Glencore (LSE:GLEN): Assessing Valuation After a Strong 90-Day Rally and Recent Pullback

Glencore (LSE:GLEN) shares have drifted lower over the past week, even after gaining over 20% in the past 3 months. This has left investors weighing whether this pullback is a fresh entry point.

See our latest analysis for Glencore.

Zooming out, Glencore’s recent pullback comes after a strong 90 day share price return of about 22%, while its five year total shareholder return of roughly 105% points to solid long term compounding despite a weaker three year patch.

If you are weighing Glencore’s momentum, it can also be useful to compare it with other commodity heavy names and explore fast growing stocks with high insider ownership for fresh ideas.

With the shares still trading below consensus targets but recent gains already strong, the key question now is whether Glencore is quietly undervalued or if the market is already pricing in the next leg of its growth.

Most Popular Narrative: 10.7% Undervalued

Glencore's most followed valuation narrative points to a fair value of £4.18 per share versus the latest £3.73 close, framing modest upside from here.

The trend of disciplined supply management (for example, targeted curtailments in coal, ferrochrome, and smelting) positions Glencore to benefit from shrinking capacity and slowing project development industry-wide, which is described as likely resulting in persistent supply deficits and structurally higher realized prices for battery and base metals, supporting long-term revenue growth and EBITDA uplift.

Want to see what powers that upside call? The narrative leans on ambitious earnings, firmer margins, and a richer future multiple than the wider mining sector.

Result: Fair Value of £4.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering ESG and regulatory pressures, alongside volatile marketing returns, could quickly undermine confidence in those growth and valuation assumptions.

Find out about the key risks to this Glencore narrative.

Another Lens on Value

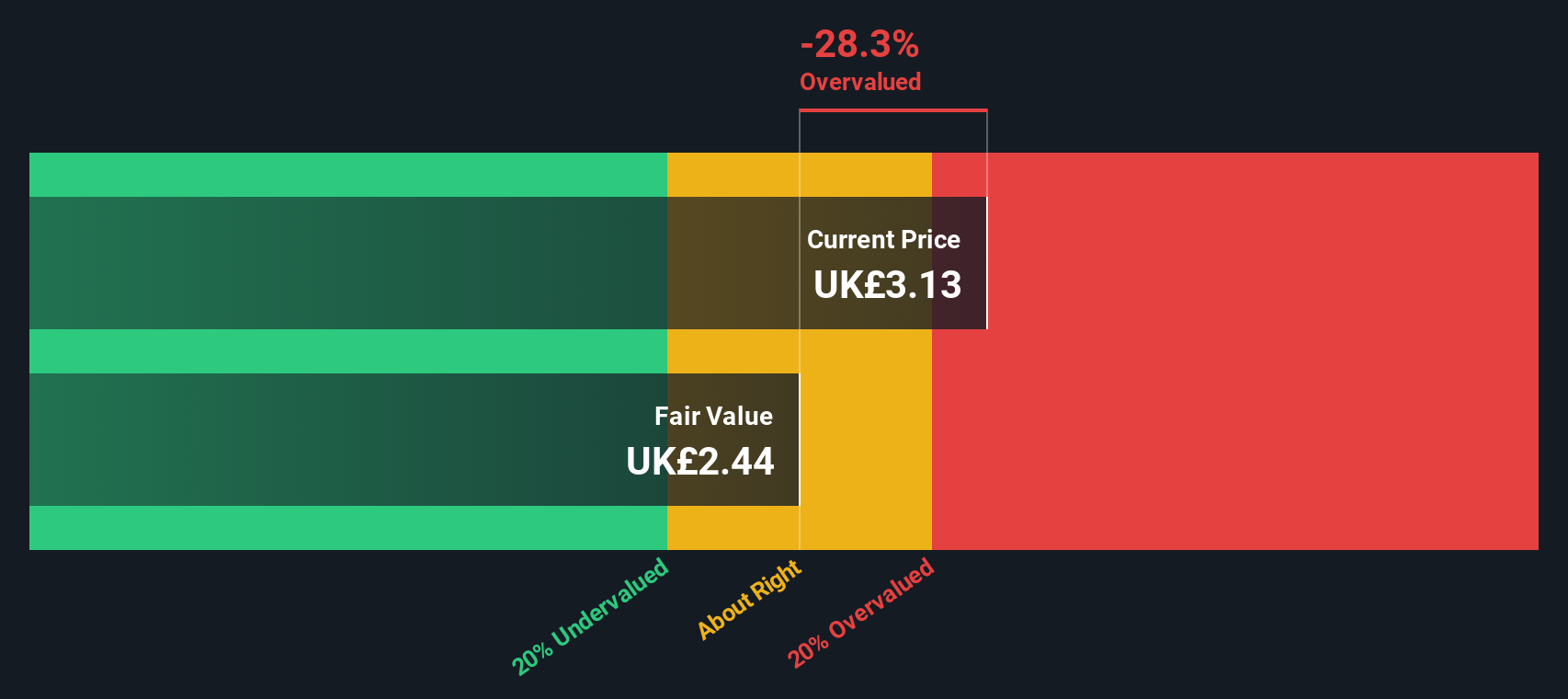

Our SWS DCF model paints a cooler picture, with Glencore trading slightly above its £3.63 fair value estimate, implying the shares are modestly overvalued on this framework. If cash flows are already priced in, how much margin for error is really left?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Glencore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Glencore Narrative

If you see the numbers differently or just want to dig into the data yourself, you can build a customised view in minutes, Do it your way.

A great starting point for your Glencore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one stock when you can quickly uncover more targeted opportunities using the Simply Wall Street Screener and stay ahead of slower moving investors.

- Harness consistent income potential by reviewing these 13 dividend stocks with yields > 3% that may strengthen your portfolio with reliable cash returns.

- Capture emerging innovation by scanning these 25 AI penny stocks positioned at the front line of artificial intelligence adoption.

- Turn market mispricing into an advantage with these 909 undervalued stocks based on cash flows that could offer compelling upside based on cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報