Commvault (CVLT) Valuation Check After New Delinea Security Integration and Ongoing AI‑Driven Resilience Push

Commvault Systems (CVLT) just expanded its security toolkit through a new integration with Delinea, tying Commvault Cloud directly into Delinea’s Secret Server to tighten credential controls and support stricter compliance for enterprise customers.

See our latest analysis for Commvault Systems.

Despite solid execution in cyber resilience and AI enabled recovery, Commvault’s 1 year total shareholder return of minus 27.33 percent and steep 90 day share price return of minus 36.15 percent show momentum has cooled after very strong multi year gains. The 3 year total shareholder return is still up 90.71 percent at a share price of 120.95 dollars.

If this kind of security driven growth story interests you, it could be worth scanning other cybersecurity and infrastructure plays alongside broader high growth tech and AI names using high growth tech and AI stocks.

With shares sliding even as billings grow and security capabilities deepen, is Commvault now a misunderstood cyber resilience play trading at a discount, or is the market already baking in its next leg of growth?

Most Popular Narrative: 37.6% Undervalued

Commvault Systems last closed at 120.95 dollars, compared with a widely followed fair value estimate of about 193.70 dollars that anchors a bullish long term thesis.

Rapid expansion and successful cross sell and upsell momentum within the SaaS (Metallic) platform evidenced by 63 percent SaaS ARR growth, a 45 percent increase in multi product customers, and 125 percent SaaS net dollar retention point to continued improvement in the quality and predictability of future revenues, directly supporting margin expansion and higher earnings visibility.

Want to see how this kind of recurring revenue engine might reshape margins and earnings power, and what future profit multiple that could support? The narrative lays out a detailed pathway of accelerating top line growth, rising profitability, and a richer earnings profile that justifies a premium valuation. Curious which specific growth and margin assumptions have to land for this upside case to hold together? Dive in to unpack the full playbook behind that fair value.

Result: Fair Value of $193.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter contract durations and reliance on large, lumpy deals could pressure margins and earnings visibility, which may challenge the upside case if growth normalizes.

Find out about the key risks to this Commvault Systems narrative.

Another Angle on Valuation

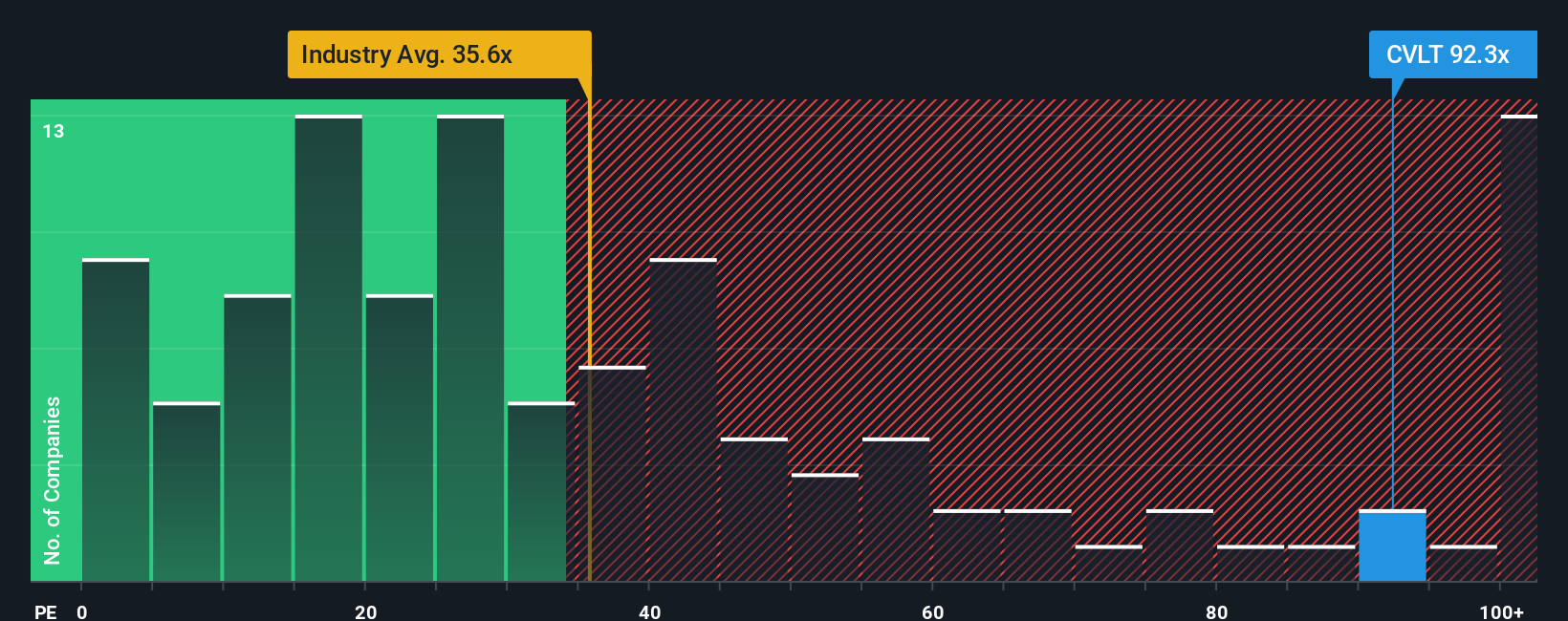

While the narrative and fair value model suggest Commvault is 37.6 percent undervalued, its current price to earnings ratio of 65.9 times looks stretched versus both the US Software industry at 32.4 times and a fair ratio of 34.6 times. This flags real de rating risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you would rather dig into the numbers yourself and shape your own view in minutes, explore the tools and Do it your way today.

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by scanning targeted stock ideas that match your style instead of waiting for opportunities to find you.

- Capitalize on market mispricing by targeting companies trading below their estimated worth through these 909 undervalued stocks based on cash flows and tighten your focus on value opportunities.

- Explore the influence of AI by focusing on innovators reshaping entire industries when you review these 25 AI penny stocks for fresh, high growth candidates.

- Strengthen your income strategy by uncovering businesses with robust cash flows and attractive payouts using these 13 dividend stocks with yields > 3% as your starting list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報