ServisFirst Bancshares (SFBS): Revisiting Valuation After a Modest Share Price Rebound

ServisFirst Bancshares (SFBS) has quietly bounced about 5 % over the past month even as its year to date performance remains weak, inviting a closer look at what investors might be pricing in now.

See our latest analysis for ServisFirst Bancshares.

The recent 1 month share price return of about 5 % looks more like a tentative rebound than a full trend change, with the year to date share price still down double digits and the 1 year total shareholder return negative despite a solid 5 year total shareholder return above 100 %. This suggests momentum is only just starting to rebuild as investors reassess growth and credit risk.

If this kind of early recovery has your attention, it could be a good moment to scan for other financials showing improving sentiment and explore fast growing stocks with high insider ownership.

With ServisFirst shares still trading at a hefty discount to both analyst targets and some intrinsic value estimates, the key debate now is clear: is this an overlooked value opportunity, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 13.7% Undervalued

ServisFirst Bancshares last closed at $74.76 compared with a most popular narrative fair value of about $86.67, framing a meaningful upside gap that hinges on future earnings power.

Recent strategic bond portfolio restructuring, with reinvestment at much higher yields, sets up for continued net interest margin expansion over coming quarters, especially as legacy, lower yielding assets mature or reprice, directly benefitting net interest income and future earnings.

Curious how steady double digit growth, fat margins, and a richer future earnings multiple can all coexist in one bank story? Explore the full playbook driving this valuation perspective and see which assumptions are most important in the upside case.

Result: Fair Value of $86.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit costs and stubborn deposit funding pressures could easily derail the margin recovery bull case if they prove more persistent than expected.

Find out about the key risks to this ServisFirst Bancshares narrative.

Another View: Multiples Paint a Tougher Picture

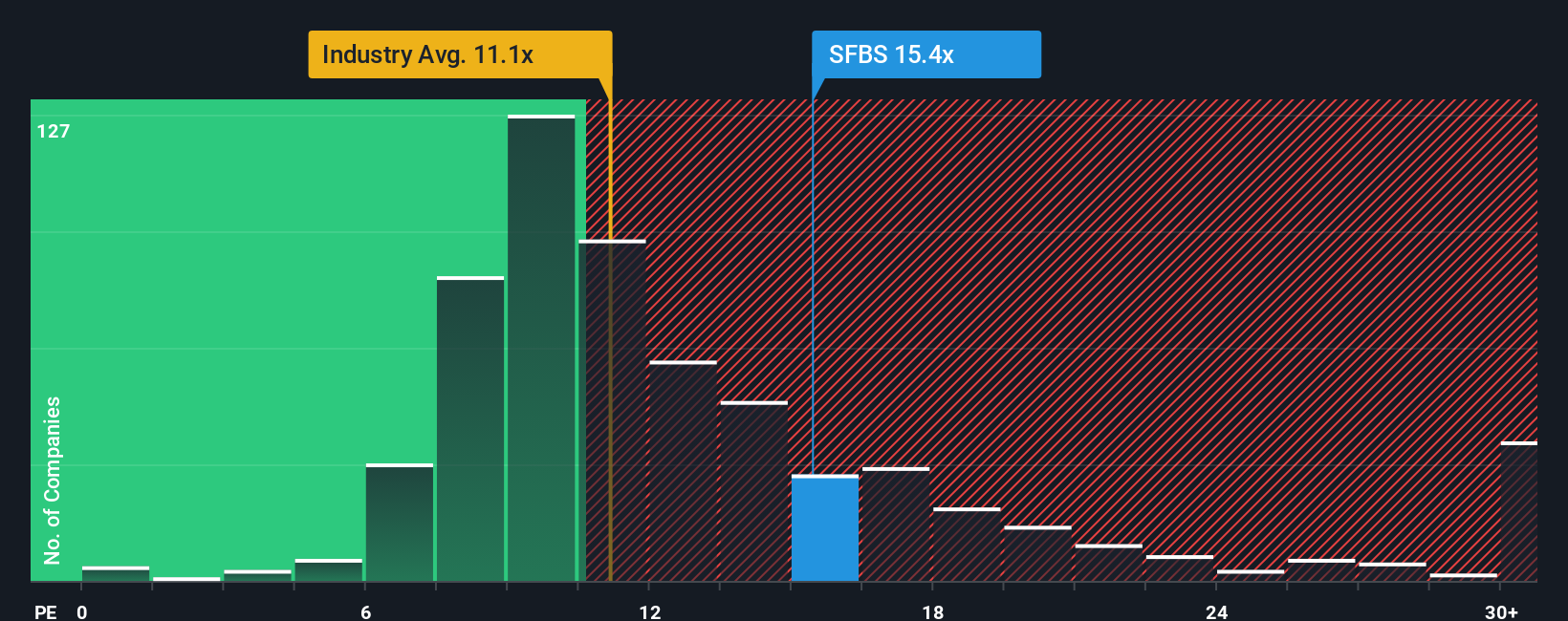

On earnings, the stock looks less forgiving. ServisFirst trades at about 16 times earnings versus a 12 times average for US banks, and above its own fair ratio of 14.3 times, suggesting less margin for error if growth or credit trends disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServisFirst Bancshares Narrative

If this take does not quite match your view, or you would rather dig into the numbers yourself, you can build a personalised narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ServisFirst Bancshares.

Looking for more investment ideas?

Before you move on, give yourself the chance to uncover fresh opportunities that match your style, from growth stories to income plays and everything in between.

- Capitalize on mispriced quality by scanning these 911 undervalued stocks based on cash flows that strong cash flow data suggests the market has not fully appreciated yet.

- Ride powerful technological shifts by targeting these 25 AI penny stocks positioned at the heart of automation, data intelligence, and long term digital transformation.

- Strengthen your portfolio’s income engine with these 13 dividend stocks with yields > 3% that can potentially boost returns while cushioning volatility over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報