Sphere Entertainment (SPHR): Reassessing Valuation After Seaport Global’s Downgrade and a Powerful Share Price Run

Sphere Entertainment (SPHR) just hit a speed bump, with Seaport Global Securities shifting its rating to Neutral after a sharp run up that has investors rethinking how much future growth is already priced in.

See our latest analysis for Sphere Entertainment.

That downgrade lands after a huge run, with a roughly 110% year to date share price return and a 130% one year total shareholder return that suggest momentum is still strong but now attracting valuation worries.

If Sphere’s surge has you thinking about what else could run, this is a good moment to explore fast growing stocks with high insider ownership.

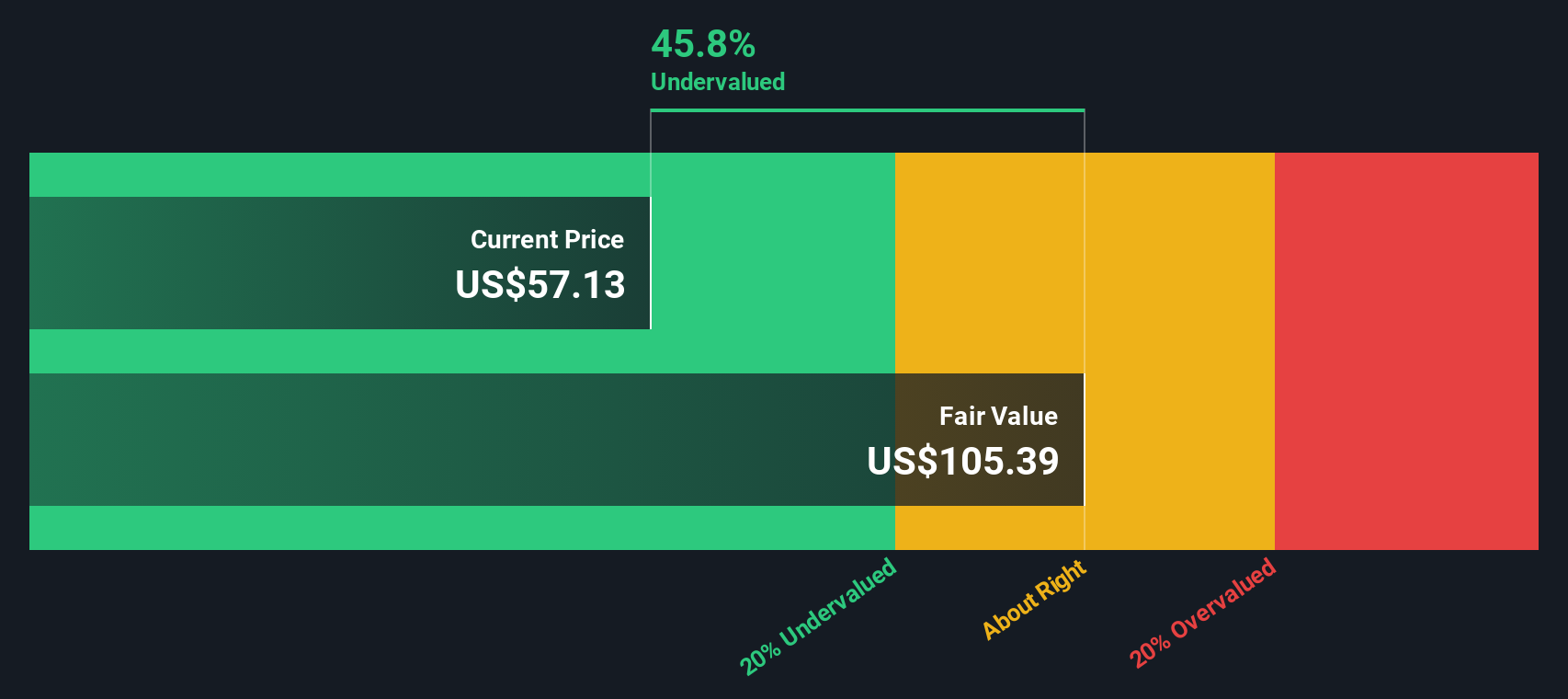

With the stock now trading above the average analyst target but screens still flagging a hefty intrinsic discount, investors face a crucial question: Is Sphere Entertainment undervalued here, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 16.2% Overvalued

With Sphere Entertainment closing at $87.50 against a narrative fair value of $75.30, the storyline leans cautious on how far the rally can stretch.

The analysts have a consensus price target of $53.9 for Sphere Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $35.0.

Want to see the full playbook behind that stance? The narrative quietly reframes revenue trajectories, margin recovery, and a future earnings multiple that might surprise growth skeptics.

Result: Fair Value of $75.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Las Vegas tourism softness or underperforming capital intensive new venues could quickly challenge assumptions about Sphere’s long term earnings power and valuation.

Find out about the key risks to this Sphere Entertainment narrative.

Another Lens on Value

While the narrative fair value implies Sphere Entertainment is 16.2% overvalued, our DCF model paints a very different picture, suggesting shares trade roughly 55.7% below an estimated fair value of $197.58. When one framework signals caution and another suggests potential opportunity, which perspective do you focus on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sphere Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sphere Entertainment Narrative

If you see the story differently or simply want to stress test the assumptions yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Sphere Entertainment, you could miss sharper opportunities. Use the Simply Wall St Screener to uncover focused ideas that match your strategy.

- Capture potential high risk, high reward setups by scanning these 3625 penny stocks with strong financials before the crowd catches on.

- Position yourself for the next wave of automation by targeting these 30 healthcare AI stocks reshaping patient care and medical decision making.

- Lock in income focused candidates by reviewing these 13 dividend stocks with yields > 3% offering yields that can strengthen your long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報