NRG Energy (NRG): Rethinking Valuation After a Powerful Year-to-Date Share Price Surge

NRG Energy (NRG) has been on investors radar after a powerful run this year, with the stock up roughly 72% year to date even as returns have cooled over the past month.

See our latest analysis for NRG Energy.

That surge has been driven more by shifting perceptions of NRG Energy’s earnings power than by any one headline. While the latest share price of $159.99 comes after a modest pullback in recent weeks, the stock’s strong year to date share price return alongside an exceptional multi year total shareholder return suggests momentum is cooling rather than reversing.

If this kind of move has you rethinking your watchlist, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other rapidly growing, management aligned opportunities.

With NRG Energy now trading well below consensus price targets yet boasting years of outsized returns, the key question is whether investors are getting a rare value entry point or if the market has already priced in future growth.

Most Popular Narrative Narrative: 23.1% Undervalued

With NRG Energy closing at $159.99 versus an implied fair value near $208, the prevailing narrative sees meaningful upside still embedded in future earnings power.

The accelerated adoption of data centers, electrification, and the signing of long term, premium margin agreements for large, multi year power delivery significantly increases NRG's exposure to growing electricity demand, pointing to higher recurring revenue and margin expansion through 2030 and beyond.

There is curiosity about how steady, mid single digit growth and rising margins can still justify a rich future earnings multiple for a utility name. The narrative hinges on bold assumptions about profit expansion, capital discipline, and how long new power contracts can keep lifting earnings per share.

Result: Fair Value of $208.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could be challenged if natural gas exposure faces tougher regulation or if the integration of smart home and VPP investments underdelivers.

Find out about the key risks to this NRG Energy narrative.

Another Take on Valuation

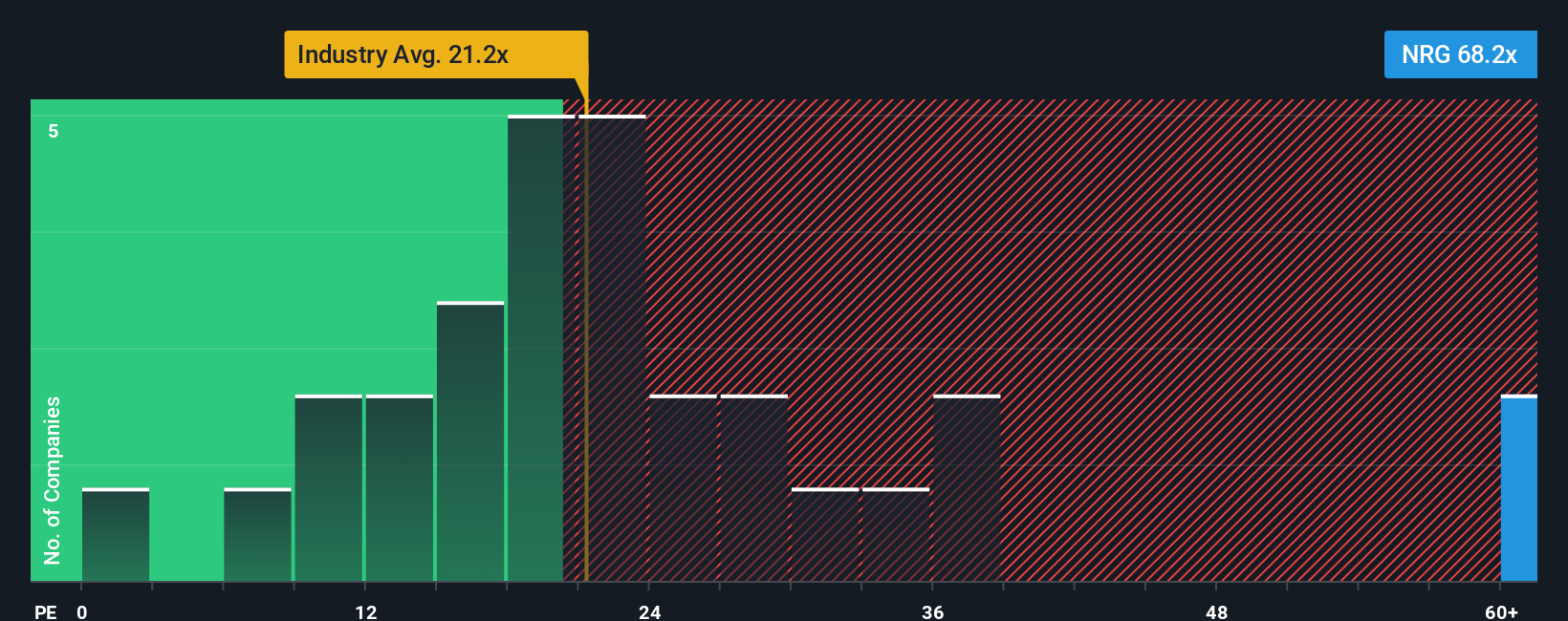

While the narrative model flags NRG as about 23% undervalued versus a $208 fair value, earnings based ratios paint a more cautious picture. The stock trades on 22.3 times earnings, richer than the US utilities industry at 20.1 times and peers at 19.7 times, even if a 33.8 times fair ratio hints at longer term upside. Is this a margin of safety, or a premium that could shrink if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NRG Energy Narrative

If you see things differently, or simply want to dig into the numbers yourself, you can build a fully tailored view in just a few minutes: Do it your way.

A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to uncover targeted ideas that match your strategy.

- Capture potential bargains by scanning these 913 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Capitalize on cutting edge innovation by zeroing in on these 25 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that could boost long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報