The Price Is Right For Luk Fook Holdings (International) Limited (HKG:590)

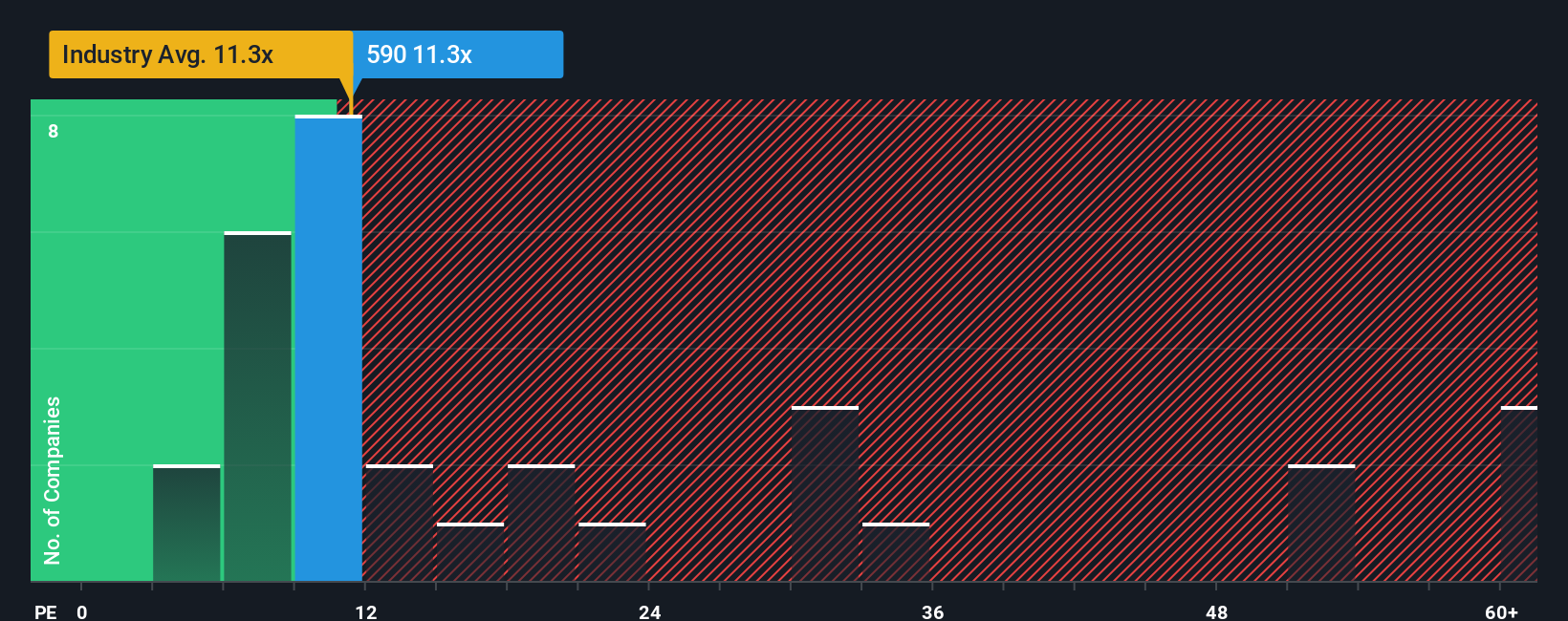

It's not a stretch to say that Luk Fook Holdings (International) Limited's (HKG:590) price-to-earnings (or "P/E") ratio of 11.3x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Luk Fook Holdings (International)'s and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

View our latest analysis for Luk Fook Holdings (International)

Is There Some Growth For Luk Fook Holdings (International)?

The only time you'd be comfortable seeing a P/E like Luk Fook Holdings (International)'s is when the company's growth is tracking the market closely.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 8.0% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 14% each year, which is not materially different.

With this information, we can see why Luk Fook Holdings (International) is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Luk Fook Holdings (International)'s P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Luk Fook Holdings (International) maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Luk Fook Holdings (International), and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報