Is Bristol Myers (BMY) Undervalued After Its Recent Share Price Rebound?

Bristol-Myers Squibb (BMY) has quietly staged a comeback, with the stock up about 16% over the past month and 18% in the past 3 months, even as revenue dipped last year.

See our latest analysis for Bristol-Myers Squibb.

That rebound comes after a tougher stretch, with the share price still posting a year-to-date share price return of negative 4.5 percent and a 1-year total shareholder return of negative 1.3 percent, suggesting sentiment is improving but the longer-term picture is still catching up.

If Bristol Myers recent move has you rethinking your healthcare exposure, it could be worth exploring other pharma stocks with solid dividends that pair income potential with defensible business models.

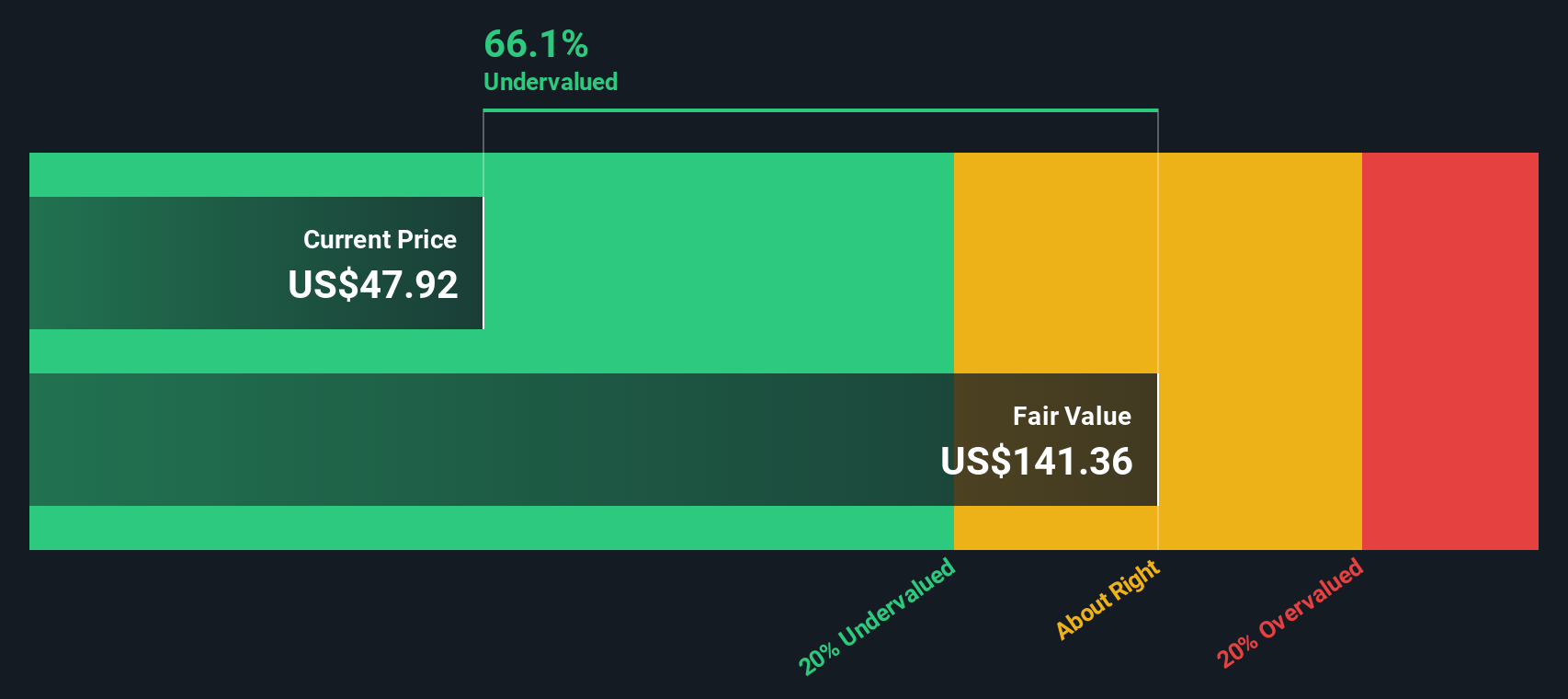

With shares still down over the past year but trading near analyst targets and screens flagging a large intrinsic discount, the key question now is simple: is Bristol Myers genuinely undervalued or is the market already pricing in its next leg of growth?

Most Popular Narrative: 1.3% Overvalued

With Bristol-Myers Squibb last closing at $54.23 against a narrative fair value of about $53.55, the valuation gap is slim but telling.

Fair Value: nudged slightly higher from approximately $53.00 to about $53.55 per share, reflecting a modestly richer intrinsic value estimate.

Curious why a richer future earnings multiple is being used despite softer revenue and margin assumptions, and a higher discount rate? The narrative leans on a tight mix of modest earnings growth, expanding profitability and a sector wide rerating thesis. Want to see exactly how those moving parts combine into today’s fair value signal?

Result: Fair Value of $53.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering patent cliffs and ongoing pricing reform debates could still derail the rerating narrative if revenue pressure and margin compression overshoot current expectations.

Find out about the key risks to this Bristol-Myers Squibb narrative.

Another Lens on Value

While the narrative fair value suggests Bristol Myers is about 1.3 percent overvalued, our SWS DCF model paints a very different picture, implying shares trade roughly 54 percent below intrinsic value at about $117.66. Is this a genuine margin of safety or a sign the cash flow assumptions are too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bristol-Myers Squibb Narrative

If you see the numbers differently or would rather dig into the details yourself, you can build a personalized view in just minutes using Do it your way.

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall Street Screener to uncover focused, high-conviction stock ideas tailored to your strategy.

- Target faster potential growth by scanning these 25 AI penny stocks that could benefit most as artificial intelligence reshapes industries and earnings power.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that may offer steadier cash returns in changing markets.

- Aim for mispriced upside by pinpointing these 909 undervalued stocks based on cash flows where current prices look out of sync with long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報