BrightSpring Health Services (BTSG) valuation after bullish analyst reaffirmations and strong earnings estimate upgrades

BrightSpring Health Services (BTSG) just caught fresh attention after analysts reaffirmed top tier ratings, backing up the stock’s steady uptrend with improving earnings estimates and stronger confidence in its underlying healthcare platform.

See our latest analysis for BrightSpring Health Services.

Those upbeat ratings are landing on a stock that has already been moving, with a roughly 13.9 percent 1 month share price return and a powerful year to date share price return of about 110 percent, signaling momentum that investors clearly do not want to fade.

If BrightSpring’s run has you thinking more broadly about healthcare, this could be a good moment to explore other names in the space using healthcare stocks for fresh ideas.

Still, with shares up sharply and trading just below bullish analyst targets, the key question now is whether BrightSpring remains undervalued on its fundamentals or if the market is already pricing in most of its future growth.

Most Popular Narrative Narrative: 10.1% Undervalued

With BrightSpring closing at $36.44 against a fair value of about $40.54, the most followed narrative sees more upside embedded in its growth engine.

Bullish analysts highlight a long runway for BrightSpring to secure additional limited distribution drug contracts, which they view as a key driver of sustained top line and margin expansion.

Increased generic conversions are expected to enhance profitability by improving mix and supporting scalable earnings growth without requiring outsized capital investment.

Want to see what powers that optimism, beyond the headlines? The narrative leans on aggressive earnings compounding, expanding margins, and a future valuation multiple that assumes real execution. Curious how those moving parts add up?

Result: Fair Value of $40.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat case could be knocked off course if staffing and wage pressures worsen or if policy shifts squeeze Medicaid and Medicare reimbursement.

Find out about the key risks to this BrightSpring Health Services narrative.

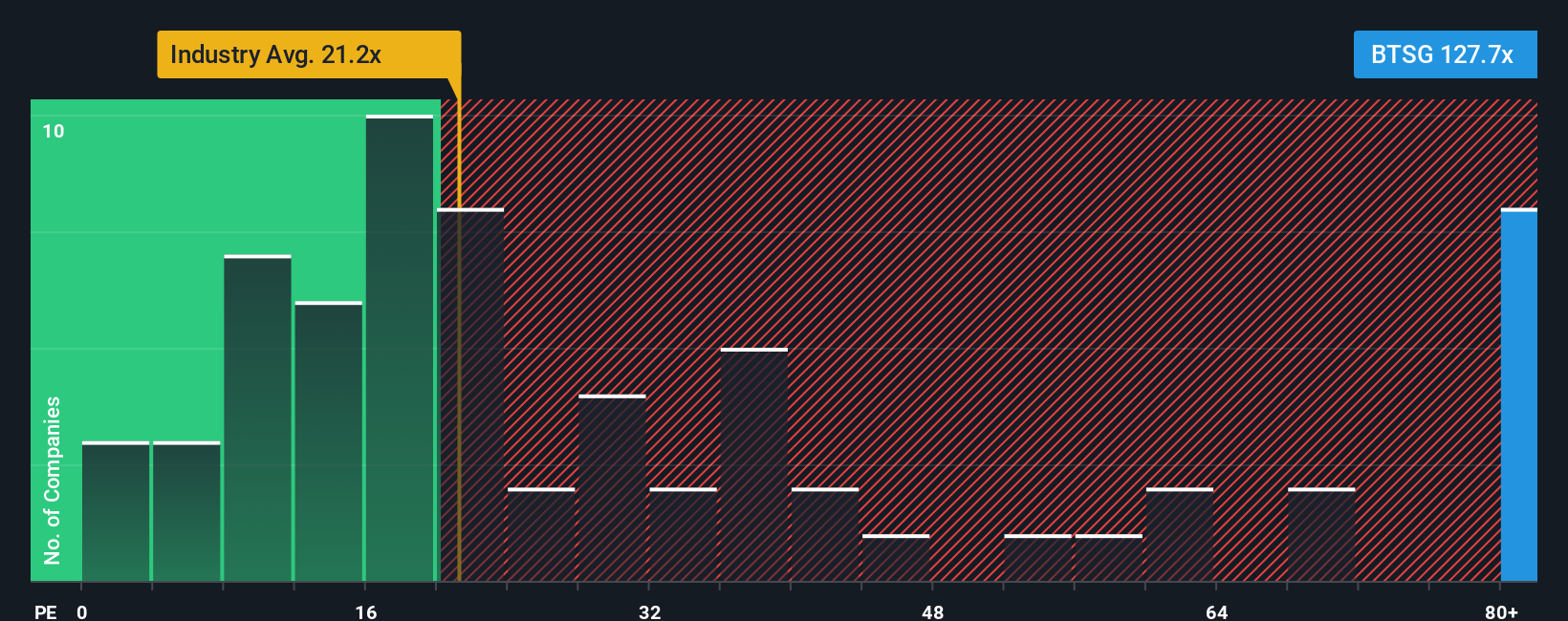

Another View: Multiples Flash a Caution Signal

While the narrative suggests BrightSpring is about 10 percent undervalued, its current price to earnings ratio of 68.2 times looks stretched beside a fair ratio of 38 times, the US Healthcare industry average of 23.9 times, and peer average of 30.1 times. This raises clear valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you see things differently or simply want to dig into the numbers yourself, you can shape a personalized view in just minutes: Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop scanning for the next opportunity, so use the Simply Wall St Screener now to avoid missing stocks quietly setting up their next big move.

- Capitalize on fast moving innovation by targeting early stage growth stories using these 3625 penny stocks with strong financials that already show financial strength beneath the surface.

- Ride the next wave of automation and productivity gains by filtering for businesses powering intelligent software and infrastructure through these 25 AI penny stocks.

- Explore potential value opportunities by focusing on companies trading below what their cash flows suggest they are worth with these 909 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報