Butterfly Network (BFLY) Is Up 7.7% After New AI Platform And Insider Buying - What's Changed

- Recently, Butterfly Network announced a co-development and licensing agreement with Midjourney for its semiconductor-based ultrasound technology and launched Compass AI, an enterprise software platform aimed at improving point-of-care ultrasound documentation and workflow.

- Alongside these moves, director Larry Robbins increased his direct ownership by purchasing 21,370 Class A shares, signaling internal confidence in the company’s AI-enabled ultrasound roadmap.

- Next, we’ll examine how the Compass AI launch may influence Butterfly Network’s investment narrative and its recurring software revenue ambitions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Butterfly Network Investment Narrative Recap

To own Butterfly Network, you need to believe handheld, AI-enabled ultrasound can become a standard part of everyday clinical practice and support meaningful software-led revenue. The Midjourney partnership and Compass AI launch directly tie into that thesis, but the key near term catalyst remains converting large enterprise deals, while the biggest risk is that long sales cycles and ongoing losses continue to weigh on execution.

Among the recent announcements, Compass AI looks most relevant for investors, because it targets documentation and workflow bottlenecks that have limited point-of-care ultrasound adoption and billing. If Compass AI can gain traction across health systems, it may help address concerns about flat domestic revenue and weaker subscription renewals by deepening software usage and potentially lifting recurring revenue over time.

Yet investors should also be aware that Butterfly’s high R&D spend and continued operating losses mean the path to breakeven still depends on...

Read the full narrative on Butterfly Network (it's free!)

Butterfly Network's narrative projects $135.9 million revenue and $17.0 million earnings by 2028. This requires 15.8% yearly revenue growth and a $79.8 million earnings increase from -$62.8 million today.

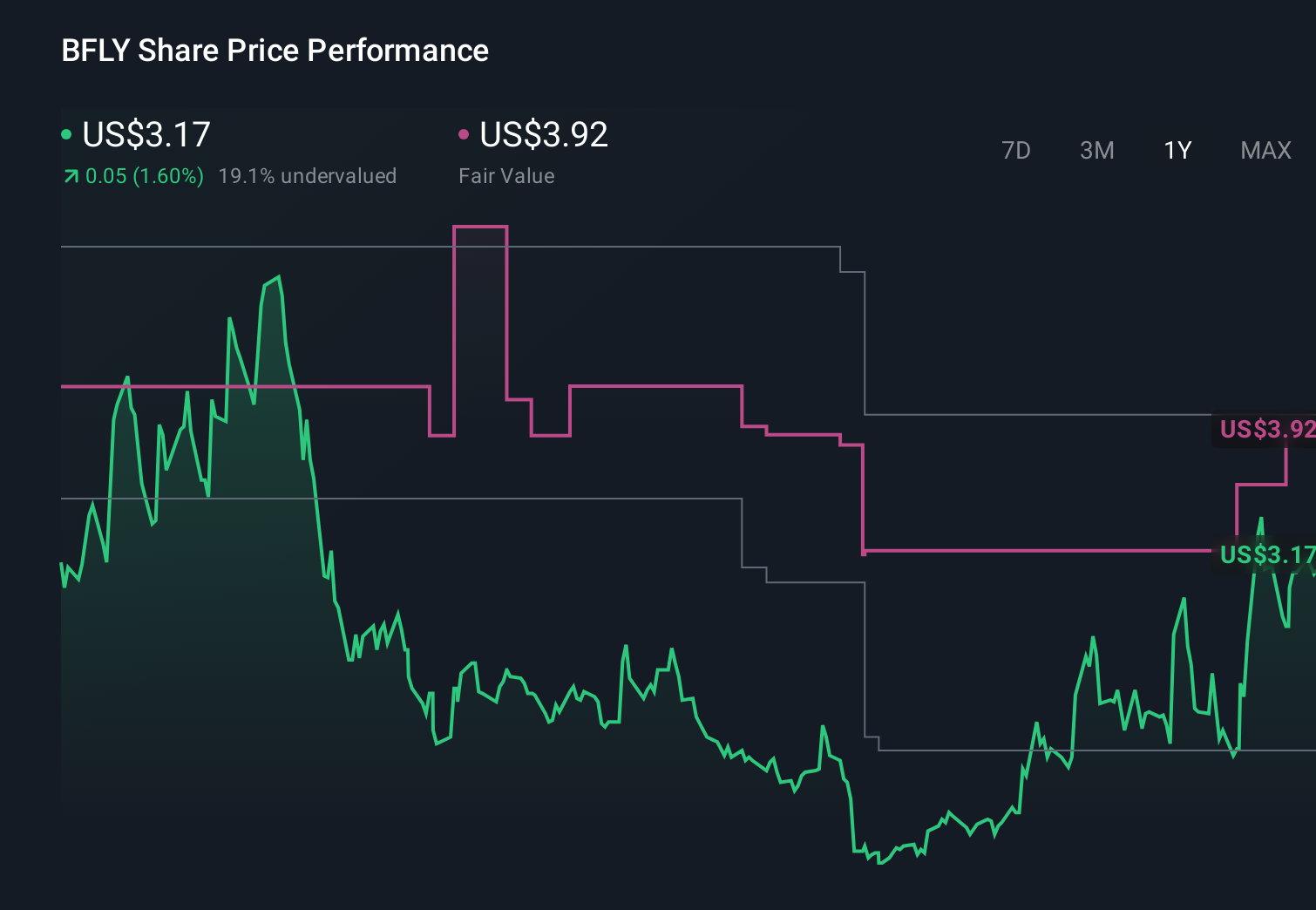

Uncover how Butterfly Network's forecasts yield a $3.92 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see Butterfly’s fair value anywhere between US$0.89 and US$5.00, highlighting very different expectations. Against that backdrop, the Compass AI launch and the company’s continued operating losses give you concrete catalysts and risks to weigh as you consider these competing views.

Explore 9 other fair value estimates on Butterfly Network - why the stock might be worth less than half the current price!

Build Your Own Butterfly Network Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Butterfly Network research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Butterfly Network research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Butterfly Network's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報