Disney (DIS) Valuation Check as It Strikes Strategic AI Content and Equity Deal with OpenAI’s Sora Platform

Walt Disney (DIS) just inked a three year content and equity deal with OpenAI’s Sora platform, letting fans generate short videos with Disney, Marvel, Pixar, and Star Wars characters while Disney leans deeper into AI powered storytelling.

See our latest analysis for Walt Disney.

The OpenAI deal lands as Disney’s share price hovers around $111.62, with a 7 day share price return of 4.30 percent but a roughly flat 1 year total shareholder return. This suggests sentiment is improving yet the longer term reset is still in progress.

If generative video is on your radar after this move, it may be worth scanning other media and tech names riding similar trends by exploring high growth tech and AI stocks.

With shares still trading about 19 percent below the average analyst target despite decent growth, investors now face a familiar crossroads: is Disney quietly undervalued after years of reset, or is the market already baking in an AI powered rebound?

Most Popular Narrative Narrative: 15.1% Undervalued

With Walt Disney last closing at $111.62 versus a narrative fair value of $131.50, the narrative framework implies meaningful upside if its assumptions land.

The next five years are poised to be transformative: ESPN’s NFL-driven streaming dominance, streaming scaling into multibillion-dollar profits, parks and cruises expanding globally, and blockbuster releases fueling the IP machine. Disney could see sustained double-digit EPS growth and a re-rating of the stock as sports transforms from a cable anchor into a digital rocket booster.

According to Cashflow_Queen, this story hinges on a powerful trio: expanding margins, rising free cash flow, and a richer earnings multiple than the market currently implies.

Result: Fair Value of $131.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating sports rights costs or a stumble in streaming execution could quickly compress margins and challenge the ESPN-led, AI-powered growth story.

Find out about the key risks to this Walt Disney narrative.

Another Lens on Value

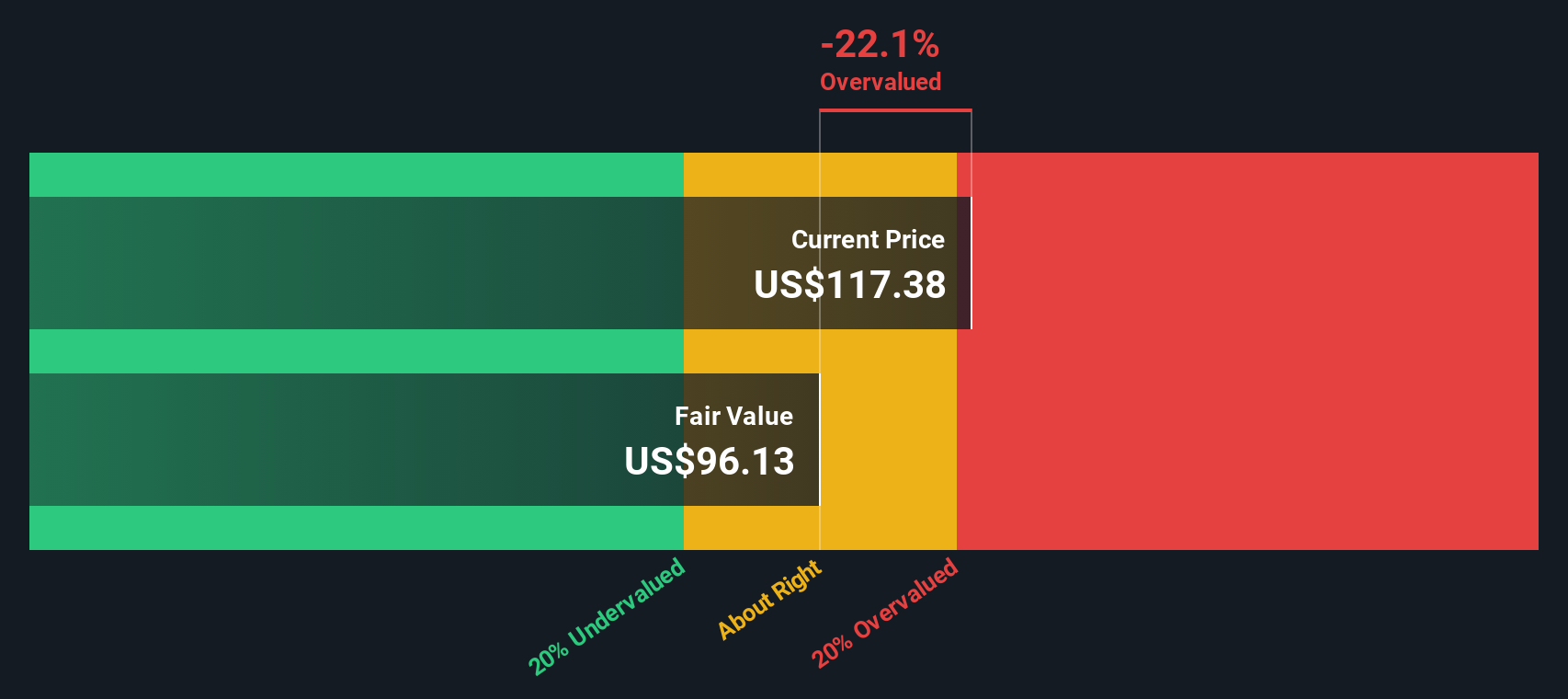

Our SWS DCF model paints a cooler picture than the upbeat narrative. On this view, Disney is trading slightly above an estimated fair value of $106.34, which suggests the stock may be modestly overvalued rather than a clear bargain. Is the cash flow math missing the magic, or are expectations running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you see the outlook differently or prefer to dig into the numbers yourself, you can craft a fresh narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Walt Disney.

Looking for more investment ideas?

Before you move on, put your research to work and uncover stocks that match your strategy using the Simply Wall Street Screener so you are not leaving opportunities on the table.

- Capture potential multi-baggers early by scanning these 3627 penny stocks with strong financials where strong financials back up ambitious growth stories.

- Position yourself at the heart of the AI boom by targeting companies within these 25 AI penny stocks pushing the boundaries of automation and intelligent software.

- Lock in a steadier income stream by reviewing these 13 dividend stocks with yields > 3% and focus on businesses rewarding shareholders with meaningful cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報