Hexcel (HXL): Reassessing Valuation After Buyback Plan and Upgraded Analyst Price Target

Hexcel (HXL) has quietly outperformed many industrial peers this year, with the stock up about 17% year to date and roughly 15% over the past year, as investors revisit aerospace demand.

See our latest analysis for Hexcel.

At around $72.31 per share, Hexcel has given investors a solid 17.01% year to date share price return, and its 58.24% five year total shareholder return suggests momentum has been steadily building as confidence in aerospace and defense demand improves.

If this aerospace strength has your attention, it could be a good moment to explore other potential beneficiaries using our screener for aerospace and defense stocks.

Yet with Hexcel trading just below analyst targets but still at a near 20 percent discount to some intrinsic value estimates, investors now face a key question: is this a fresh buying opportunity or is future growth already priced in?

Most Popular Narrative Narrative: 4.6% Undervalued

With Hexcel last closing at $72.31 versus a narrative fair value near $75.79, the story points to a modest upside grounded in long term cash generation.

Analysts have raised their price target on Hexcel by $8 to $83 per share from $75, citing the newly announced $600M share buyback and growing confidence in the company’s ability to generate over $1B in free cash flow over the next four years.

Curious how a billion dollar free cash flow runway, rising margins, and a richer future earnings multiple combine to justify only a slight discount today? The full narrative reveals the exact growth, profitability, and re rating assumptions behind that fair value call.

Result: Fair Value of $75.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering supply chain bottlenecks and heavy reliance on Airbus and Boeing schedules could quickly derail the expected margin recovery and cash flow trajectory.

Find out about the key risks to this Hexcel narrative.

Another Angle on Valuation

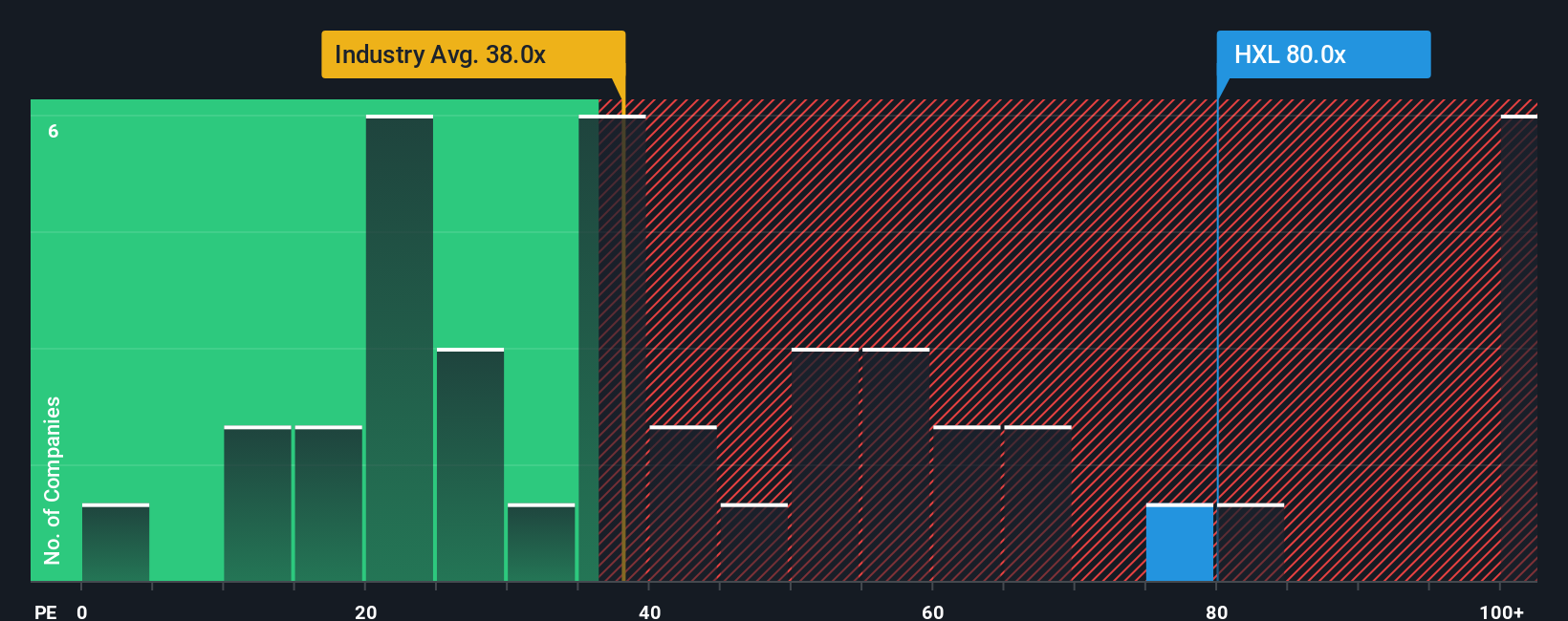

On earnings, the story looks very different. Hexcel trades on a rich 83.7 times P/E, far above the US Aerospace and Defense average of 37.5 times and even the 38.5 times fair ratio that our models suggest the market could gravitate toward. This raises clear valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hexcel Narrative

If you see the story differently or want to analyze the numbers yourself, you can build a full narrative in just a few minutes using Do it your way.

A great starting point for your Hexcel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunity by scanning tailored stock ideas on Simply Wall Street that match different strategies and risk profiles.

- Capture high potential turnarounds by reviewing these 3625 penny stocks with strong financials that pair low prices with stronger underlying fundamentals.

- Position yourself for the next wave of innovation by targeting these 25 AI penny stocks shaping the future of intelligent technology.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that offer attractive yields supported by solid businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報