Wonik IPS' (KOSDAQ:240810) investors will be pleased with their solid 169% return over the last year

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Wonik IPS Co., Ltd. (KOSDAQ:240810). Its share price is already up an impressive 168% in the last twelve months. Also pleasing for shareholders was the 35% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 18% in 90 days). Looking back further, the stock price is 122% higher than it was three years ago.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Wonik IPS went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We doubt the modest 0.08% dividend yield is doing much to support the share price. We think that the revenue growth of 37% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

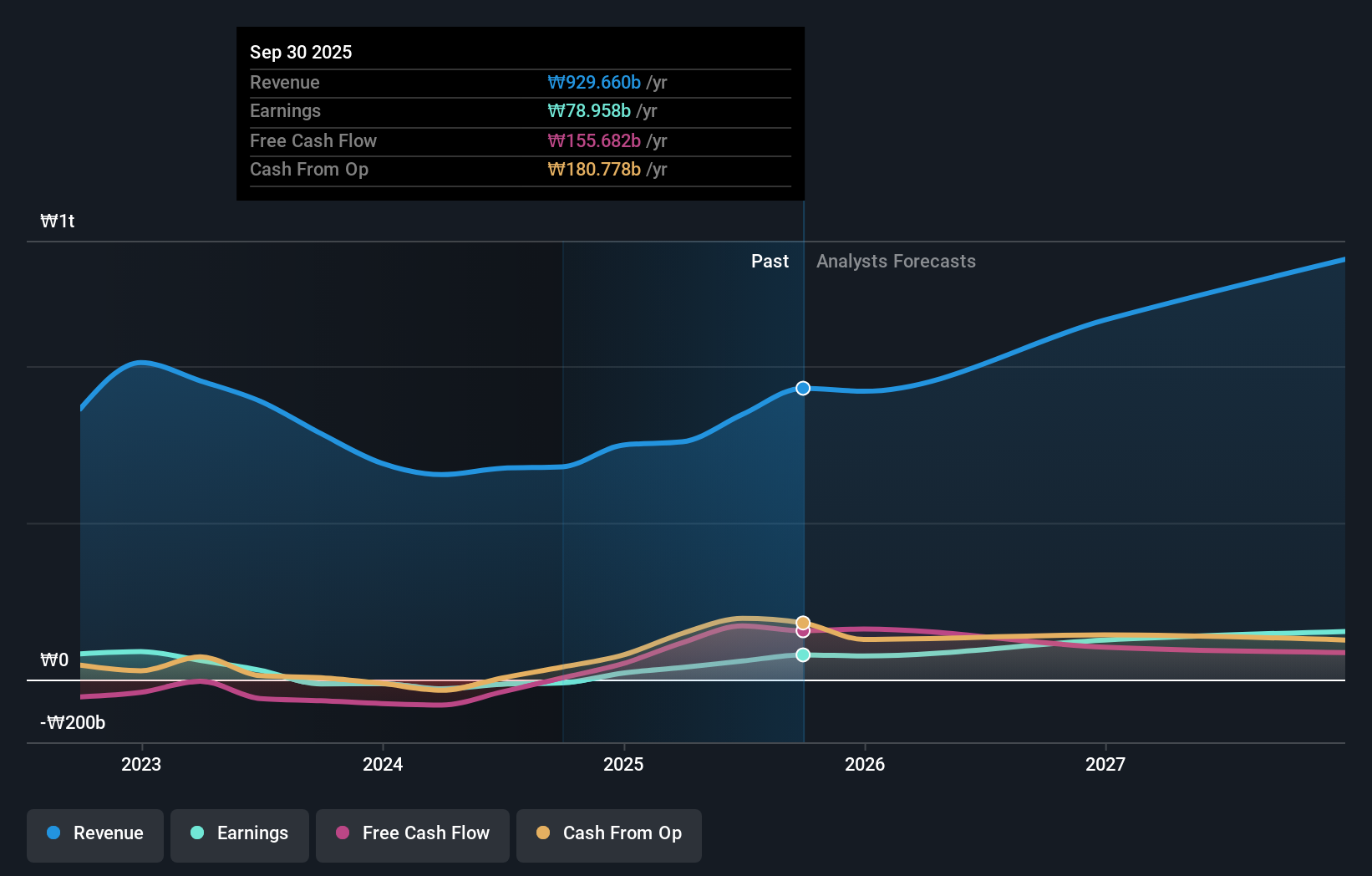

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Wonik IPS is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Wonik IPS stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's good to see that Wonik IPS has rewarded shareholders with a total shareholder return of 169% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 8% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is Wonik IPS cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報