Emerging Asian Opportunities Including 3 Promising Small Caps

The Asian markets have been navigating a complex landscape marked by fluctuating interest rates and mixed economic signals, with small-cap stocks showing particular sensitivity to these dynamics. As investors seek opportunities in this evolving environment, identifying promising small-cap companies can be rewarding, especially those that demonstrate resilience and innovation amidst broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oriental Precision & EngineeringLtd | 32.67% | 9.30% | 4.58% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 10.07% | 11.02% | -5.75% | ★★★★★★ |

| Nextronics Engineering | 20.23% | 11.39% | 24.54% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Guangdong Green Precision Components | NA | -8.91% | -38.16% | ★★★★★★ |

| Jiangsu Rainbow Heavy Industries | 25.93% | 19.62% | 2.58% | ★★★★★☆ |

| CTCI Advanced Systems | 28.70% | 17.79% | 19.38% | ★★★★★☆ |

| Shandong Sacred Sun Power SourcesLtd | 19.20% | 12.37% | 36.24% | ★★★★★☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. specializes in the research, development, production, and sale of rice wine under various brands and has a market capitalization of approximately CN¥10.21 billion.

Operations: Kuaijishan generates revenue primarily through the sale of rice wine under its brands, including Kuaijishan, Wuzhengmao, Xitang, and Tangsong. The company's financial performance is highlighted by a notable trend in its net profit margin.

Kuaijishan Shaoxing Rice Wine, a niche player in the beverage industry, has demonstrated robust financial health with no debt compared to five years ago when its debt to equity ratio was 6.6%. The company reported sales of CNY 1.21 billion for the first nine months of 2025, up from CNY 1.06 billion a year earlier, alongside net income growth to CNY 116.27 million from CNY 112.63 million last year. Earnings per share rose slightly to CNY 0.25 from CNY 0.24, reflecting steady performance amidst challenging market conditions and indicating potential for continued earnings growth at a forecasted rate of nearly 29% annually.

- Take a closer look at Kuaijishan Shaoxing Rice Wine's potential here in our health report.

Learn about Kuaijishan Shaoxing Rice Wine's historical performance.

Guangzhou Ruili Kormee Automotive Electronic (SZSE:001285)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Ruili Kormee Automotive Electronic Co., Ltd. is a company engaged in the production and distribution of automotive electronic components, with a market cap of CN¥9.51 billion.

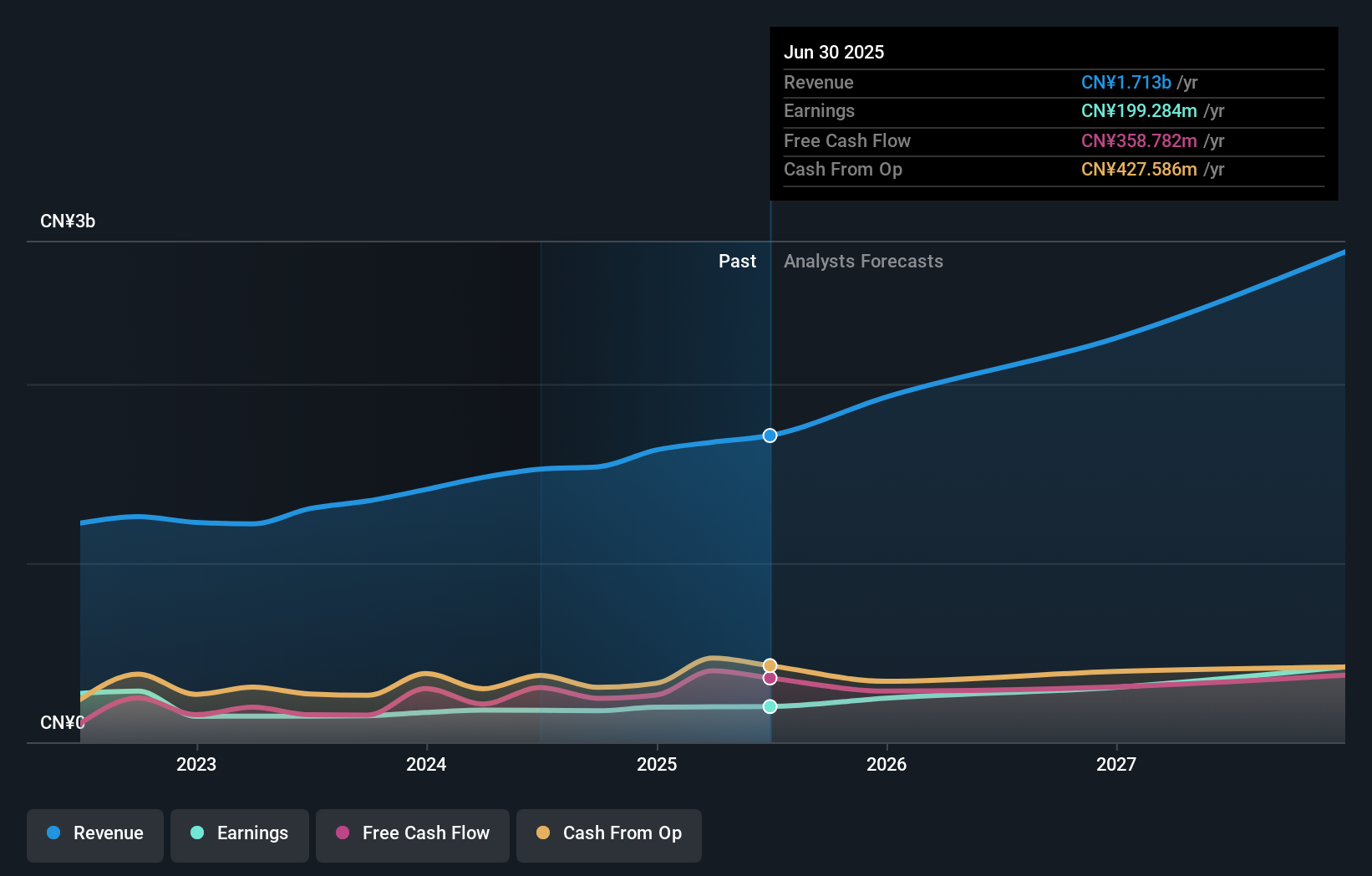

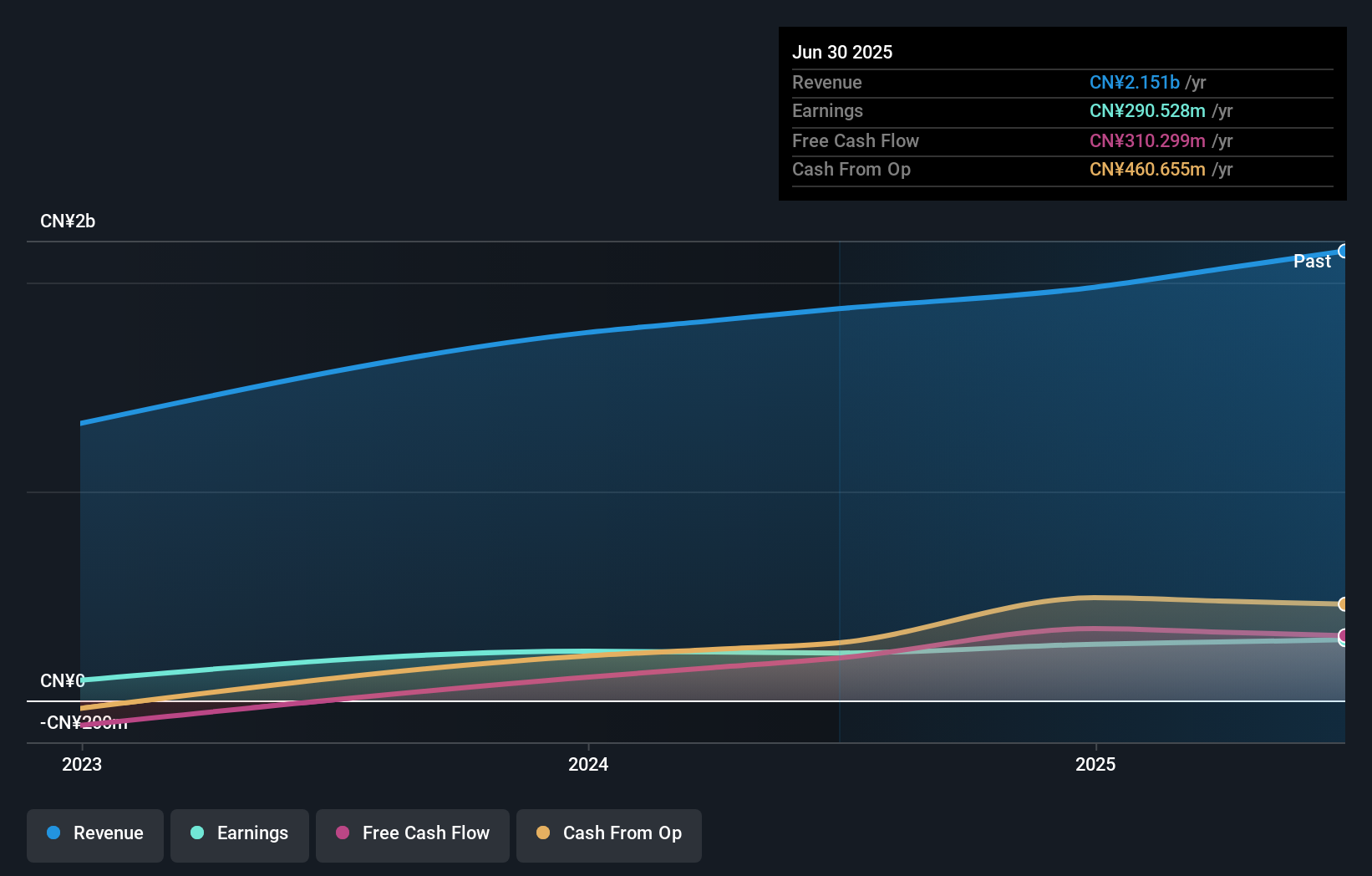

Operations: Ruili Kormee's primary revenue stream is from the Auto Parts & Accessories segment, generating CN¥2.15 billion.

Guangzhou Ruili Kormee Automotive Electronic, a burgeoning player in the auto components sector, recently completed an IPO raising CNY 1.90 billion, highlighting its growth trajectory. Its earnings surged by 27.8% last year, outpacing the industry's 8% growth rate and underscoring high-quality earnings. The company trades at nearly half of its estimated fair value, presenting potential investment appeal. Despite a rise in the debt-to-equity ratio from 3.2% to 13.5% over five years, it maintains more cash than total debt and generates positive free cash flow, suggesting robust financial health and operational efficiency moving forward.

HyUnion HoldingLtd (SZSE:002537)

Simply Wall St Value Rating: ★★★★☆☆

Overview: HyUnion Holding Co., Ltd operates in the automobile manufacturing industry in China with a market capitalization of CN¥9.24 billion.

Operations: HyUnion Holding Co., Ltd generates revenue primarily from the automobile manufacturing sector. The company reported a market capitalization of CN¥9.24 billion, reflecting its scale within the industry.

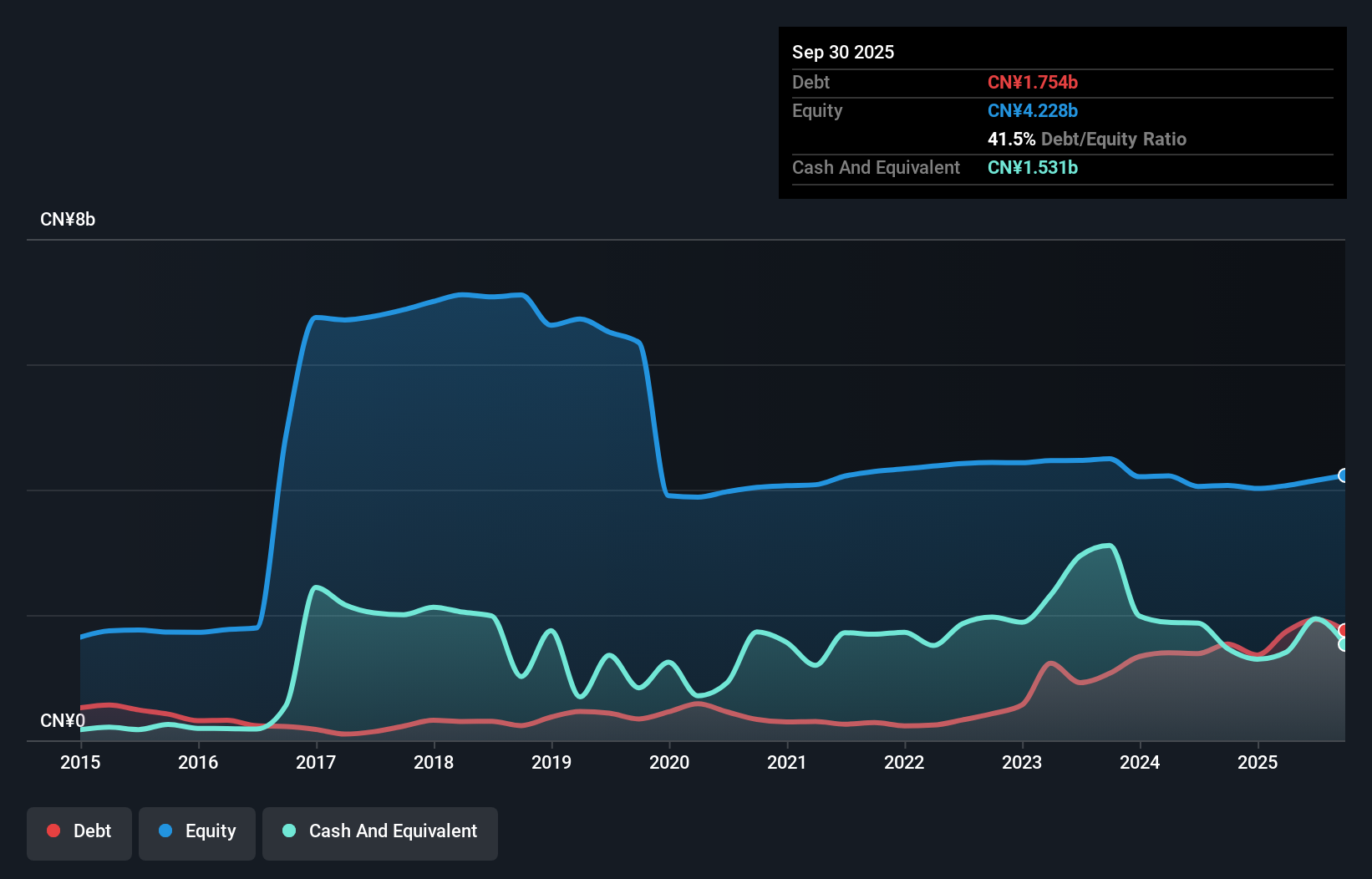

HyUnion Holding has shown remarkable earnings growth of 1708.3% over the past year, significantly outpacing the Auto Components industry's 8% growth. Despite a large one-off loss of CN¥178M affecting recent results, net income rose to CN¥200.64M from CN¥44.19M last year, reflecting improved profitability with basic earnings per share climbing to CN¥0.19 from CN¥0.04. However, the debt-to-equity ratio increased from 8.3% to 41.5% over five years, indicating rising leverage levels that warrant attention despite a satisfactory net debt-to-equity ratio of 5.3%. Recent governance changes include appointing Xu Guoliang as an independent director and amending company bylaws at their latest extraordinary meeting in November 2025.

- Unlock comprehensive insights into our analysis of HyUnion HoldingLtd stock in this health report.

Assess HyUnion HoldingLtd's past performance with our detailed historical performance reports.

Summing It All Up

- Reveal the 2499 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報