Vend Marketplaces (OB:VENDA) Valuation After Pre‑Silent Letter Highlights Ongoing Volume Headwinds

Vend Marketplaces (OB:VENDA) slipped after its latest pre-silent letter reported ongoing volume headwinds, with Mobility Professional, Jobs and new ads in Norway and Finland still under pressure despite a few brighter spots.

See our latest analysis for Vend Marketplaces.

Even with the pre-silent letter rattling sentiment, the share price at NOK 358.0 has eked out a modest year to date share price gain. A slightly negative 1 year total shareholder return contrasts sharply with the very strong 3 year total shareholder return, suggesting long term momentum is intact but nearer term enthusiasm has cooled.

If this kind of mixed momentum has you reassessing your watchlist, it might be worth exploring fast growing stocks with high insider ownership as a way to spot the next wave of potential outperformers.

With growth stalling and the stock trading only slightly below analyst targets, the big question now is whether Vend Marketplaces is quietly slipping into value territory, or if the market already reflects all the growth that lies ahead.

Price-to-Earnings of 10.5x: Is it justified?

Vend Marketplaces trades on a price to earnings ratio of 10.5x, and at NOK 358.0 the stock screens as inexpensive relative to peers and the wider Norwegian market.

The price to earnings ratio compares the current share price to earnings per share, and for a profitable, mature classifieds marketplace group like Vend it is a core yardstick for how investors value its cash generation and growth prospects.

With VENDA expected to see earnings decline over the next three years, a lower multiple can signal that the market is already discounting weaker future profitability, even as the company currently boasts high return on equity and has dramatically improved margins in the recent period.

Versus both its local peer group and the global Interactive Media and Services industry, Vend Marketplaces looks sharply cheaper, with its 10.5x multiple set against a peer average of 27.5x and a global industry average of 22.7x, which underscores how cautiously investors are pricing its earnings profile.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, sustained volume weakness in key Nordic verticals and further earnings downgrades could quickly erode any perceived value cushion in the shares.

Find out about the key risks to this Vend Marketplaces narrative.

Another Lens on Value

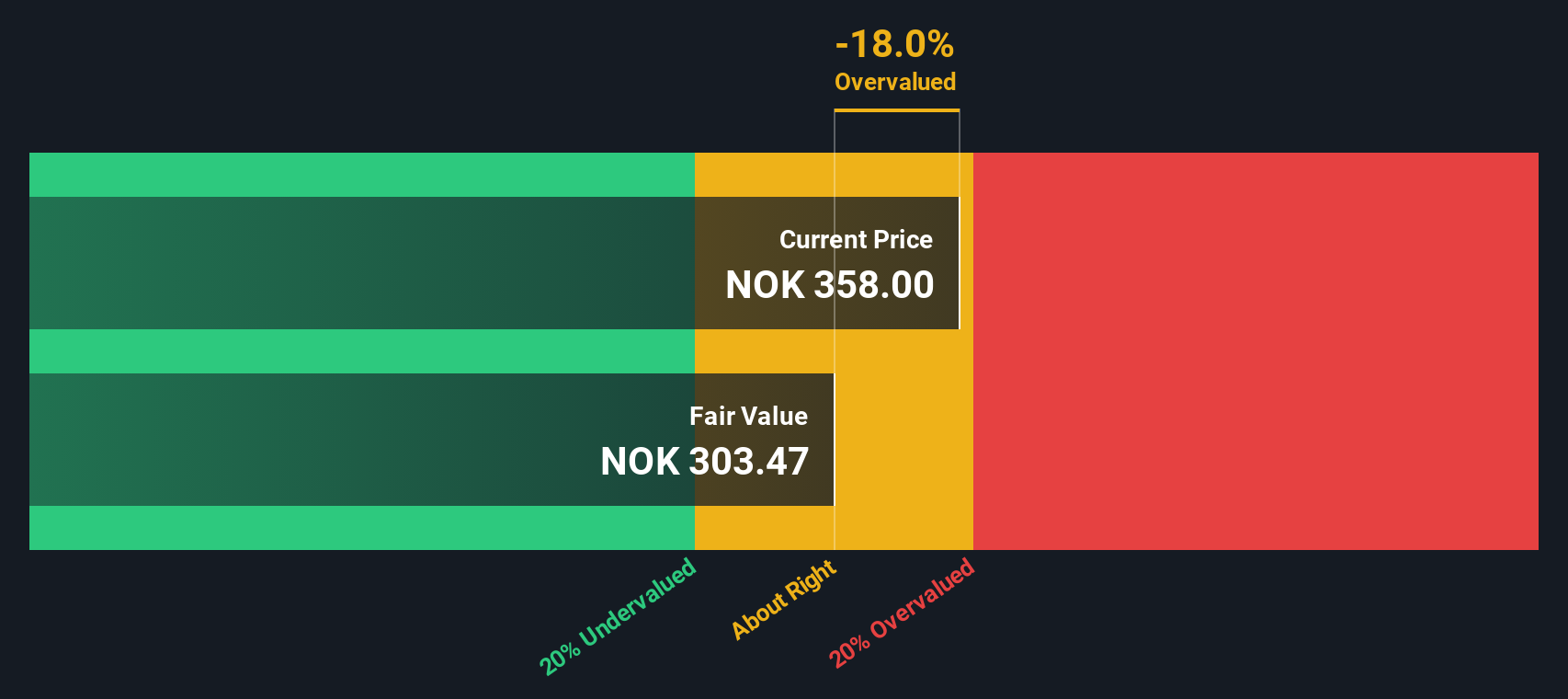

Our SWS DCF model tells a different story, pointing to a fair value of about NOK 303.5 per share, which leaves Vend Marketplaces trading at a premium rather than a discount. If earnings are set to fall, is this really a margin of safety or a value trap in the making?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vend Marketplaces for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vend Marketplaces Narrative

If you prefer to dig into the numbers yourself and shape a view that fits your own research style, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Vend Marketplaces research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one stock. Use the Simply Wall Street Screener to uncover high conviction ideas that could reshape your portfolio before the crowd notices.

- Capture powerful growth potential by targeting companies using AI to transform medicine with these 30 healthcare AI stocks.

- Focus on steady cash flow by looking at businesses that consistently pay out with these 13 dividend stocks with yields > 3%.

- Explore structural shifts in digital assets by examining innovators at the heart of blockchain and tokenization with these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報