Lamb Weston’s Valuation After Strong Earnings Beat and Upgraded Full-Year Guidance

Lamb Weston Holdings (LW) just got a lift from better than expected Q1 2026 results, with both adjusted earnings and net sales topping forecasts, and management backing it up with confident full year guidance.

See our latest analysis for Lamb Weston Holdings.

The better than expected quarter comes as Lamb Weston tries to rebuild momentum, with a roughly 3 percent 3 month share price return but a much weaker 1 year total shareholder return of about negative 26 percent highlighting how investors are only cautiously rotating back into the name.

Given how sentiment can shift quickly after an earnings surprise, this is also a good moment to scan the wider staples space and see which other healthcare stocks might offer a healthier balance of growth and resilience.

With earnings momentum improving but the share price still lagging its past highs and trading at a meaningful discount to most analyst targets, is Lamb Weston quietly undervalued, or already reflecting all the future growth investors can reasonably expect?

Most Popular Narrative Narrative: 9.9% Undervalued

With the narrative fair value at $66 versus a last close of $59.46, valuation hinges on whether modest growth and margin repair can compound steadily from here.

Lamb Weston's $250 million cost savings program including operational streamlining, zero based budgeting, and supply chain efficiency aims to lower the cost base significantly by fiscal 2028, which could directly enhance net margins and overall profitability.

Want to see what happens when slow top line growth meets a sharp margin reset and a lower future earnings multiple, usually reserved for defensive stalwarts? The narrative walks through how those moving parts combine into today’s fair value call, and why the projected earnings path could still surprise many investors.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent restaurant traffic declines and competitive price promotions could undermine volume growth and delay the margin repair that underpins today’s undervaluation case.

Find out about the key risks to this Lamb Weston Holdings narrative.

Another View, Using Market Ratios

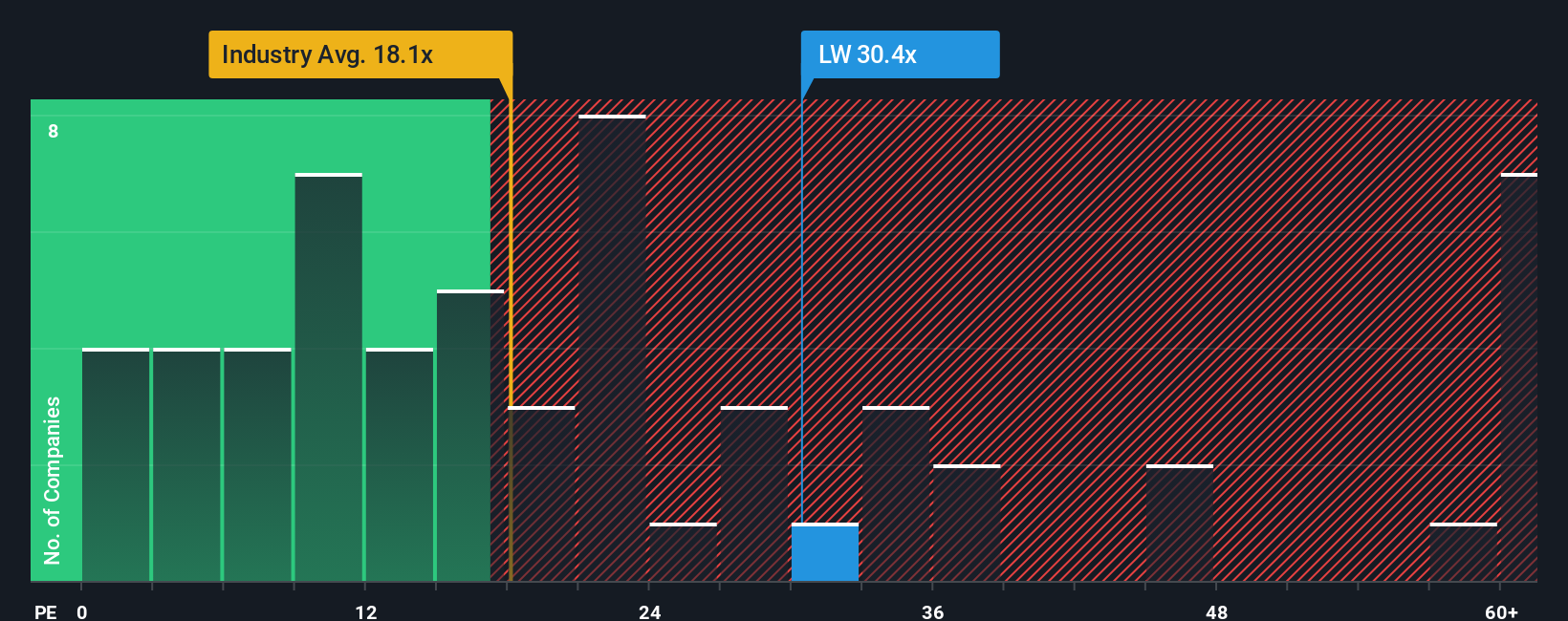

While the narrative points to a fair value of $66, the market’s own yardstick tells a tougher story. Lamb Weston trades on a 28.2x price to earnings ratio, versus a 23.6x fair ratio, 20.2x for the US Food industry, and 10.6x for peers. This implies investors are still paying up despite recent setbacks. Is that a premium you are comfortable with if growth underdelivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamb Weston Holdings Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a full narrative in minutes, Do it your way.

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities with the Simply Wall St Screener, so you are not leaving potential returns on the table.

- Capture early-stage growth potential by reviewing these 3626 penny stocks with strong financials that already show robust financial strength.

- Position your portfolio for tomorrow’s innovation by targeting these 25 AI penny stocks poised to benefit from the AI adoption wave.

- Lock in quality at attractive prices by focusing on these 913 undervalued stocks based on cash flows that look mispriced based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報