S&P 500 Inclusion Amid Turnaround Could Be A Game Changer For Carvana (CVNA)

- Carvana is being added to the S&P 500 on December 22, 2025, following a year marked by record Q3 2025 retail sales, improved profitability, and a widely cited operational turnaround in its online used-car platform.

- At the same time, insider share sales and mixed analyst views on valuation highlight that enthusiasm around Carvana’s index inclusion and growth story is paired with ongoing debates about risk and sustainability.

- We’ll now examine how Carvana’s upcoming S&P 500 inclusion may affect its investment narrative built around online growth and efficiency.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Carvana Investment Narrative Recap

To be a Carvana shareholder today, you likely need to believe its online model can keep scaling profitably while operational efficiencies hold up under faster growth. The near term catalyst is the S&P 500 inclusion, which may amplify trading volumes but does not change the core questions around margins, capital intensity and whether high expectations leave the stock exposed if growth or profitability stumble.

Against that backdrop, Carvana’s record Q3 2025 performance, with 143,280 retail units sold and strong profitability, is especially relevant. It reinforces the recent turnaround narrative that underpins bullish reactions to its index inclusion, yet the contrast with insider selling and ongoing valuation concerns keeps the debate alive over how durable these improvements will be if used car demand or execution slip.

Yet investors should also be aware of how quickly ambitious growth plans could strain reconditioning and logistics capacity...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $33.2 billion revenue and $2.2 billion earnings by 2028.

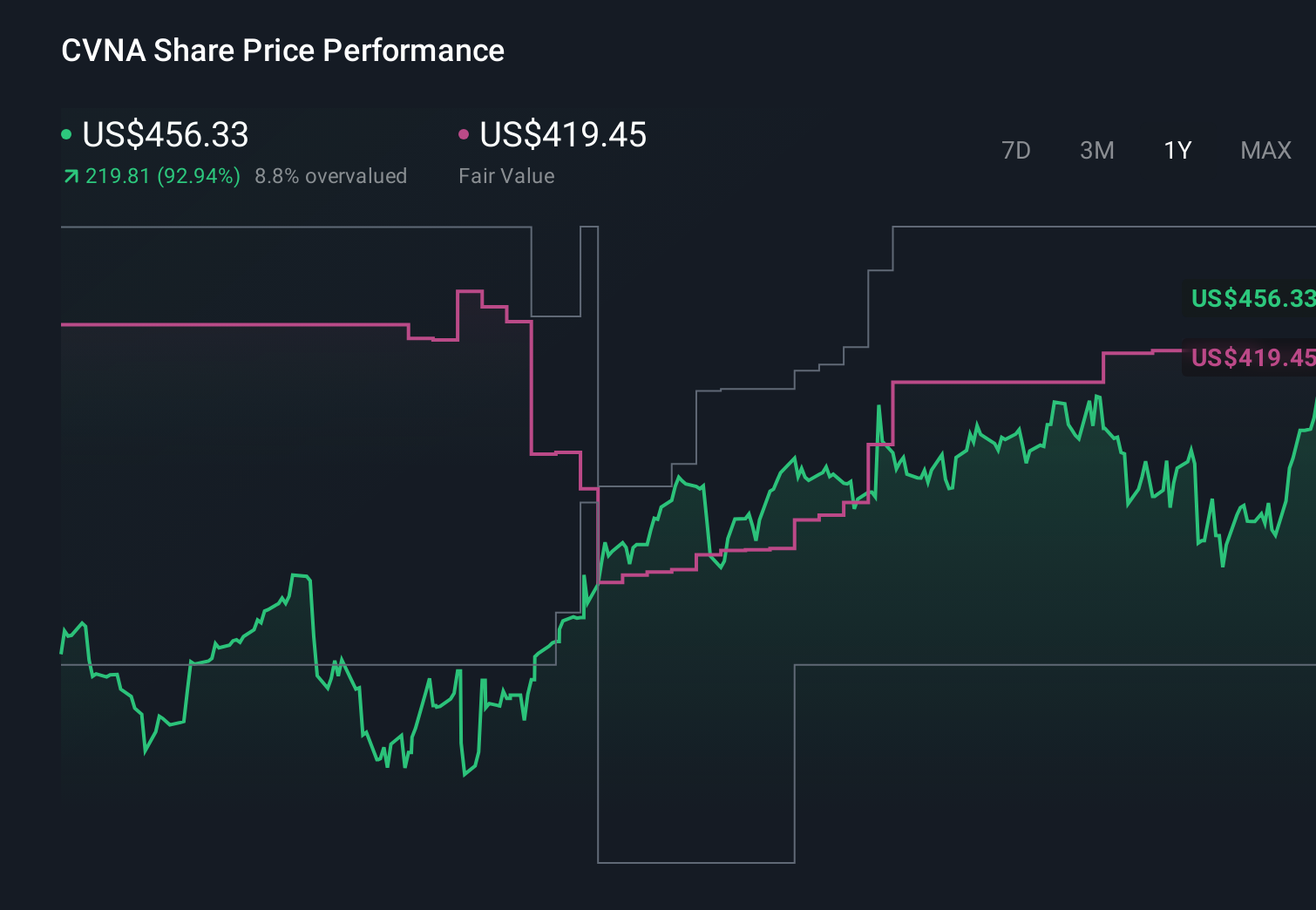

Uncover how Carvana's forecasts yield a $419.45 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Eighteen members of the Simply Wall St Community currently estimate Carvana’s fair value between US$60 and about US$532.6, highlighting very different expectations. When you set those views against the ambitious growth goals and execution risks around scaling reconditioning and logistics, it underlines why many investors are closely comparing the story with the current share price.

Explore 18 other fair value estimates on Carvana - why the stock might be worth as much as 17% more than the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報