recently reported sales of £238.9 million and a net income of £17.1 million for the year ending September 30, 2025. Despite a basic loss per share from continuing operations at £0.03, insider confidence is evident through recent share purchases in the past six months. The company is embarking on an ambitious project to build a swim center in Rödeby with an order value of approximately SEK 200 million. Earnings are forecasted to grow by over 100% annually, although funding relies entirely on external borrowing, which carries higher risk compared to customer deposits.

- Click to explore a detailed breakdown of our findings in NCC Group's valuation report.

Gain insights into NCC Group's historical performance by reviewing our past performance report.

Kid (OB:KID)

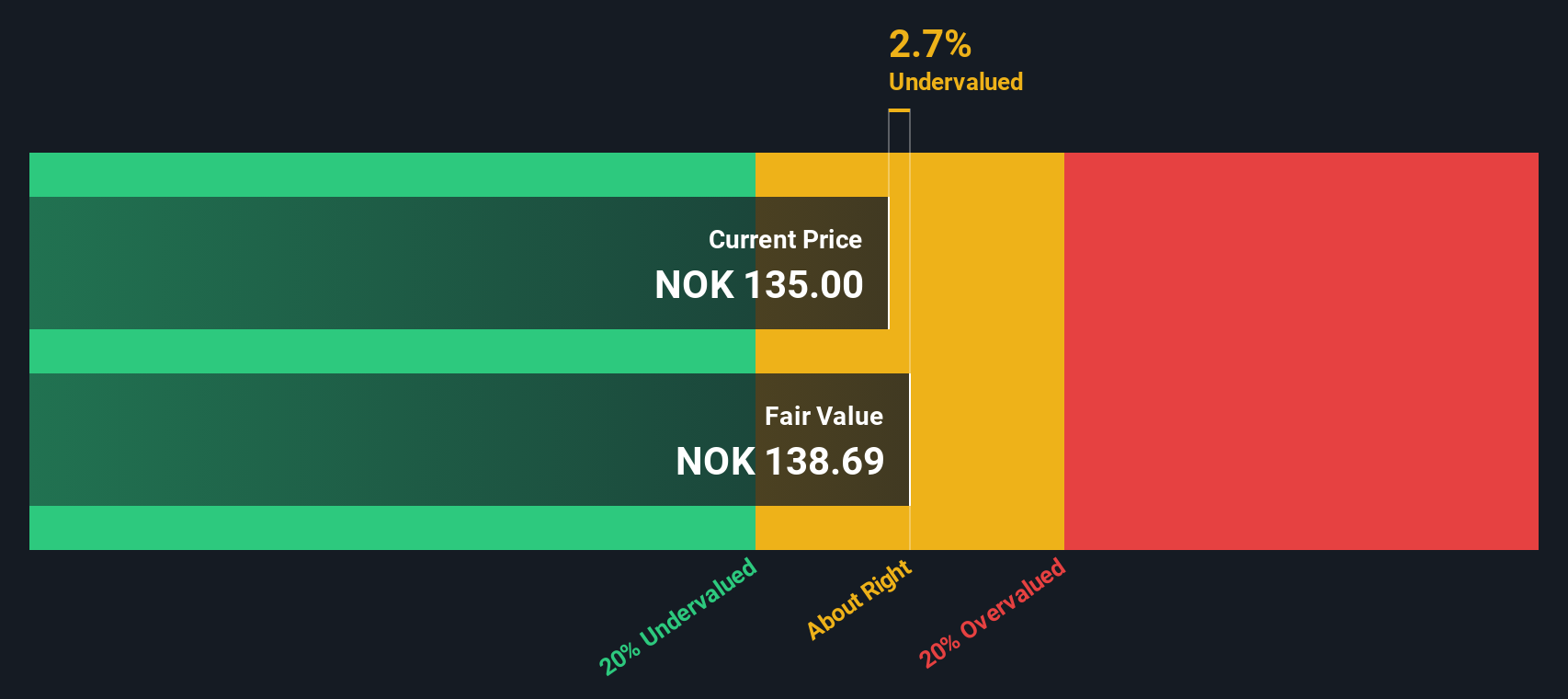

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kid operates in the home textiles and interior products sector, with its business comprising Hemtex and KID Interior segments, and has a market capitalization of NOK 3.25 billion.

Operations: Hemtex and KID Interior contribute significantly to revenue, with the latter generating more income. The company's cost structure includes notable expenses in Cost of Goods Sold (COGS) and operating expenses, which impact its net income margin. Net income margin has fluctuated, reaching 10.53% in December 2024 before dropping to 7.60% by September 2025.

PE: 17.9x

Kid ASA, a European company often seen as undervalued, has demonstrated insider confidence with Managing Director of Hemtex Anders Lorentzson purchasing 4,950 shares recently. Despite a high debt level and reliance on external borrowing, the company's earnings are projected to grow nearly 20% annually. Recent financials show mixed results: Q3 sales rose slightly to NOK 902 million while net income fell to NOK 39.85 million from NOK 70.22 million last year. A dividend decrease was announced in November 2025, reflecting cautious financial management amid growth efforts.

- Delve into the full analysis valuation report here for a deeper understanding of Kid.

Examine Kid's past performance report to understand how it has performed in the past.

Taking Advantage

- Click through to start exploring the rest of the 72 Undervalued European Small Caps With Insider Buying now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報