Globalstar (GSAT): Valuation Check After Successful Skydio Private 5G Drone Connectivity Trial

Globalstar (GSAT) just cleared an important technology hurdle, finishing a joint trial with drone maker Skydio that proved its Band n53 spectrum and XCOM RAN private 5G platform can reliably power advanced drone operations.

See our latest analysis for Globalstar.

Even after a choppy week that saw a 1 day share price return of negative 7.75 percent and a 7 day share price return of negative 6.65 percent, the bigger picture is still one of strong momentum. A 90 day share price return of 85.82 percent and a standout 1 year total shareholder return of 123.51 percent suggest investors are steadily pricing in more growth optionality from moves like this Skydio trial.

If this kind of connectivity story has your attention, it could be a good moment to see what else is happening across high growth tech and AI stocks using our high growth tech and AI stocks.

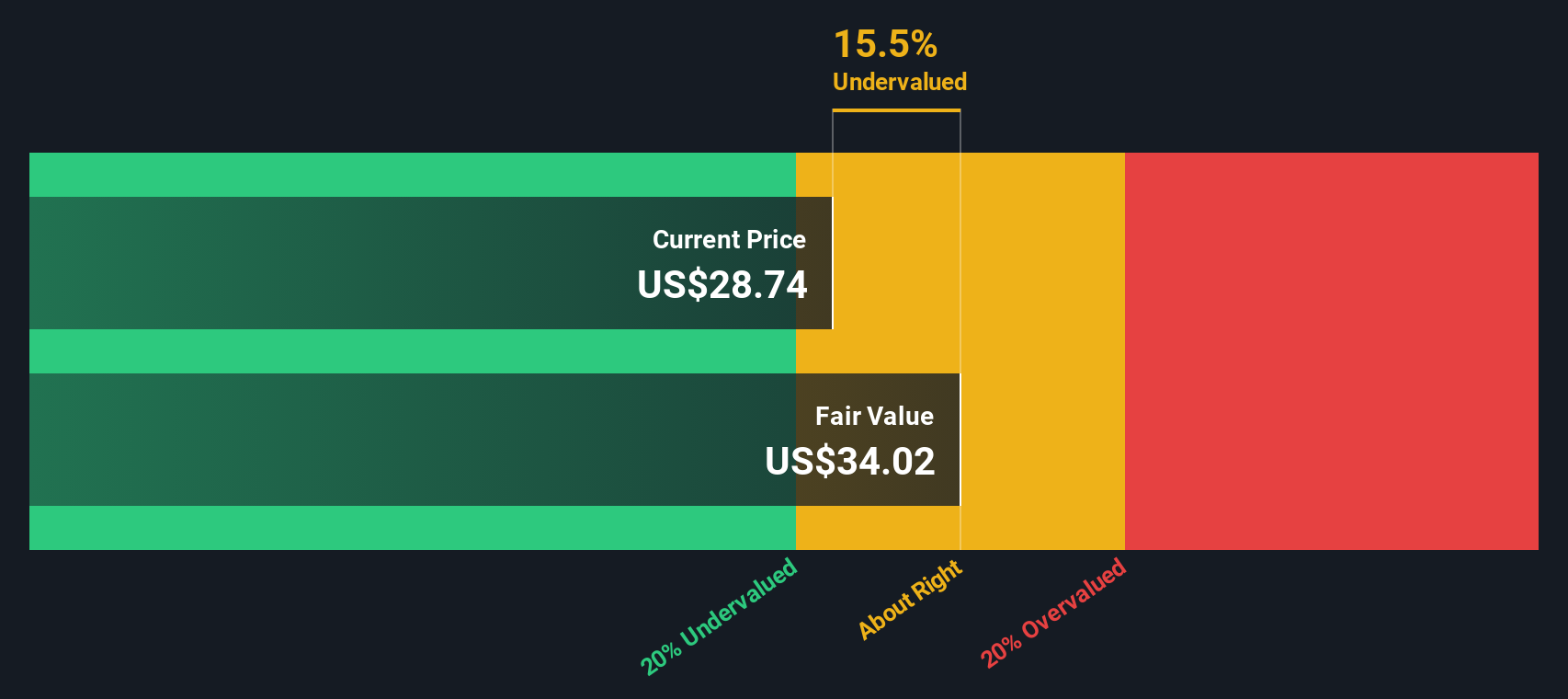

With revenue still growing at a double-digit pace but profits remaining in the red, and with the share price already up more than 100 percent over 12 months, the real question is whether Globalstar is still attractively valued or already fully priced for future growth.

Most Popular Narrative Narrative: 5.6% Undervalued

With Globalstar last closing at $63.70 against a narrative fair value of $67.50, the story leans modestly positive on further upside potential.

Advancements in software defined radio (XCOM RAN) and Network as a Service models create new opportunities to capture enterprise and horizontal markets (beyond initial customers), capitalizing on the convergence of satellite and terrestrial networks to drive incremental service and licensing revenues with improved gross margins.

Want to see what justifies paying a premium for a still unprofitable satellite player? The narrative leans on aggressive revenue scaling, sharply higher margins, and a future earnings multiple usually reserved for elite growth stories. Curious which specific profitability and growth milestones must fall into place to reach that fair value band?

Result: Fair Value of $67.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, long sales cycles, heavy capital needs, and intense satellite and 5G competition could easily derail those optimistic revenue and margin assumptions.

Find out about the key risks to this Globalstar narrative.

Another View on Valuation

Set against that upbeat narrative of fair value, our SWS DCF model is far more conservative, indicating Globalstar is overvalued at around $63.70 versus a fair value closer to $15.91. If the market gravitates toward that lower number, how much upside is really left?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Globalstar Narrative

If this take does not quite match your view, or you would rather dig into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Globalstar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall Street Screener today to uncover fresh ideas before the crowd claims the most compelling setups.

- Generate potential breakout candidates by scanning these 3625 penny stocks with strong financials that already pair tiny share prices with surprisingly solid underlying financials.

- Position your portfolio for structural growth by targeting these 25 AI penny stocks building real products and revenue around artificial intelligence, not just hype filled headlines.

- Explore stronger cash flow potential by focusing on these 909 undervalued stocks based on cash flows where market pessimism may have overshot the fundamentals and left pricing misaligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報