Is Costco Still Attractive After Strong Multi Year Gains And Recent Valuation Concerns In 2025

- If you are wondering whether Costco Wholesale is still worth buying at these levels, or if the best days are already priced in, you are not the only one asking that question right now.

- After an impressive multi year run where the stock is up 95.8% over 3 years and 151.2% over 5 years, more recent returns have cooled, with the share price down 3.2% over 7 days, 6.8% over 30 days, 5.4% year to date and 11.9% over the last year.

- Those moves come as investors digest a steady stream of headlines about consumer spending holding up better than feared, and ongoing membership and store traffic strength that reinforces Costco's reputation as a defensive retail powerhouse. At the same time, broader concerns about interest rates and valuations in high quality retail names have made the market more selective about what it is willing to pay.

- Against that backdrop, Costco scores just 1 out of 6 on our valuation checks. This suggests the market may already be paying up for its strengths. Next, we will walk through traditional valuation approaches and then finish with a more holistic way to judge what this stock is truly worth.

Costco Wholesale scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Costco Wholesale Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms.

For Costco Wholesale, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $9.4 billion. It then builds analyst forecasts and extrapolated estimates. Analyst projections and Simply Wall St extensions imply free cash flow could rise to roughly $12.9 billion in 2035, reflecting steady, mid single digit annual growth as the warehouse network and membership base expand.

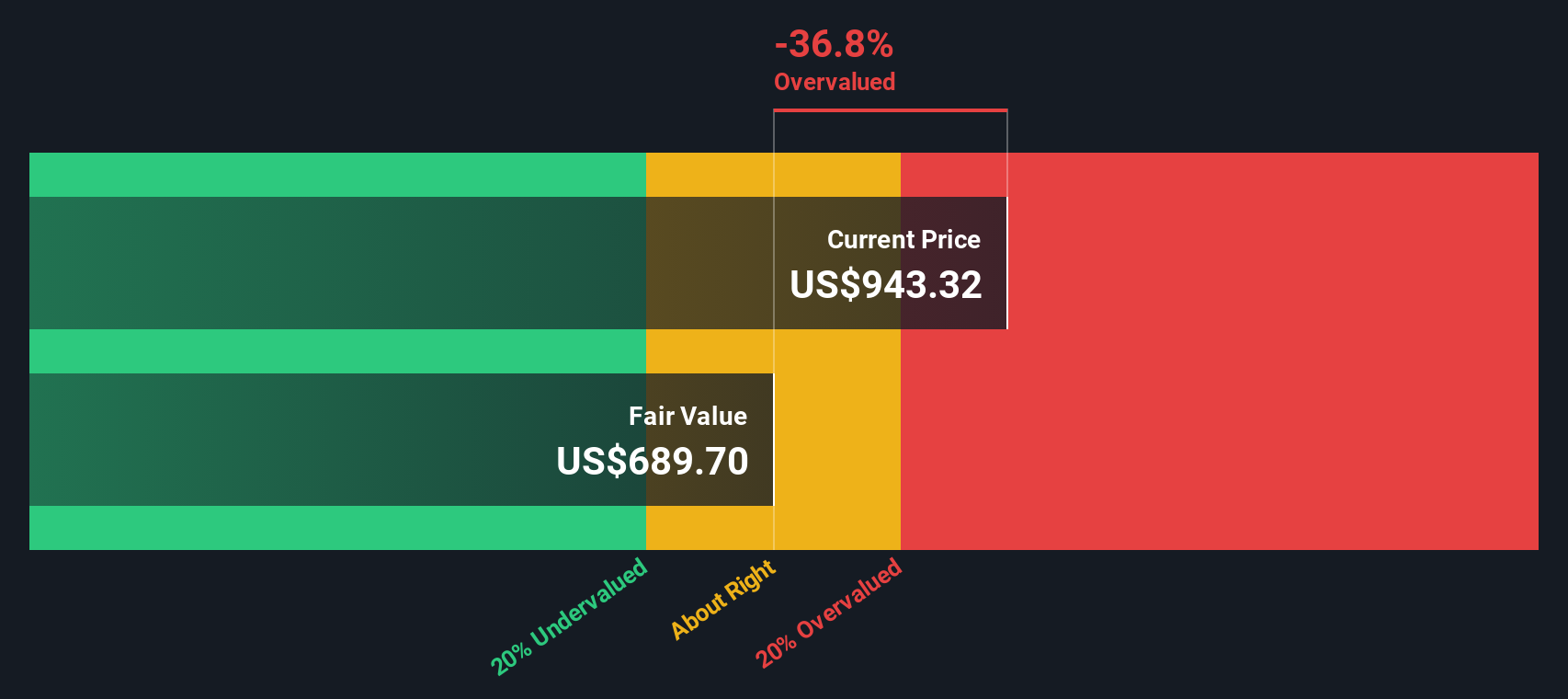

When those future cash flows are discounted back to today, the model produces an intrinsic value of about $581 per share. The current share price is roughly 48.1% higher, indicating the stock screens as materially overvalued on this DCF view and that much of Costco’s quality and resilience may already be priced in.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Costco Wholesale may be overvalued by 48.1%. Discover 911 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Costco Wholesale Price vs Earnings

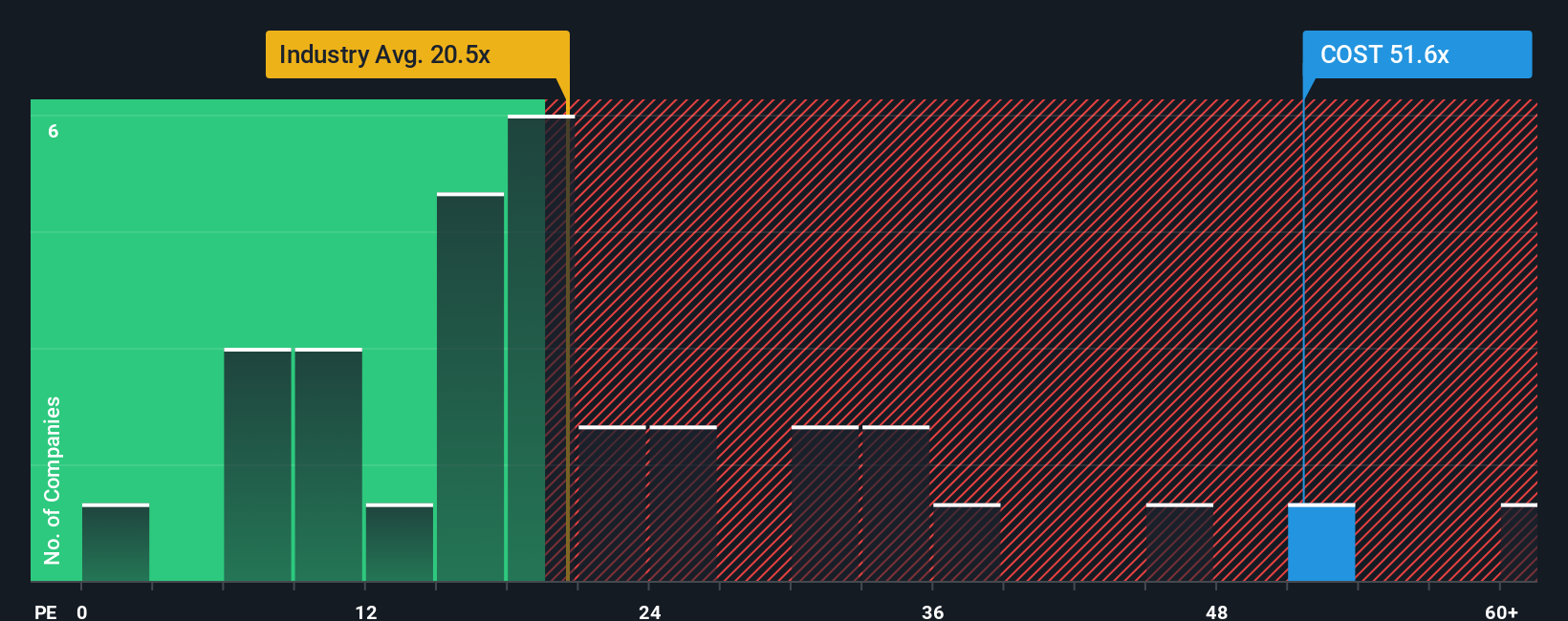

For a consistently profitable company like Costco Wholesale, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or more uncertainty usually call for a lower, more conservative multiple.

Costco currently trades on a PE of about 46.0x, which is well above the Consumer Retailing industry average of roughly 22.9x and also ahead of the broader peer group average of around 24.6x. On the surface, that suggests investors are paying a significant premium for Costco compared to many other retailers.

Simply Wall St’s Fair Ratio provides a more tailored benchmark by estimating what PE multiple Costco should trade on given its earnings growth outlook, profitability, industry, market size and risk profile. For Costco, this Fair Ratio is 34.4x, meaning the current 46.0x valuation sits materially above what those fundamentals would justify. That points to the shares looking expensive even after accounting for the company’s quality and growth characteristics.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Costco Wholesale Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about Costco Wholesale to the numbers by linking what you believe about its future revenue, earnings and margins to a financial forecast, a fair value estimate, and a clear buy or sell decision on Simply Wall St’s Community page, where millions of investors already compare their Fair Value to the current price, see how those views shift dynamically when new news or earnings arrive, and understand why one Costco investor might build a bullish Narrative around continued warehouse expansion, resilient high income members and a fair value near the top end of analyst targets around $1,225, while another more cautious investor might focus on margin pressure, rich valuation and competitive risks and land on a far lower fair value closer to $620.

Do you think there's more to the story for Costco Wholesale? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報