Is Ericsson (OM:ERIC B) Fairly Priced After a 20% Three‑Month Rebound? A Valuation Check

Recent Performance Snapshot

Telefonaktiebolaget LM Ericsson (OM:ERIC B) has been treading water lately, with the share price roughly flat this month but still up around 20% over the past 3 months, reshaping how investors view its recovery story.

See our latest analysis for Telefonaktiebolaget LM Ericsson.

The latest 90 day share price return of about 20% suggests momentum is rebuilding after a softer year to date. A 3 year total shareholder return near 68% underlines how strongly the long term story has compounded.

If Ericsson’s rebound has your attention, it might be worth seeing what else is setting up for potential growth across high growth tech and AI stocks right now.

With earnings still under pressure but intrinsic value models implying a sizeable discount to fair value, should investors view Ericsson as a mispriced turnaround candidate, or accept that the market is already discounting future growth?

Most Popular Narrative: 2.5% Overvalued

With Telefonaktiebolaget LM Ericsson closing at SEK 89.6 against a narrative fair value of about SEK 87.4, the story implies only a slim valuation premium built on finely balanced expectations for margins and growth.

Expansion of AI powered applications and edge compute is expected to significantly boost network data traffic, requiring further buildout and modernization of telecom infrastructure where Ericsson has strong product and R&D positioning providing a long term tailwind to both revenues and gross margins.

Curious how modest top line assumptions can still justify a richer future earnings multiple than today. Want to see which margin and discount rate choices make the numbers click.

Result: Fair Value of $87.4 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent telecom capex headwinds and geopolitical restrictions on network vendors could delay 5G rollouts, which may undermine the margin and growth assumptions behind this narrative.

Find out about the key risks to this Telefonaktiebolaget LM Ericsson narrative.

Another Angle on Value

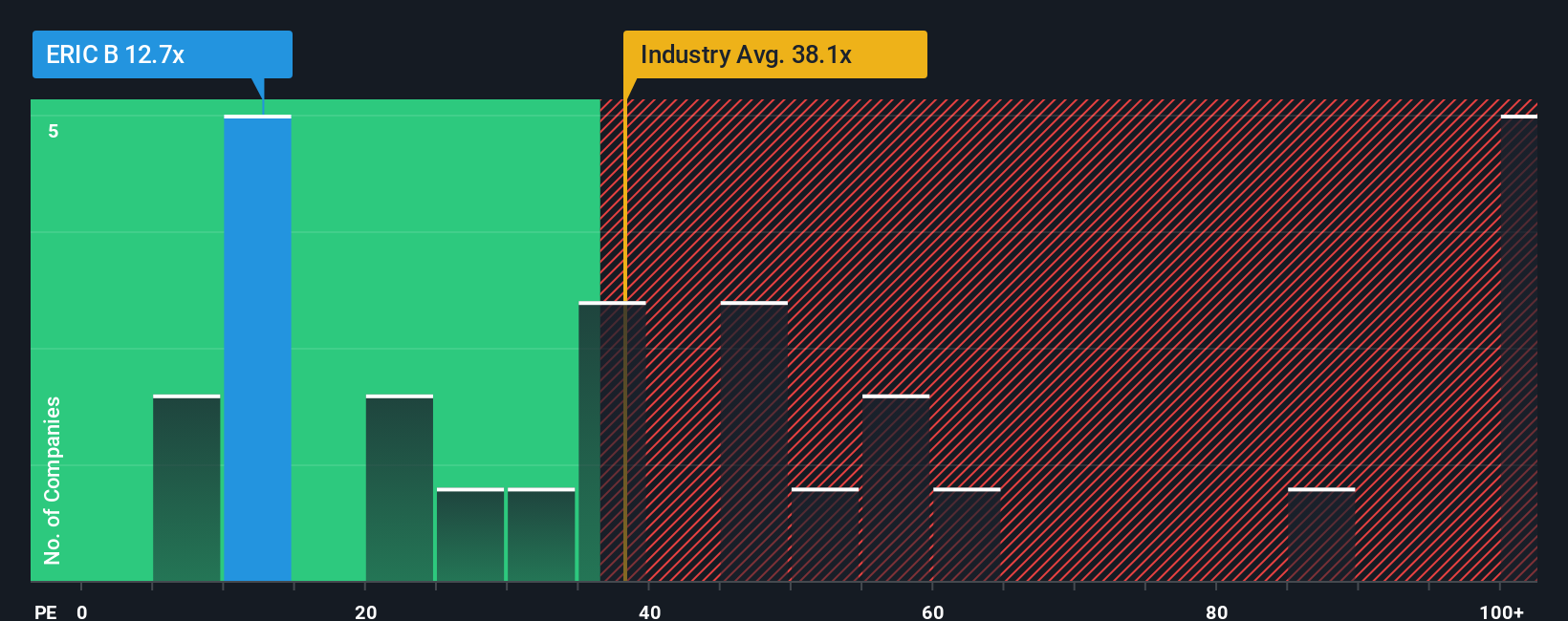

On simple earnings ratios, Ericsson looks far cheaper than both peers and what our fair ratio suggests. The stock trades on about 12.1 times earnings, versus roughly 39 to 42 times for the sector, while our fair ratio points closer to 22.6 times. Is the market mispricing execution risk or overlooking a potential rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

If you are not fully aligned with this view or simply want to dig into the numbers yourself, you can build a fresh perspective in just a few minutes, Do it your way.

A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your edge sharp by handpicking your next opportunity with the Simply Wall Street Screener, where focused lists surface ideas you will not want to miss.

- Secure potentially overlooked bargains by scanning these 909 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

- Ride the next wave of innovation by targeting these 25 AI penny stocks positioned at the forefront of artificial intelligence adoption.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that can help support reliable, long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報