Is CareTrust REIT Still Attractive After Its Strong Multi Year Share Price Surge?

- Wondering if CareTrust REIT is still a smart buy after its big run up, or if the easy money has already been made? In this article, we break down whether the current share price really matches the underlying value.

- The stock has cooled slightly in the last week, down 3.1%, but it is still up 1.2% over the past month, 37.0% year to date, and 32.9% over the last year, with gains of 119.2% over three years and 104.1% over five years.

- Those moves have come as investors focus on CareTrust's growing senior housing and healthcare real estate footprint and its continued execution on acquisitions and operator partnerships. Against a backdrop of an aging population and tight supply in quality care facilities, the market has been rethinking what this REIT could be worth over the long term.

- On our valuation checks, CareTrust scores a 4/6, suggesting it looks undervalued on several fronts, but not all. In the sections ahead, we walk through different valuation methods to see how they line up, and then finish with a broader way to think about what this stock could be worth over time.

Approach 1: CareTrust REIT Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects CareTrust REIT's future adjusted funds from operations, then discounts those cash flows back to today to estimate what the business is worth right now.

For CareTrust, analysts and internal estimates point to steadily rising cash generation, with projected free cash flow to equity in the mid to high $400 million range over the next few years and reaching about $662.7 million by 2035. These figures, all in dollars, are based on a 2 stage model that uses analyst forecasts out to 2028 and then extrapolates growth beyond that.

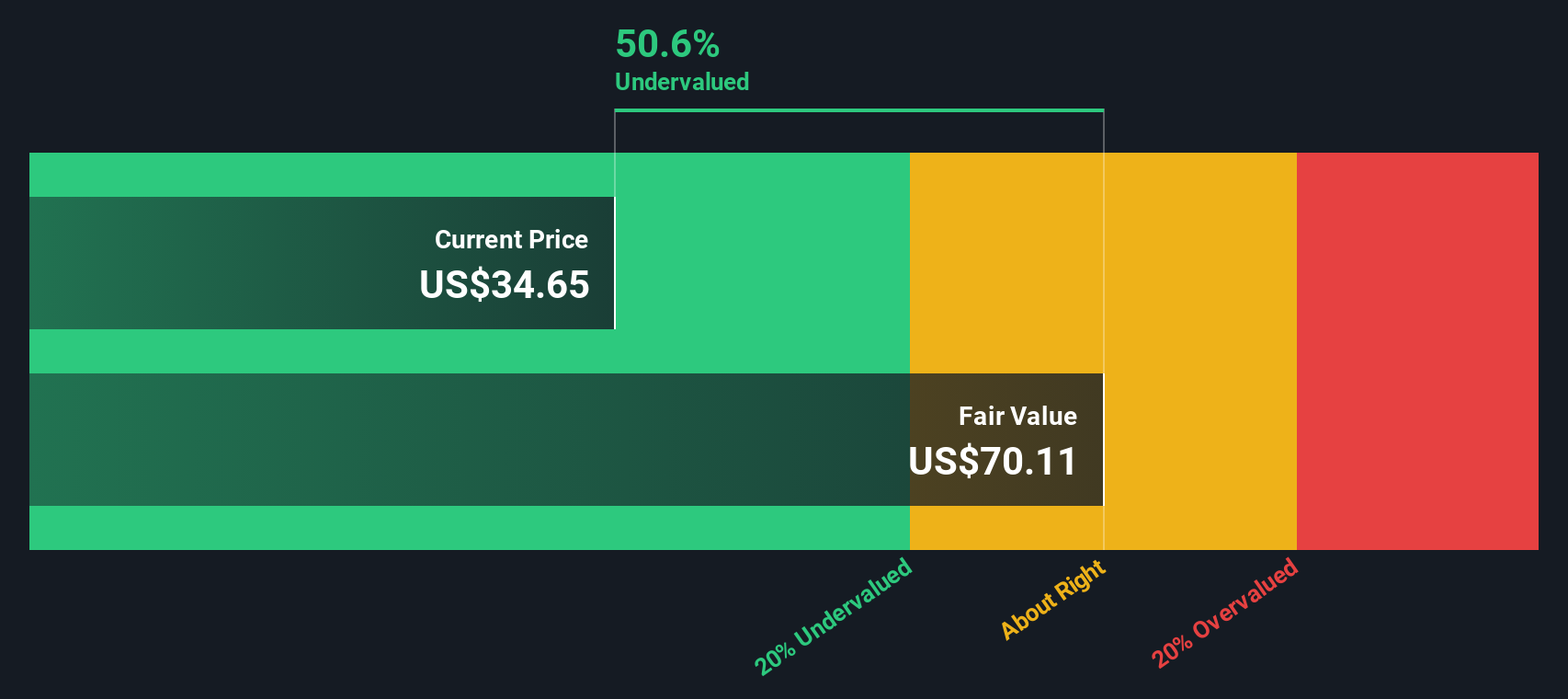

When all of those future cash flows are discounted back, the model arrives at an intrinsic value of about $58.36 per share. Compared with the current market price, this implies the stock is trading at roughly a 37.8% discount to its estimated fair value, suggesting investors are not fully pricing in the expected growth in cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CareTrust REIT is undervalued by 37.8%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: CareTrust REIT Price vs Earnings

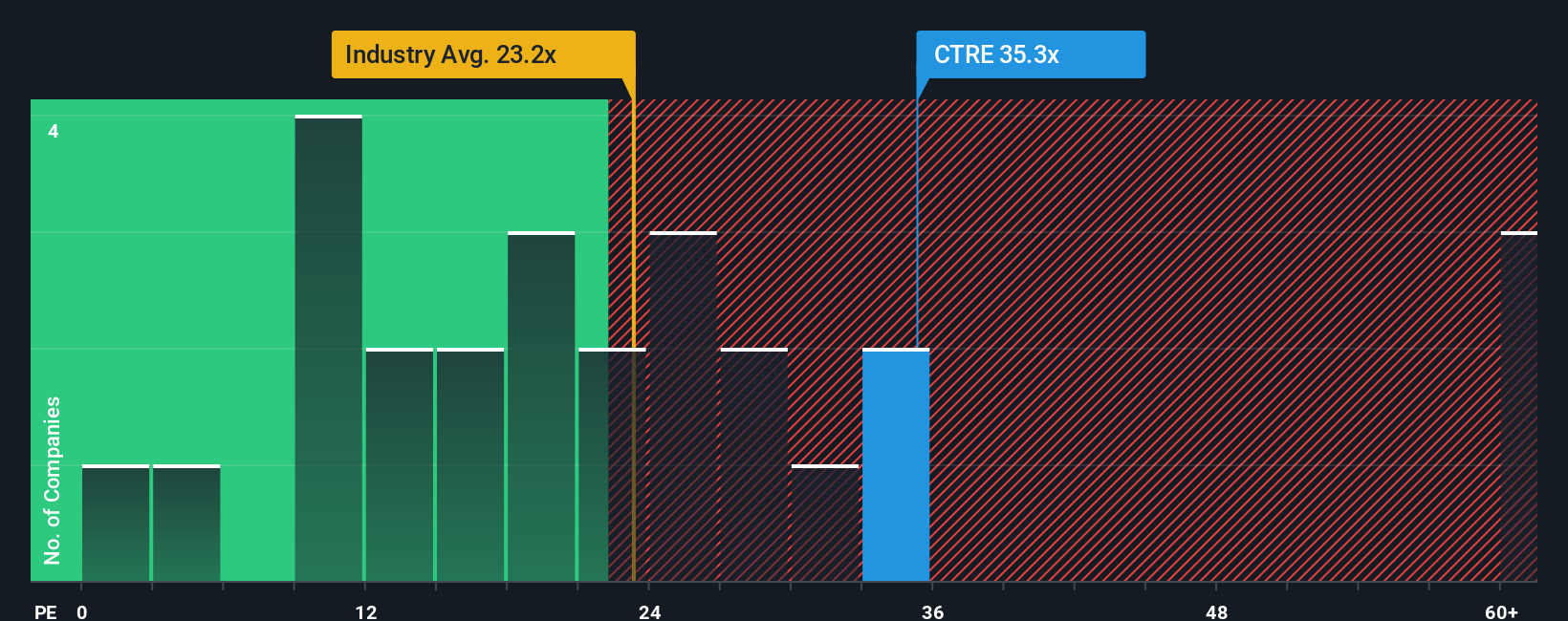

For a profitable company like CareTrust, the price to earnings ratio, or PE, is a useful way to see how much investors are paying for each dollar of current earnings. A higher PE can be justified when a business has strong, durable growth prospects and relatively low risk, while slower growing or riskier companies typically warrant a lower, more conservative multiple.

CareTrust currently trades on a PE of about 31.1x, which sits above the Health Care REITs industry average of roughly 25.4x and also below the broader peer group average of around 57.8x. To move beyond simple comparisons, Simply Wall St calculates a Fair Ratio, the PE multiple that would be reasonable given the company’s earnings growth outlook, profitability, size, industry and risk profile. This tailored benchmark is more informative than raw peer or industry averages because it explicitly adjusts for the factors that drive what a stock should be worth.

For CareTrust, the Fair Ratio comes out at roughly 36.7x, meaning the shares trade at a discount to what would be expected based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CareTrust REIT Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you write the story you believe about CareTrust REIT, translate that story into assumptions for future revenue, earnings and margins, and instantly see the fair value that falls out of those numbers so you can compare it to today’s share price and decide whether to buy, hold, or sell.

A Narrative links three things together in one place: the business story you believe (for example, how quickly CareTrust scales its U.K. care homes, how resilient skilled nursing demand is, and how management handles regulatory and integration risks), the financial forecast that follows from that story (such as 18% annual revenue growth, higher long term margins near 70%, and a future PE ratio around 27x), and the implied fair value per share, which then updates dynamically as new news, earnings, and analyst revisions come in.

On CareTrust specifically, one bullish Narrative on the platform currently pegs fair value near 40.64 per share while a more cautious view sits closer to 33.00, underscoring how different but clearly articulated perspectives can coexist and helping you decide where your own Narrative fits along that spectrum.

Do you think there's more to the story for CareTrust REIT? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報