Fujikura (TSE:5803): Assessing Valuation After a Sharp Pullback in a Strong Multi‑Year Run

Fujikura (TSE:5803) has quietly pulled back over the past week, even after a strong run over the past year. That disconnect between recent weakness and longer term gains is where the story gets interesting.

See our latest analysis for Fujikura.

After a sharp pullback that includes a 1 month share price return of minus 14.9 percent, Fujikura still sits on a powerful year to date share price gain and exceptional multi year total shareholder returns, suggesting momentum is cooling rather than breaking.

If Fujikura’s long run surge has you rethinking where the next big compounding story might come from, it could be worth exploring fast growing stocks with high insider ownership.

With earnings still growing, a double digit pullback, and the share price trading below analyst targets, are investors being handed a rare value entry into Fujikura, or is the market already baking in years of growth?

Price to Earnings of 35.1x: Is it justified?

On a headline basis, Fujikura’s last close at ¥16,500 reflects a rich price to earnings multiple of 35.1 times, pointing to a premium valuation rather than a bargain.

The price to earnings ratio compares what investors pay for each unit of current earnings. It is a useful shorthand for how the market values a company’s profit engine. For a diversified industrial and electrical equipment group like Fujikura, this lens is especially relevant because earnings capture the benefits of margin expansion and scale that have driven its recent profit surge.

That premium comes into sharper focus against the backdrop of peers. Fujikura trades on 35.1 times earnings, more than double the 14.1 times average for the wider JP Electrical industry and well above the 18.6 times peer average, suggesting investors are paying up aggressively for its growth profile. Yet compared with an estimated fair price to earnings ratio of 39.7 times, the current multiple sits at a discount to where the market could plausibly re rate the shares if strong returns on equity and above market earnings growth persist.

Explore the SWS fair ratio for Fujikura

Result: Price-to-Earnings of 35.1x (OVERVALUED)

However, slowing revenue growth or a sharp de rating from its premium valuation could quickly reverse sentiment and challenge the high growth, high multiple thesis.

Find out about the key risks to this Fujikura narrative.

Another View on Value

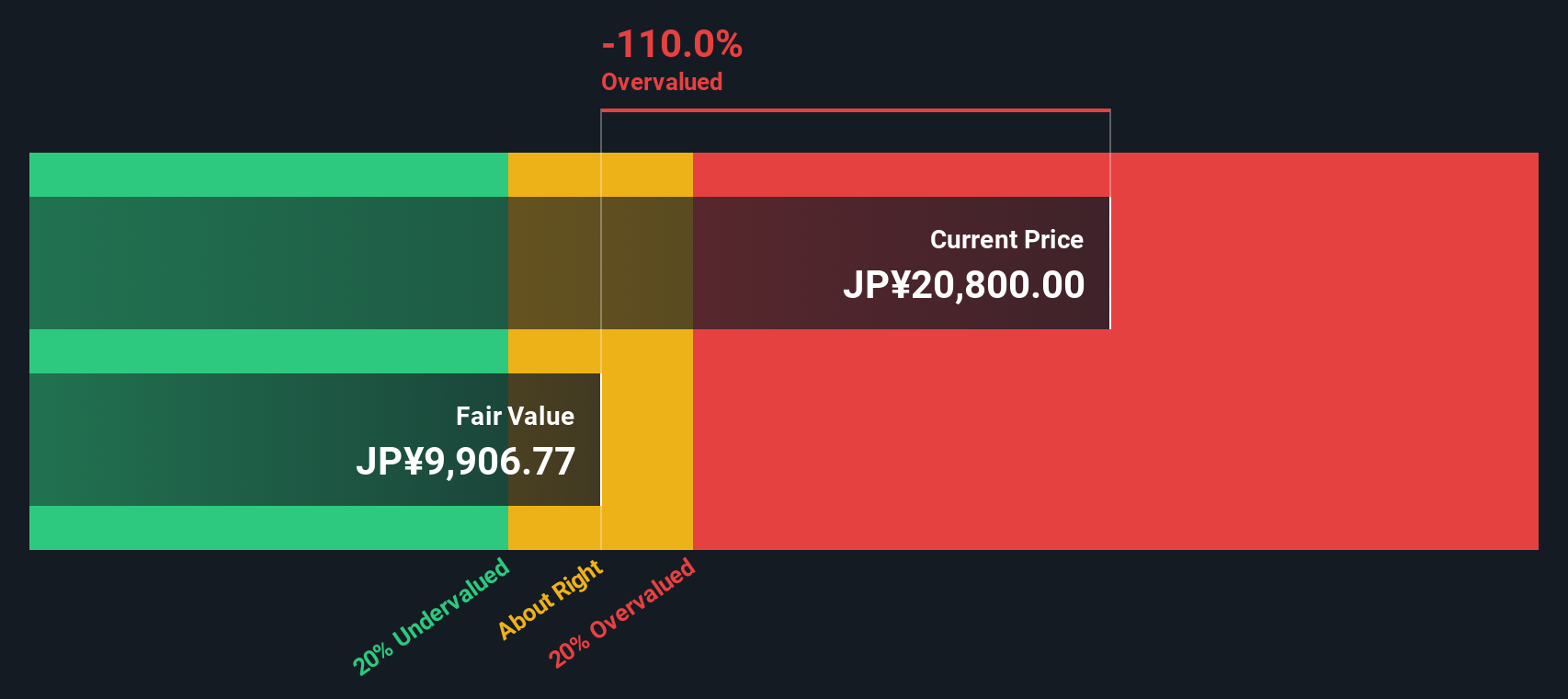

While the price to earnings multiple argues Fujikura is expensive, our DCF model paints a gentler picture. On that lens, the shares sit above an estimated fair value of ¥13,995, implying overvaluation but not by a huge margin. Is this a warning sign, or the cost of quality growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fujikura for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fujikura Narrative

If this view does not quite align with your own, you can review the numbers yourself and shape a fresh perspective in minutes: Do it your way.

A great starting point for your Fujikura research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider identifying your next potential opportunity by using the Simply Wall Street Screener to uncover focused ideas you may not spot elsewhere.

- Explore early stage opportunities by reviewing these 3629 penny stocks with strong financials that pair smaller market size with relatively robust financials.

- Assess these 30 healthcare AI stocks that may be contributing to changes in patient care, diagnostics, and medical decision making.

- Review these 13 dividend stocks with yields > 3% that combine dividend payments with payout profiles that appear more sustainable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報