Asian Market Insights: Luzhou Bank And 2 More Promising Penny Stocks

As global markets react to interest rate adjustments and economic uncertainties, investors are increasingly looking toward alternative investment opportunities. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.45 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.106 | SGD55.49M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.90 | HK$21.67B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 980 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Luzhou Bank (SEHK:1983)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. operates in the People’s Republic of China, offering corporate and retail banking as well as financial market services, with a market cap of HK$5.68 billion.

Operations: Luzhou Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$5.68B

Luzhou Bank, with a market cap of HK$5.68 billion, has shown promising earnings growth of 26.7% over the past year, outpacing the industry average. The bank maintains a solid allowance for bad loans at 435% and an appropriate Loans to Assets ratio of 57%. Recent developments include the issuance of RMB1.8 billion in tier 2 capital bonds to strengthen its financial position and board changes with new director appointments. Despite these strengths, its Return on Equity remains low at 11.1%, and it faces challenges such as an unstable dividend track record and declining net profit margins from last year’s figures.

- Unlock comprehensive insights into our analysis of Luzhou Bank stock in this financial health report.

- Explore historical data to track Luzhou Bank's performance over time in our past results report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in Mainland China with a market cap of HK$8.92 billion.

Operations: The company generates revenue primarily from its retail segment, specifically grocery stores, amounting to CN¥7.04 billion.

Market Cap: HK$8.92B

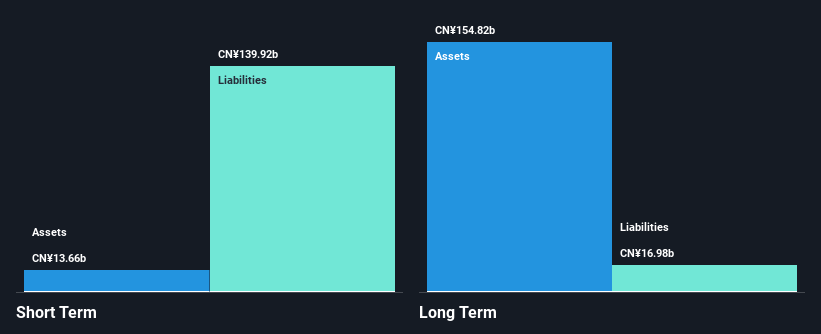

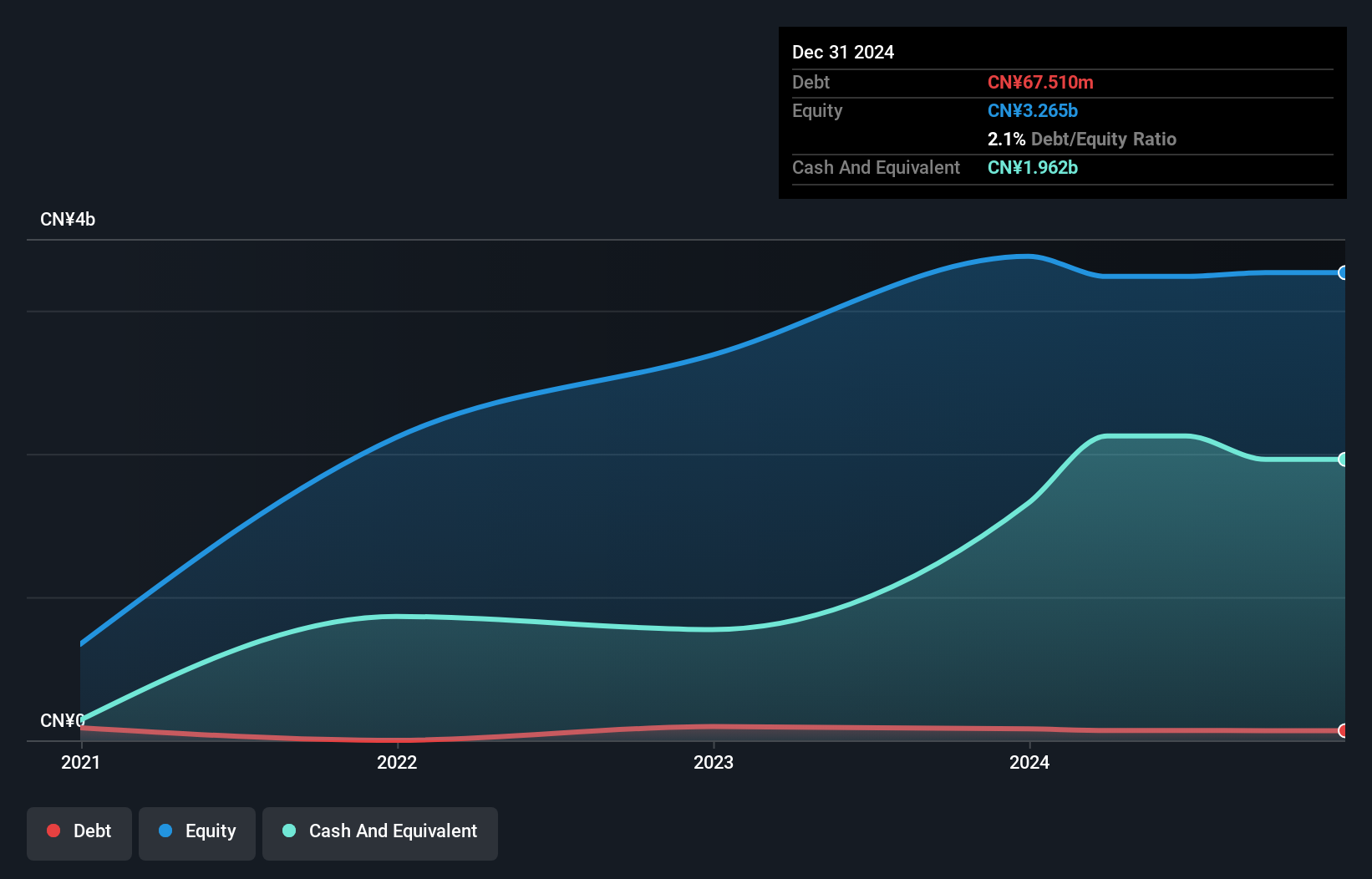

Guoquan Food (Shanghai) Co., Ltd. demonstrates solid financial health with short-term assets of CN¥3 billion exceeding both short and long-term liabilities, and more cash than total debt. The company has initiated a share repurchase program, potentially enhancing shareholder value. Despite a low Return on Equity of 11%, Guoquan's earnings have grown significantly by 50.5% over the past year, surpassing industry performance. However, its dividend yield of 4.68% is not well covered by earnings or free cash flows, indicating potential sustainability concerns. Recent inclusion in the S&P Global BMI Index highlights its growing market recognition.

- Dive into the specifics of Guoquan Food (Shanghai) here with our thorough balance sheet health report.

- Gain insights into Guoquan Food (Shanghai)'s future direction by reviewing our growth report.

Optima Automobile Group Holdings (SEHK:8418)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Optima Automobile Group Holdings Limited is an investment holding company offering after-market automotive services in Singapore and the People's Republic of China, with a market cap of HK$476 million.

Operations: The company's revenue is primarily derived from its automotive supply business (SGD 60.49 million), followed by after-market automotive services (SGD 14.83 million) and car rental services (SGD 2.13 million).

Market Cap: HK$476M

Optima Automobile Group Holdings faces challenges with profitability but maintains a stable financial position, having more cash than its total debt and short-term assets exceeding liabilities. Despite a volatile share price, the company has not diluted shareholders recently. It has reduced losses over five years and possesses an experienced management team with an average tenure of 4.3 years. While unprofitable, Optima's positive free cash flow provides a sufficient runway for over three years if current conditions persist. The company's debt to equity ratio has increased significantly in recent years, which may warrant attention from investors.

- Click to explore a detailed breakdown of our findings in Optima Automobile Group Holdings' financial health report.

- Evaluate Optima Automobile Group Holdings' historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 980 Asian Penny Stocks by using our screener here.

- Contemplating Other Strategies? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報