Investors Don't See Light At End Of Vital Innovations Holdings Limited's (HKG:6133) Tunnel And Push Stock Down 29%

Vital Innovations Holdings Limited (HKG:6133) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The last month has meant the stock is now only up 4.7% during the last year.

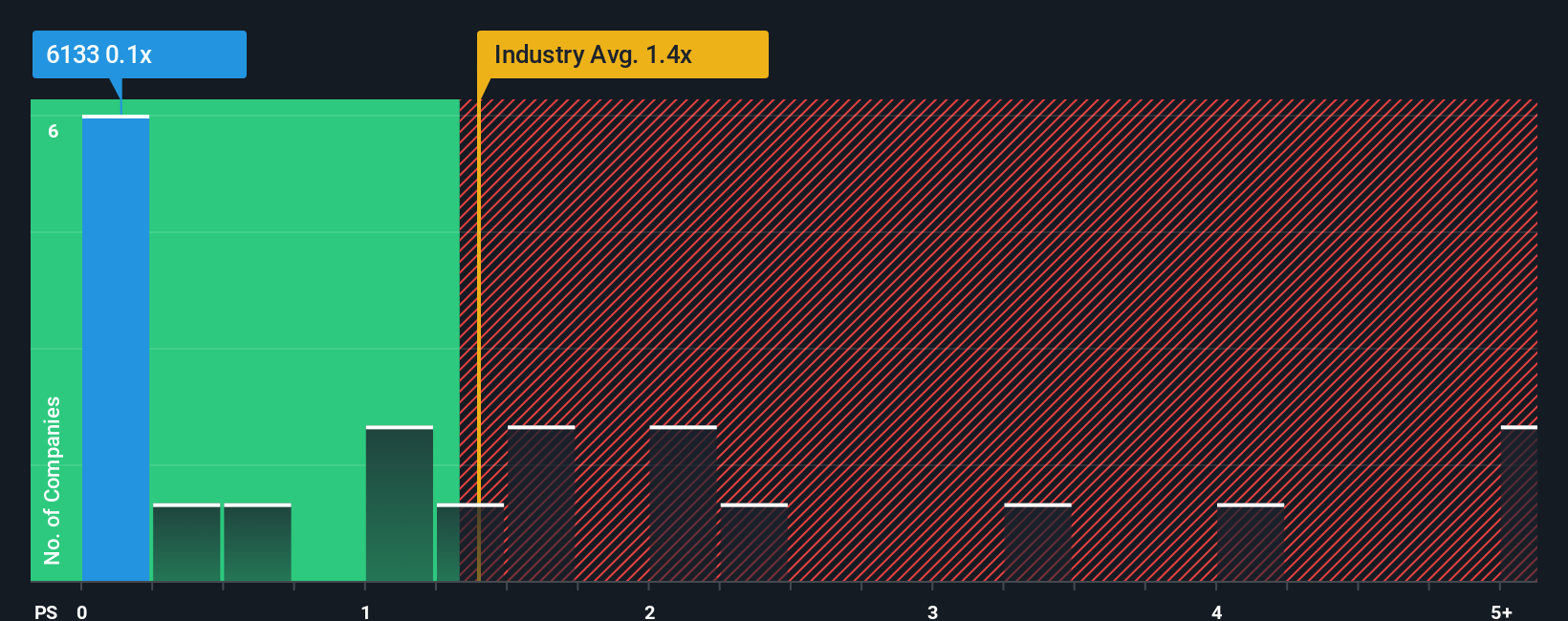

After such a large drop in price, when close to half the companies operating in Hong Kong's Tech industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Vital Innovations Holdings as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Vital Innovations Holdings

What Does Vital Innovations Holdings' Recent Performance Look Like?

The recent revenue growth at Vital Innovations Holdings would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vital Innovations Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Vital Innovations Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.9%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 2.8% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this information, we are not surprised that Vital Innovations Holdings is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

The southerly movements of Vital Innovations Holdings' shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Vital Innovations Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Vital Innovations Holdings that you need to be mindful of.

If these risks are making you reconsider your opinion on Vital Innovations Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報