Cidara Therapeutics (CDTX): Assessing Valuation After a 239% Three‑Month and 864% One‑Year Share Price Surge

Cidara Therapeutics (CDTX) has quietly delivered striking long term gains, with the stock up sharply over the past year and even more over the past 3 years, despite ongoing losses.

See our latest analysis for Cidara Therapeutics.

Most of that excitement is baked into the recent move, with a roughly 239 percent 3 month share price return feeding into an 864 percent 1 year total shareholder return. This suggests momentum is still very much with the bulls.

If Cidara’s surge has you thinking more broadly about biotech opportunities, this could be a good moment to explore other healthcare stocks that are starting to stand out.

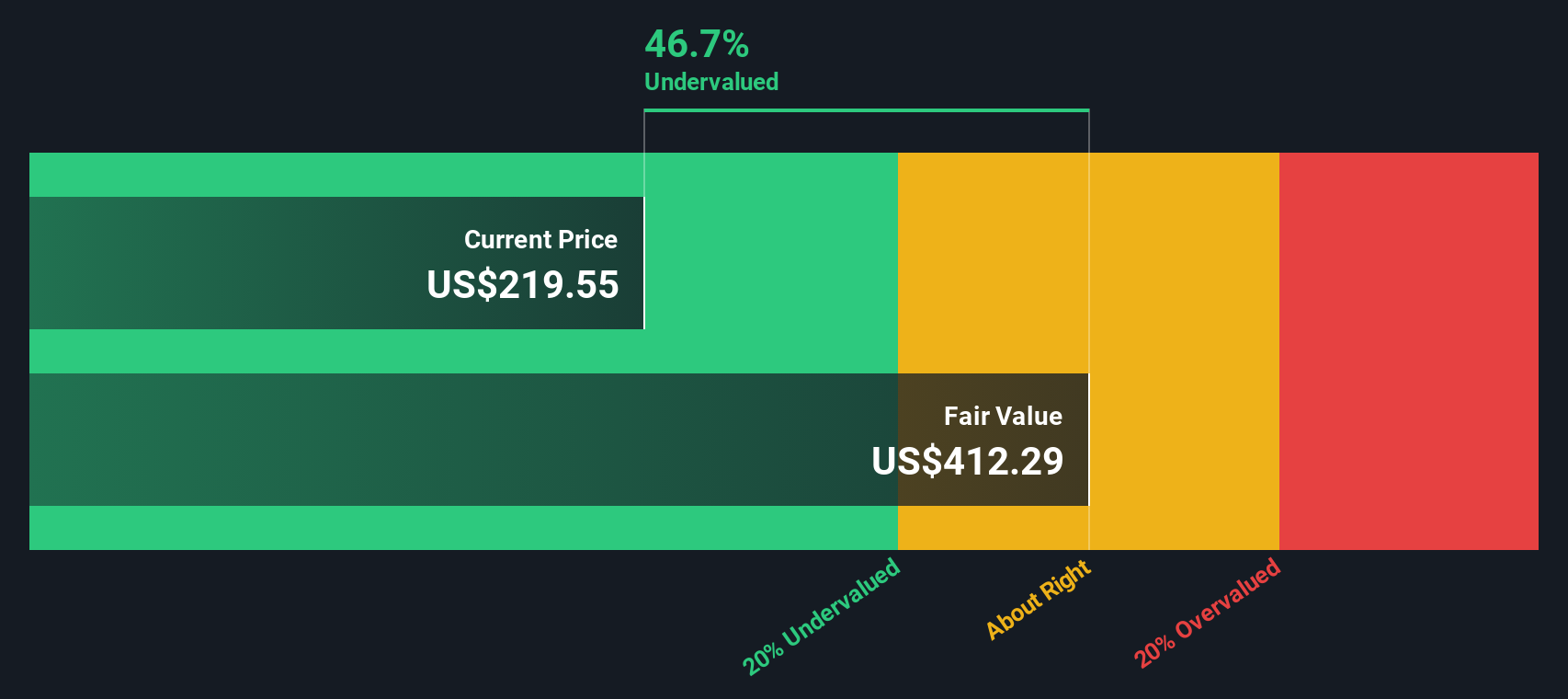

But after such explosive gains and with the stock now trading close to analyst targets yet still showing a sizable intrinsic discount, is Cidara genuinely undervalued, or has the market already priced in its future growth?

Price to Book of 16.4x: Is it justified?

Cidara’s latest close at $220.05 comes alongside a steep 16.4 times price to book ratio, signaling an aggressive valuation versus assets and peers.

The price to book ratio compares the company’s market value to its net assets on the balance sheet, a commonly watched yardstick for early stage biotechs without profits. At 16.4 times book, investors are effectively paying a substantial premium over the company’s accounting equity, which reflects expectations for future value creation that has not yet appeared in current financials.

That premium is difficult to ignore when set against the wider US biotechs industry, where the average price to book is just 2.7 times, and Cidara also trades above a 3.6 times peer average. This indicates that the market is pricing in a more optimistic trajectory for Cidara than for typical biotech names, which may limit flexibility if growth or clinical milestones do not progress as anticipated.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 16.4x (OVERVALUED)

However, clinical or regulatory setbacks in its antifungal or influenza programs, or delays converting pipeline promise into revenue, could quickly challenge today’s rich valuation.

Find out about the key risks to this Cidara Therapeutics narrative.

Another View on Valuation

While Cidara looks expensive at 16.4 times book, our DCF model tells a different story, suggesting the shares trade about 45.8 percent below an estimated fair value of roughly $406 per share. If cash flows catch up to that view, is the current price really stretched?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cidara Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cidara Therapeutics Narrative

If you see the numbers differently, or want to dig into the details yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Cidara Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before momentum shifts again, lock in your edge by using the Simply Wall St Screener to surface fresh, data backed stock ideas tailored to your strategy.

- Capitalize on stocks the market has overlooked by targeting these 911 undervalued stocks based on cash flows that still trade at compelling discounts to their cash flow potential.

- Ride the next wave of innovation by focusing on these 25 AI penny stocks positioned at the heart of intelligent automation and data driven disruption.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報